- South Korea

- /

- Industrials

- /

- KOSE:A000150

3 Asian Companies With High Insider Ownership Growing Earnings At 70%

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly focused on companies that demonstrate resilience and growth potential. In Asia, firms with high insider ownership can offer unique insights into corporate confidence and commitment, particularly when they are achieving impressive earnings growth.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19% | 122.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 84.7% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 26.3% | 98.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's dive into some prime choices out of the screener.

TaewoongLtd (KOSDAQ:A044490)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taewoong Co., Ltd specializes in manufacturing and selling open-die forgings and ring rolled products both in South Korea and internationally, with a market cap of ₩743.27 billion.

Operations: Revenue Segments (in millions of ₩): Open-die forgings: 120,000; Ring rolled products: 85,000. Taewoong Co., Ltd generates its revenue primarily through the production and sale of open-die forgings and ring rolled products.

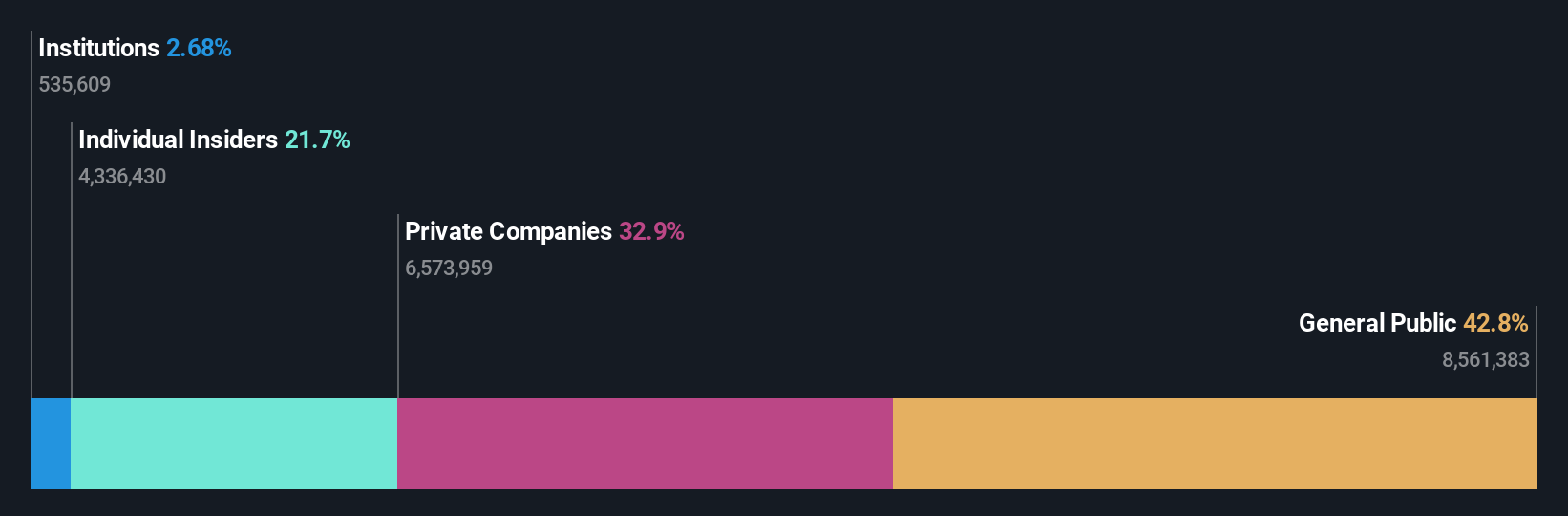

Insider Ownership: 21.7%

Earnings Growth Forecast: 51.8% p.a.

Taewoong Ltd. is experiencing substantial growth, with earnings forecasted to increase by 51.83% annually, outpacing the Korean market's 24.9%. Despite trading at 46.8% below its estimated fair value and facing a volatile share price recently, its revenue growth of 18.7% per year exceeds the market average of 8.1%. However, profit margins have decreased from last year’s figures and Return on Equity is projected to be low in three years at 8.3%.

- Navigate through the intricacies of TaewoongLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our TaewoongLtd valuation report hints at an inflated share price compared to its estimated value.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, is a biopharmaceutical company operating mainly in South Korea with a market capitalization of approximately ₩5.85 trillion.

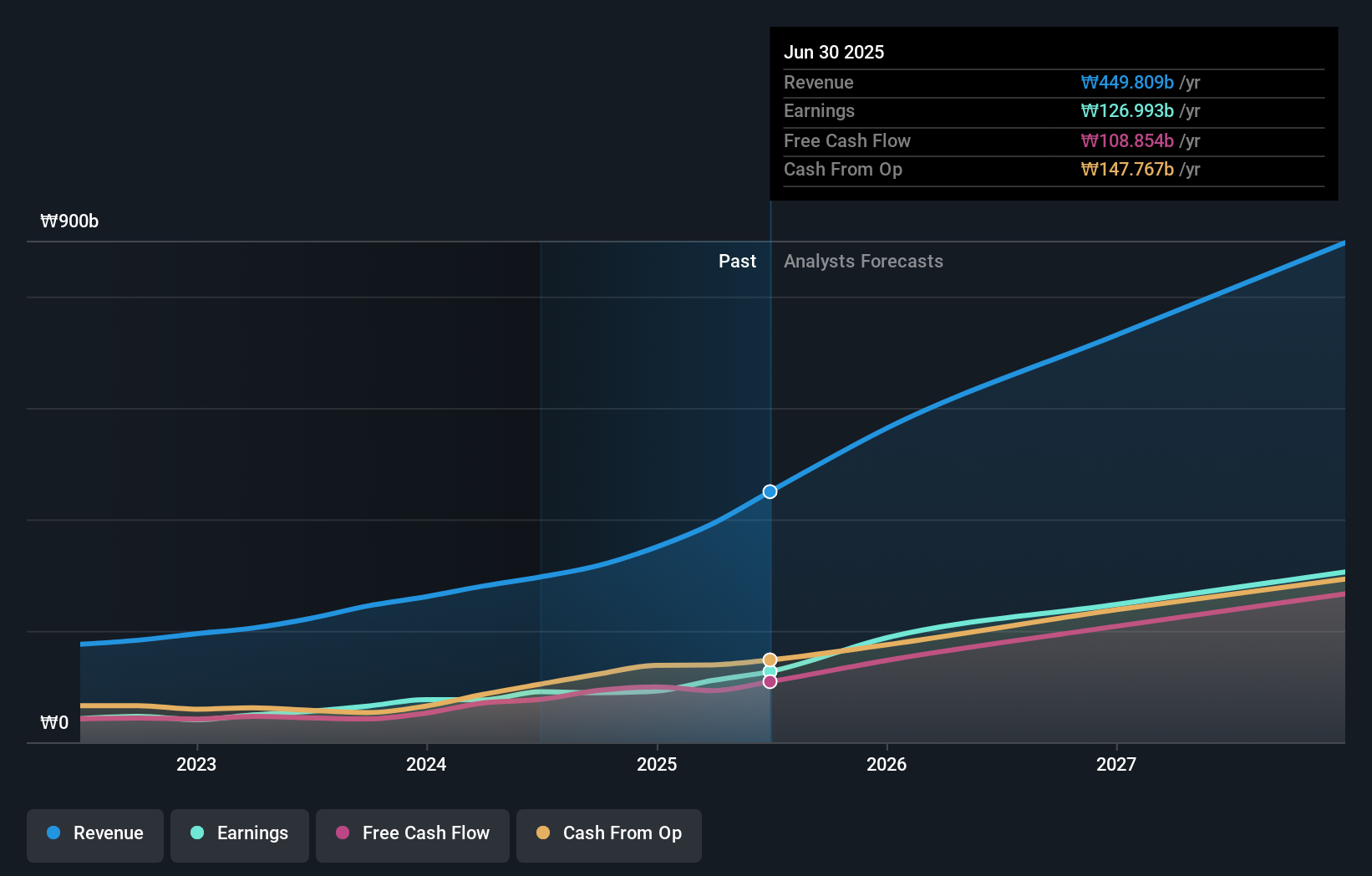

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, totaling approximately ₩449.81 billion.

Insider Ownership: 35%

Earnings Growth Forecast: 31.8% p.a.

PharmaResearch is positioned for strong growth, with earnings projected to increase by 31.8% annually, surpassing the Korean market's 24.9%. The stock trades at 36.5% below its estimated fair value and analysts anticipate a price rise of 40.8%. Recent strategic moves include a EUR 54.5 million partnership with VIVACY to distribute Rejuran in Europe, enhancing its market presence across major Western European countries through VIVACY's extensive network.

- Get an in-depth perspective on PharmaResearch's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report PharmaResearch implies its share price may be lower than expected.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation, along with its subsidiaries, operates in power generation, industrial facilities, construction machinery, engines, and construction sectors across Korea and internationally, with a market cap of approximately ₩9.93 trillion.

Operations: Revenue segments for Doosan include Doosan Bobcat at ₩8.22 billion, Doosan Energy at ₩8.07 billion, Electronic BG at ₩1.46 billion, Doosan Fuel Cell at ₩521.82 million, and Digital Innovation BU at ₩292.74 million.

Insider Ownership: 36.2%

Earnings Growth Forecast: 70.8% p.a.

Doosan Corporation's recent inclusion in the FTSE All-World Index highlights its growing stature. Despite a volatile share price, Doosan is trading at 61.1% below its estimated fair value, offering potential upside. The company reported significant earnings growth with a net income of KRW 78.59 billion for Q2 2025, up from KRW 20.62 billion the previous year. While revenue growth forecasts are modest at 7.8% annually, profit growth is expected to be robust at 70.8% per year over the next three years, indicating strong future profitability potential despite slower revenue expansion compared to market averages.

- Take a closer look at Doosan's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Doosan's share price might be too pessimistic.

Seize The Opportunity

- Gain an insight into the universe of 618 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000150

Doosan

Engages in the power generation facilities, industrial facilities, construction machinery, engines, and construction businesses in Korea, the United States, Asia, the Middle East, Europe, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives