- South Korea

- /

- Banks

- /

- KOSE:A175330

Top Asian Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by trade negotiations and economic data fluctuations, Asian indices have shown resilience with notable gains in mainland China. In this context, dividend stocks present an attractive option for investors seeking steady income streams amidst the region's dynamic economic environment.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.47% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.17% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.34% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.04% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.05% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

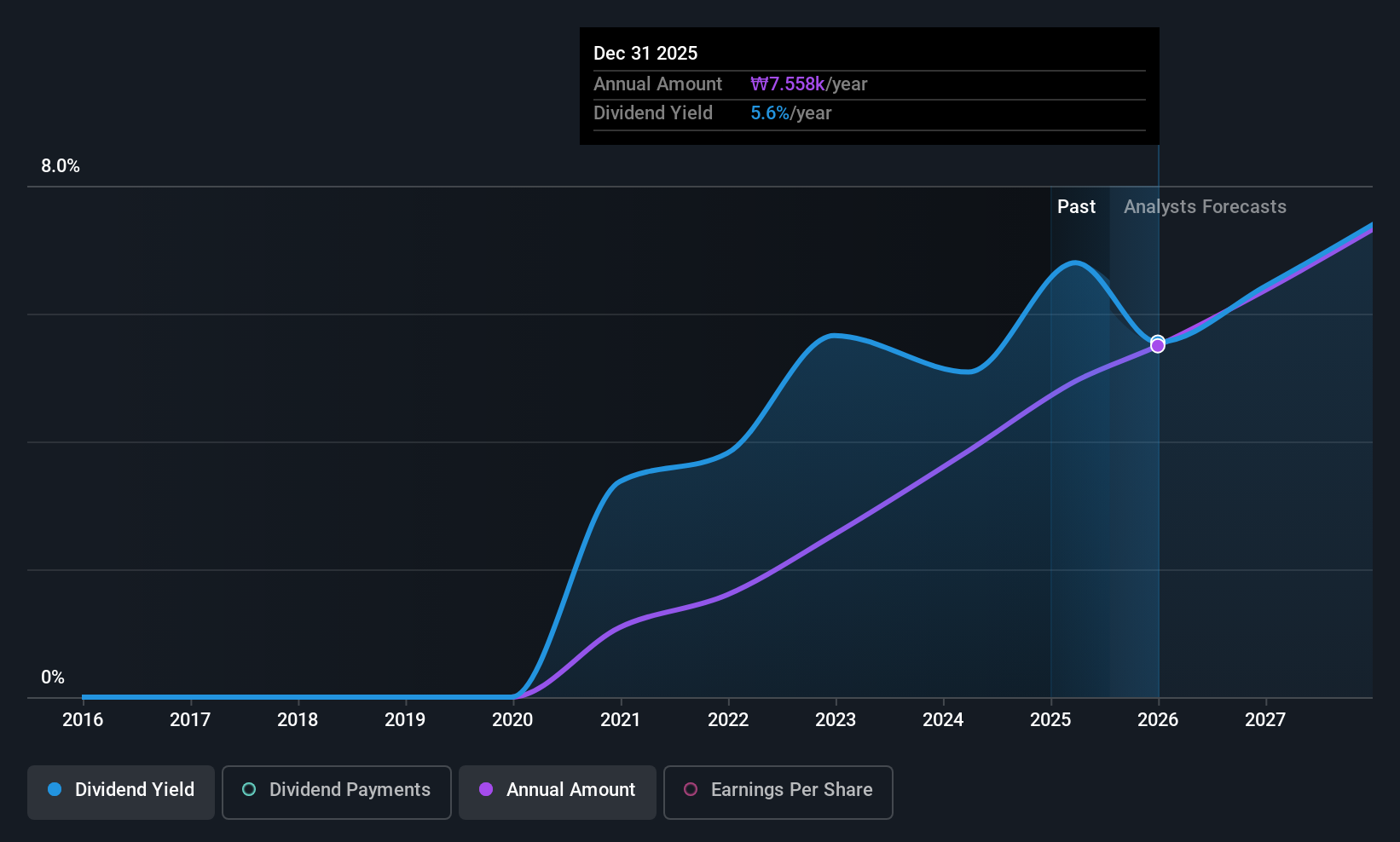

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services in South Korea, with a market cap of approximately ₩8.21 trillion.

Operations: DB Insurance Co., Ltd.'s revenue is primarily derived from its Non-Life Insurance Sector, which accounts for ₩21.29 billion, followed by the Life Insurance Sector at ₩1.71 billion and the Installment Finance Sector contributing ₩42.99 million.

Dividend Yield: 5%

DB Insurance offers a compelling dividend profile with a yield of 4.97%, placing it in the top 25% of South Korea's market. Despite only five years of dividend history, its payouts have been reliable and stable. The dividends are well-covered by both earnings (24% payout ratio) and cash flows (16.1% cash payout ratio), indicating sustainability. Furthermore, the stock is trading significantly below its estimated fair value, suggesting potential for capital appreciation alongside income generation.

- Click to explore a detailed breakdown of our findings in DB Insurance's dividend report.

- Our valuation report unveils the possibility DB Insurance's shares may be trading at a discount.

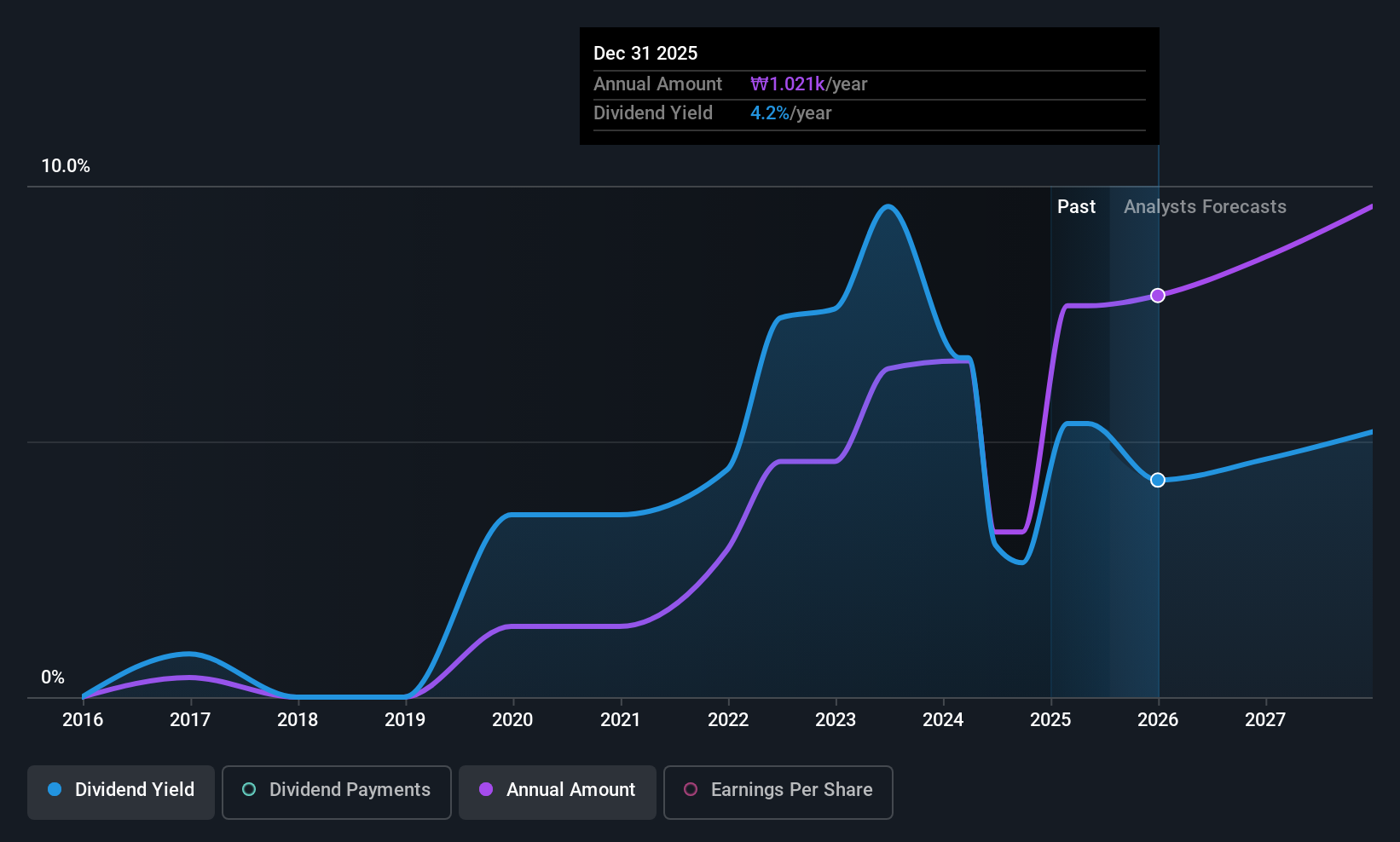

JB Financial Group (KOSE:A175330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Financial Group Co., Ltd. operates through its subsidiaries to offer banking products and services both in South Korea and internationally, with a market cap of ₩4.80 trillion.

Operations: JB Financial Group Co., Ltd.'s revenue primarily comes from its Banking Sector, contributing ₩1.31 trillion, followed by the Capital Segment at ₩406.39 million and the Asset Management Division with ₩24.39 million.

Dividend Yield: 3.9%

JB Financial Group's dividend yield of 3.94% ranks in the top 25% among Korean stocks, yet its nine-year history reveals volatility and instability in payments. Despite this, dividends are currently well-covered by earnings with a payout ratio of 31.1%, expected to decrease to 28.8% in three years, indicating sustainability. The stock trades at a significant discount to its estimated fair value, offering potential for both income and capital growth. Recent share buybacks may also support future price stability and shareholder returns.

- Delve into the full analysis dividend report here for a deeper understanding of JB Financial Group.

- Upon reviewing our latest valuation report, JB Financial Group's share price might be too pessimistic.

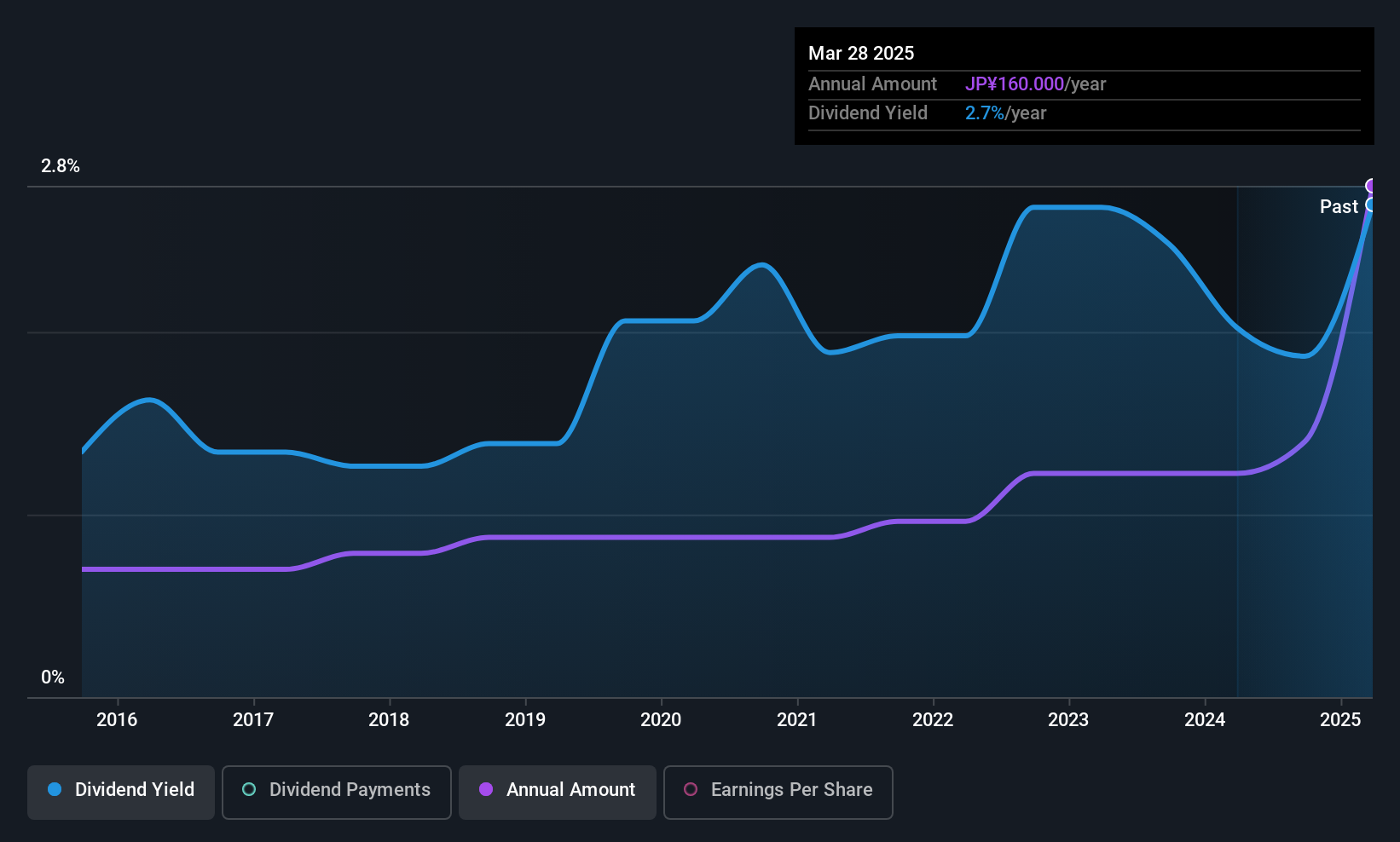

Takasago International (TSE:4914)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takasago International Corporation manufactures and sells flavors, fragrances, aroma ingredients, and other fine chemicals with a market cap of ¥146.97 billion.

Operations: Takasago International Corporation's revenue is derived from its core activities in flavors, fragrances, aroma ingredients, and fine chemicals.

Dividend Yield: 3.2%

Takasago International's dividend yield of 3.18% is lower than the top tier in Japan, yet it has shown stable and reliable growth over the past decade. The company's dividends are well-covered by earnings and cash flows, with a payout ratio of 41% and a cash payout ratio of 70.6%. However, recent guidance indicates a significant reduction in expected dividends for the year ending March 2026, suggesting potential challenges ahead despite strong earnings growth last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Takasago International.

- The analysis detailed in our Takasago International valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Navigate through the entire inventory of 1202 Top Asian Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A175330

JB Financial Group

Through its subsidiaries, provides banking products and services in South Korea and internationally.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives