- Japan

- /

- Electric Utilities

- /

- TSE:9506

Tohoku Electric Power (TSE:9506): Exploring Valuation Following Tsunami Advisory and Onagawa Plant Safety Update

Reviewed by Simply Wall St

Japan's recent tsunami advisory for Iwate prefecture put a spotlight on infrastructure stocks, particularly Tohoku Electric Power Company (TSE:9506). The company's Onagawa nuclear power plant reported no irregularities, which likely helped calm market nerves during the event.

See our latest analysis for Tohoku Electric Power Company.

This latest safety confirmation follows Tohoku Electric Power's recent dividend increase, offering some reassurance to investors after what has been a challenging stretch for the stock. Although the 1-year total shareholder return remains down at -16.8%, the company's strong 3-year total shareholder return of 87% highlights longer-term turnaround potential if momentum builds from here.

If this shift in sentiment has you interested in fresh opportunities, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

The key question for investors is whether Tohoku Electric Power is now trading at a discount in light of recent developments, or if the stock’s current price already reflects market expectations for future recovery and growth.

Price-to-Earnings of 3.3x: Is it justified?

Tohoku Electric Power shares are currently trading at a price-to-earnings ratio of just 3.3x, notably lower than both peers and the broader industry average. With a last close price of ¥1,078.5, this relative discount raises the question: is the market underestimating this utility firm's long-term earnings power?

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for one unit of a company's earnings. For a regional electric utility like Tohoku, the multiple often reflects market confidence in stable profits, resilience, and long-term growth expectations.

At just 3.3x, Tohoku Electric Power trades well below the industry average of 16.4x and even below its peer group’s 3.8x. By comparison, our fair P/E ratio estimate stands at 7x, a level that the market could move toward if sentiment shifts or operating momentum improves from here.

Explore the SWS fair ratio for Tohoku Electric Power Company

Result: Price-to-Earnings of 3.3x (UNDERVALUED)

However, ongoing declines in annual revenue and net income growth suggest that operational challenges could still disrupt a sustained turnaround for Tohoku Electric Power.

Find out about the key risks to this Tohoku Electric Power Company narrative.

Another View: What Does the DCF Model Say?

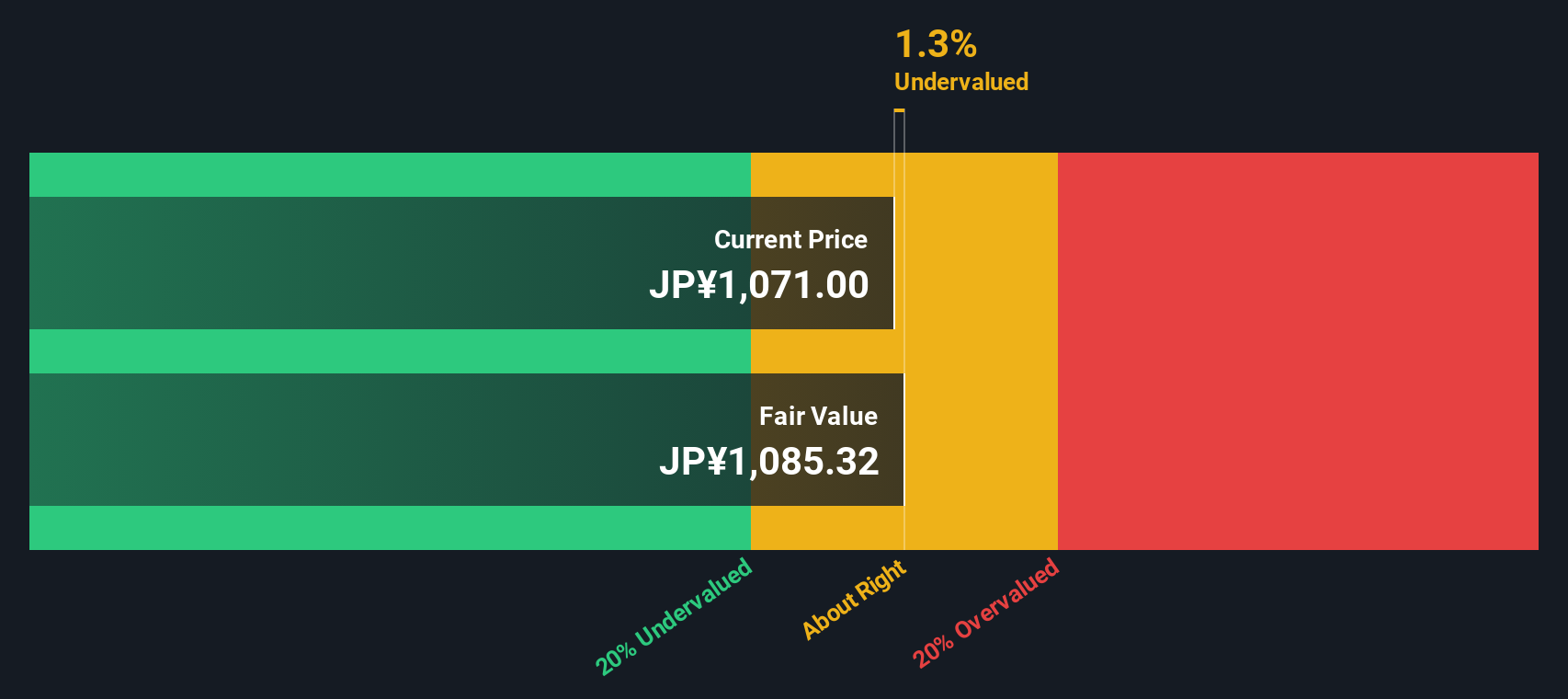

While the price-to-earnings ratio points to a discount, the SWS DCF model offers a similar conclusion and finds Tohoku Electric Power is trading just below its intrinsic fair value. This reinforces the idea of a modest undervaluation. However, will the stock deliver a bigger upside if forecasts improve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tohoku Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tohoku Electric Power Company Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own perspective in just a few minutes. So why not Do it your way?

A great starting point for your Tohoku Electric Power Company research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by tracking where the real potential is breaking out. Unlock access to new opportunities and find stocks others are missing. Your next winning idea could be just a click away.

- Shake up your watchlist by checking out these 26 AI penny stocks, which are on the cutting edge of artificial intelligence and transforming industries worldwide.

- Capture reliable returns from these 15 dividend stocks with yields > 3%, which consistently offer strong yields above 3% for income-focused portfolios.

- Act early on market momentum with these 3564 penny stocks with strong financials, delivering robust financials and the potential for outsized growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tohoku Electric Power Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9506

Tohoku Electric Power Company

Operates as an energy service in Japan and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives