- South Korea

- /

- Auto Components

- /

- KOSDAQ:A125490

Hallacast Co.,Ltd's (KOSDAQ:125490) P/S Is Still On The Mark Following 32% Share Price Bounce

Hallacast Co.,Ltd (KOSDAQ:125490) shares have continued their recent momentum with a 32% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

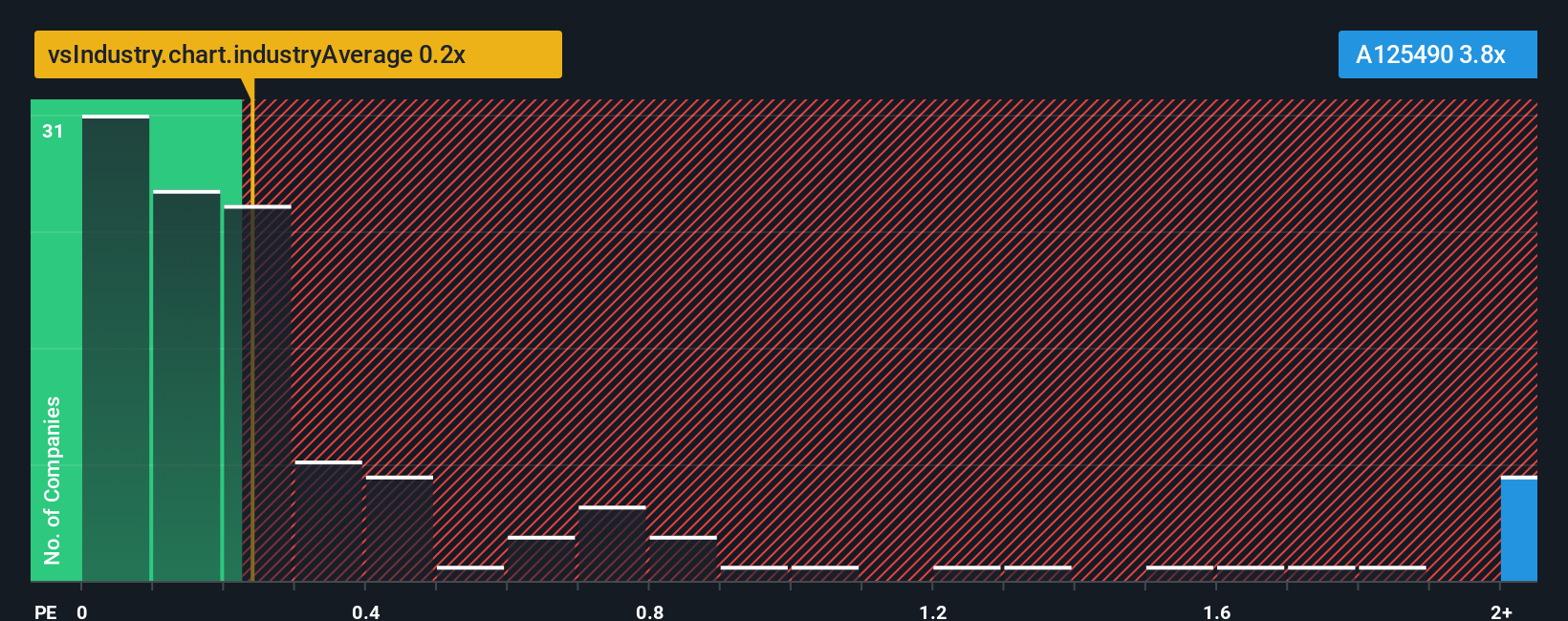

After such a large jump in price, you could be forgiven for thinking HallacastLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.8x, considering almost half the companies in Korea's Auto Components industry have P/S ratios below 0.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for HallacastLtd

What Does HallacastLtd's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, HallacastLtd has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HallacastLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like HallacastLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.7% gain to the company's revenues. The latest three year period has also seen an excellent 47% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 29% over the next year. With the industry only predicted to deliver 9.0%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that HallacastLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in HallacastLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into HallacastLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for HallacastLtd you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HallacastLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A125490

HallacastLtd

Engages in research, development, manufacturing, and selling diecasts parts of automobiles, electrical equipment, robots, and home appliances.

Excellent balance sheet with limited growth.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026