- Japan

- /

- Electric Utilities

- /

- TSE:9505

Hokuriku Electric Power (TSE:9505) Profit Margin Beat Challenges Cautious Narratives on Sector Valuation

Reviewed by Simply Wall St

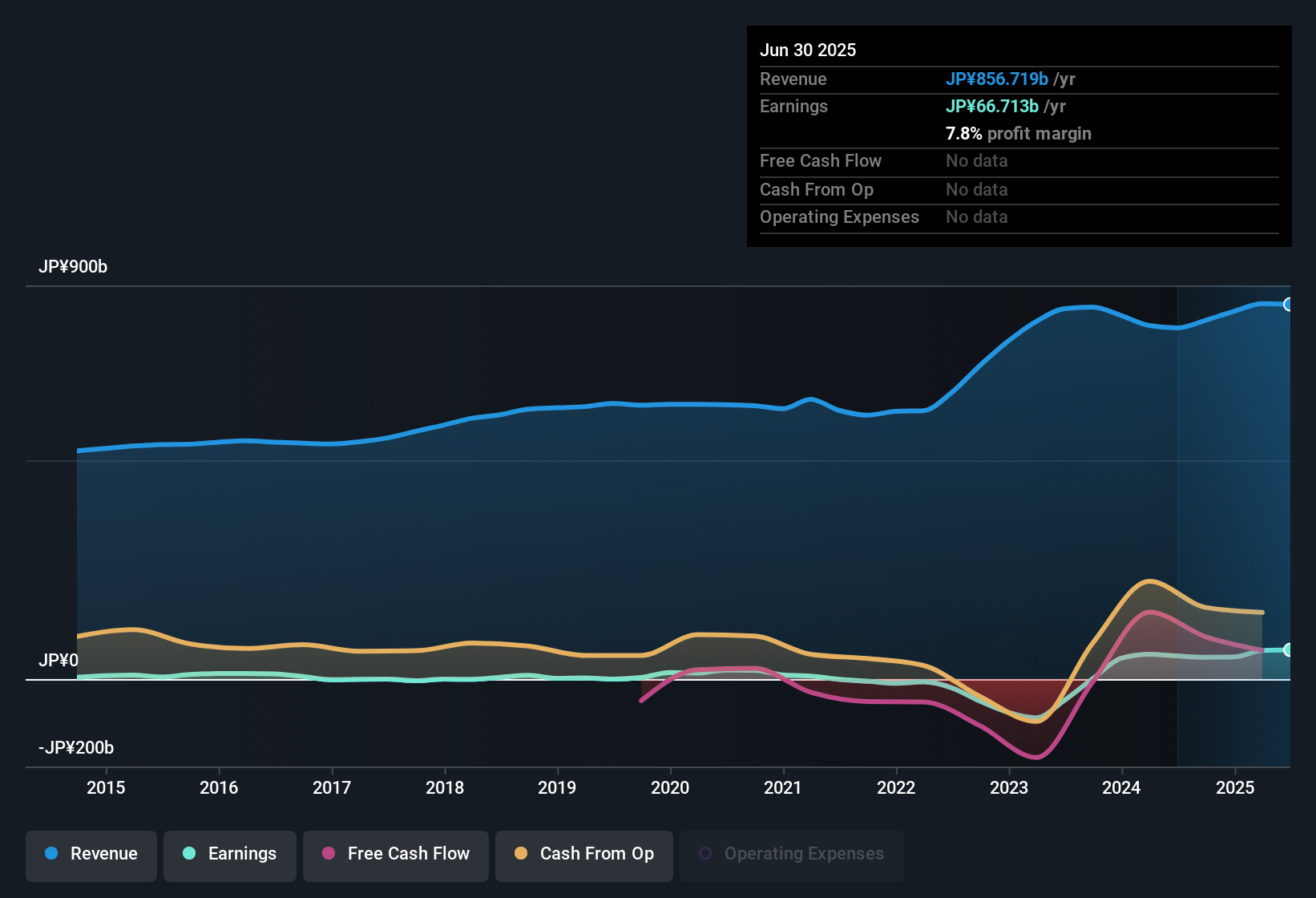

Hokuriku Electric Power (TSE:9505) reported net profit margins of 8.2%, up from 6.1% a year ago. EPS growth over the last five years has averaged an impressive 41.7%. The company’s most recent annual earnings growth came in at 38.6%, slightly below its longer-term average, with future forecasts pointing to revenue and earnings declines of 2.1% and 17.4% per year, respectively, over the next three years. With the stock trading at just 2.6x earnings, well below both industry (17.1x) and peer (4.9x) averages, investors are seeing a compelling value opportunity, even as forthcoming challenges and risks remain in focus.

See our full analysis for Hokuriku Electric Power.Next, we will compare these headline numbers to the narratives traders follow most closely and see where consensus and earnings reality may be parting ways.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Peers, but Downside Appears in Revenue Guide

- Net profit margin rose to 8.2% from 6.1% the year before, showing Hokuriku Electric Power is squeezing more earnings from each yen of revenue even as top-line sales are forecast to shrink by 2.1% annually over the next three years.

- Prevailing view is that utility sector stability and dependable operations have uplifted recent profitability, defending margins amid sector cost pressures.

- At the same time, expectations for declining earnings point to limited room for upside unless operational improvements or policy catalysts can offset anticipated revenue headwinds, especially as sector-wide input costs and regulatory scrutiny continue to rise.

Five-Year Earnings Surge Now Faces a Turning Point

- Average annual earnings growth clocked in at a robust 41.7% over the past five years, but the latest year slowed to 38.6%, offering the first sign of deceleration heading into a stretch where profits are forecast to fall 17.4% per year.

- The recent track record of sustained strong profit expansion stands in stark contrast with the prevailing anticipation of mean reversion; analysts stress that defensive qualities offer a safety net, yet warn that shrinking earnings may dampen total return potential.

- What is notable is that despite this deceleration, income investors may still find appeal in stability, though consensus points out that the period of outperformance may be ending without new growth drivers.

Trading at 2.6x Earnings: Value Play or Value Trap?

- The company's Price-to-Earnings ratio sits at only 2.6x, which is low not just by absolute standards but also compared to the industry average of 17.1x and a peer average of 4.9x. This implies markets are pricing in elevated future risks despite recent profit strength.

- Prevailing sentiment holds that while cheap valuation metrics immediately jump out, especially for risk-averse and income-oriented investors, the forecasted profit declines and concerns about dividend sustainability reveal why the discount may persist or even widen.

- Rather than a clear buy signal, the valuation makes Hokuriku Electric Power an intriguing watchlist candidate where sector changes or cost improvements could drive renewed attention.

See how the evolving story affects the company's positioning with defensive investors and if margins can offset sector headwinds. See what the community is saying about Hokuriku Electric Power

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hokuriku Electric Power's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Hokuriku Electric Power’s impressive profit margins, its declining revenue forecasts and projected earnings drop signal that sustainable growth may be a challenge in the future.

If stable expansion is your priority, check out our stable growth stocks screener (2103 results) to find companies consistently posting reliable revenue and earnings through various market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hokuriku Electric Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9505

Hokuriku Electric Power

Supplies electricity through power generation, transmission, and distribution systems in Japan.

Proven track record and fair value.

Market Insights

Community Narratives