- Japan

- /

- Electric Utilities

- /

- TSE:9506

Tohoku Electric Power (TSE:9506) Margins Improve, Challenging Bearish Sentiment on Earnings Sustainability

Reviewed by Simply Wall St

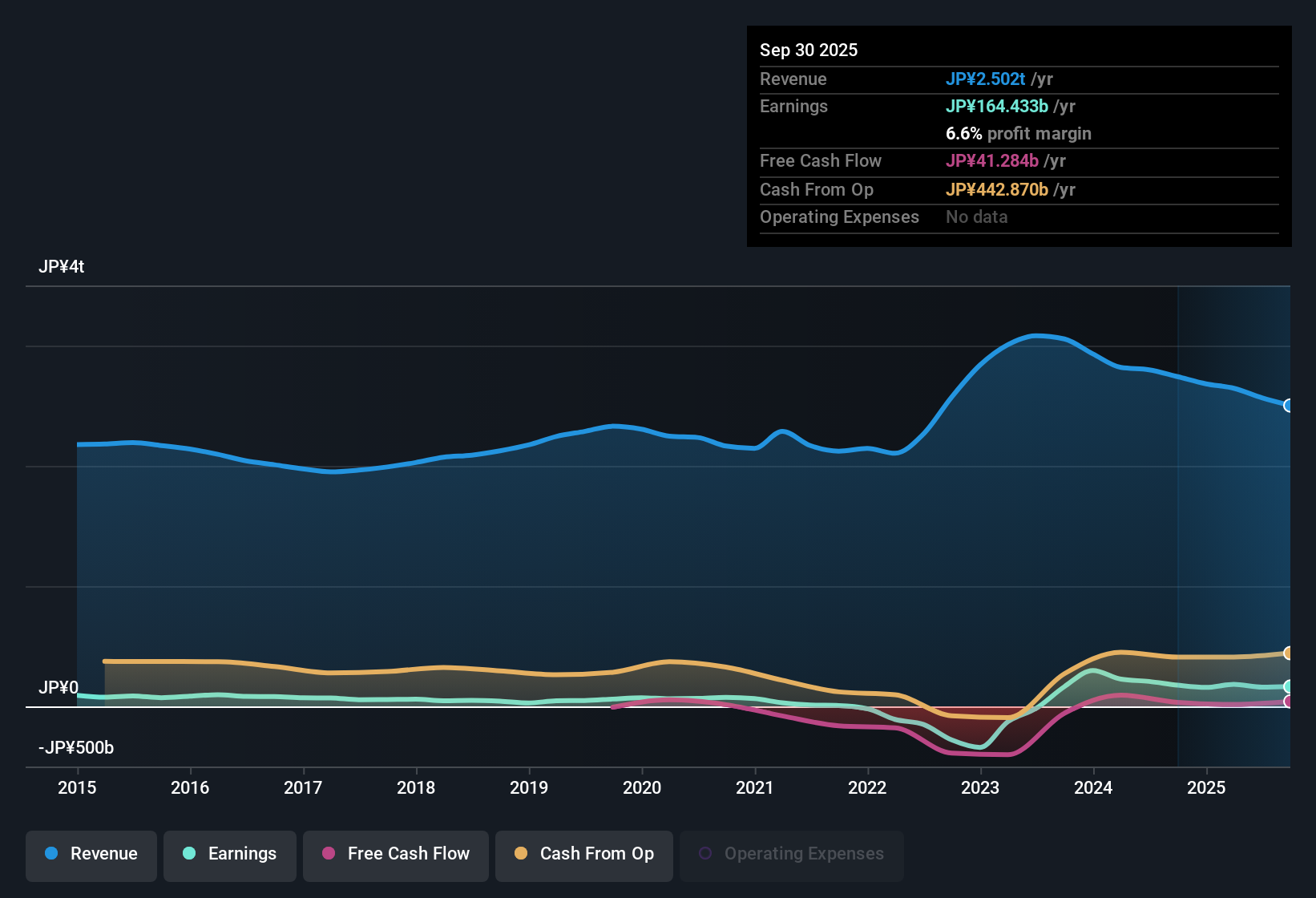

Tohoku Electric Power Company (TSE:9506) saw its net profit margin improve to 6.6% from 6.4% a year earlier, although the past year brought negative earnings growth. Over the last five years, earnings have grown at a brisk 37% per year, but future prospects appear muted with revenue expected to decline by 1.4% per year and earnings by 8.6% per year over the next three years. Investors face a mix of an attractively low 3.2x P/E ratio and discounted share price (¥1,056 vs. an estimated fair value of ¥1,085.32) along with persistent concerns about weakening fundamentals and sustainability of growth.

See our full analysis for Tohoku Electric Power Company.The next section puts these headline results up against the dominant market narratives and community perspectives to see where expectations and reality meet, and where they start to diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Up Amid Five-Year Growth

- Net profit margins increased to 6.6%, building on a five-year earnings growth rate of 37% per year, even though recent annual earnings declined.

- Profitability continues to be a key pillar that supports arguments for Tohoku’s defensive stability, as recent margin gains reinforce the company’s reputation for resilient fundamentals. However, concerns linger about the sustainability of these margins given the reversal in short-term earnings.

- The company’s long-running strong earnings track record heavily supports optimism around its role as an income-oriented, reliable stock.

- Interestingly, despite ongoing margin strength, the forecasted earnings decline of 8.6% per year challenges a straightforward bullish case and highlights tensions between historical strengths and future risks.

Revenue Declines Raise Growth Questions

- Revenue is forecast to decrease by 1.4% year-on-year for the next three years, marking a notable trend shift after extended growth.

- The prevailing analysis points out that stability and policy support help counterbalance the negative impact of declining revenues. However, there remains a persistent debate over whether the company can offset these top-line drops with operational efficiencies.

- Some investors highlight that, as a regulated utility, external policy measures could cushion the blow from revenue erosion, although such measures are not guaranteed every cycle.

- Meanwhile, the combination of falling revenue and an 8.6% annual earnings decline amplifies the challenge of delivering sustained dividend payouts or capital growth.

Share Price Trades at a Discount to DCF Fair Value

- The company’s shares currently trade at ¥1,056, which is below its DCF fair value of ¥1,085.32 and well under the industry P/E average (3.2x vs. 17.1x). This highlights clear valuation appeal relative to sector benchmarks.

- Prevailing market analysis notes that the discounted valuation attracts value-focused investors. However, there is a constant balancing act between the low P/E and headwinds from expected declines in both revenue and earnings.

- The substantial discount to DCF fair value and industry multiples supports arguments that the market has priced in significant risk, possibly overshooting the actual downside.

- Nevertheless, the persistent expectation of weakening fundamentals means that skeptical investors may want to see a turnaround in growth metrics before viewing the stock as a bargain rather than a value trap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tohoku Electric Power Company's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Revenue and earnings for Tohoku Electric are projected to decline over the coming years, which signals uncertainty about the company’s ability to sustain consistent growth.

If you want to focus on more reliable expansion, check out stable growth stocks screener (2103 results) for companies consistently delivering steady results through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tohoku Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9506

Tohoku Electric Power Company

Operates as an energy service in Japan and internationally.

Undervalued average dividend payer.

Market Insights

Community Narratives