- Japan

- /

- Electric Utilities

- /

- TSE:9505

Hokuriku Electric Power (TSE:9505): Assessing Valuation After Upgraded Earnings and Dividend Guidance

Reviewed by Simply Wall St

Hokuriku Electric Power (TSE:9505) caught investors’ attention after revising its earnings guidance upward for the fiscal year. The company cited stronger electricity sales and the impact of fuel cost adjustment timing.

See our latest analysis for Hokuriku Electric Power.

These upbeat earnings and dividend announcements seem to have reignited investor interest, with the share price up 3.76% over the last 90 days. Despite a disappointing 1-year total shareholder return of -10.32%, three-year total shareholder returns stand at an impressive 86.53%. This highlights Hokuriku’s longer-term resilience and signals that momentum may be building again as the company improves profitability.

If you’re curious what other companies might be seeing a shift in fortunes, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock rebounding and recent upgrades to profits and dividends, investors now face a key question: is Hokuriku Electric Power still undervalued, or is the market already pricing in these brighter prospects?

Price-to-Earnings of 2.7x: Is it justified?

Hokuriku Electric Power trades at a price-to-earnings (PE) ratio of 2.7x, which is well below the Japanese market average. With the share price at ¥883.1, the market values the company's earnings at a deep discount.

The price-to-earnings (PE) ratio shows how much investors are willing to pay for each yen of earnings. For an electric utility like Hokuriku, the PE ratio is a quick way to compare value against both peers and industry averages.

This low PE ratio can signal that the market is either underpricing Hokuriku’s earnings potential or anticipating tougher conditions ahead. However, compared to its Japanese peers (PE of 14.2x) and regional utilities (industry average 16.4x), the discount appears considerable. When measured against the estimated fair PE ratio of 5.4x, there is still significant room for market sentiment to shift higher should future prospects improve.

Explore the SWS fair ratio for Hokuriku Electric Power

Result: Price-to-Earnings of 2.7x (UNDERVALUED)

However, annual declines in revenue and net income remain a risk. Any prolonged slowdown could challenge a swift turnaround in sentiment.

Find out about the key risks to this Hokuriku Electric Power narrative.

Another View: The SWS DCF Model Offers a Different Take

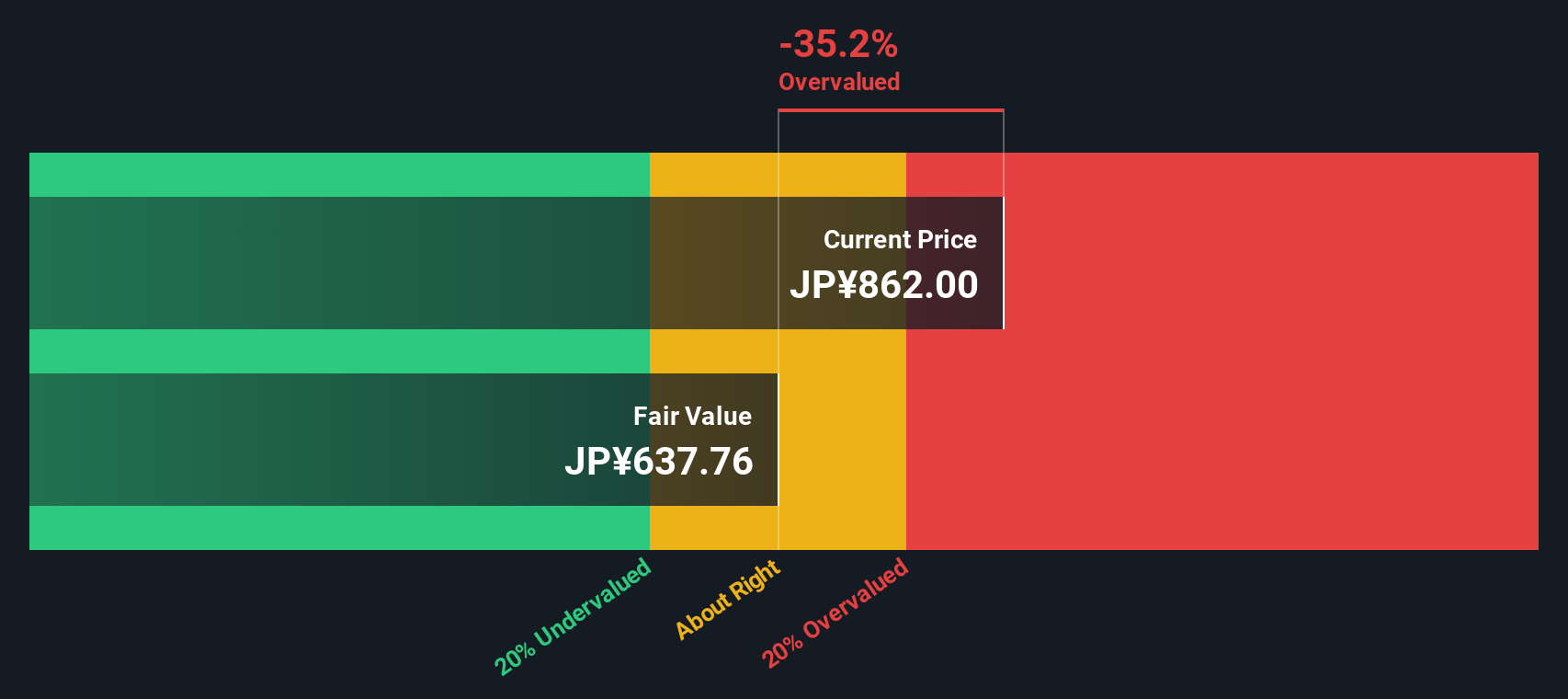

While Hokuriku Electric Power’s low price-to-earnings ratio suggests a bargain, our DCF model offers a more cautious perspective. It estimates fair value at ¥646.26, which is well below the current share price. This suggests the market may be more optimistic than the fundamentals support. Could near-term upgrades be masking deeper challenges?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hokuriku Electric Power for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hokuriku Electric Power Narrative

If you want to take a different view or prefer your own research process, it only takes a few minutes to build your own perspective and Do it your way.

A great starting point for your Hokuriku Electric Power research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t miss out on the next big winner. Broaden your scope and get ahead by tapping into fresh investment ideas with our screener tools below.

- Tap into the wave of digital finance’s evolution by checking out these 82 cryptocurrency and blockchain stocks for companies at the forefront of secure payments and blockchain advancements.

- Unlock access to potential high-yield income streams by reviewing these 15 dividend stocks with yields > 3% that consistently offer strong dividend returns above 3%.

- Get ahead of the AI revolution by checking out these 26 AI penny stocks and see which innovative companies are pushing artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hokuriku Electric Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9505

Hokuriku Electric Power

Supplies electricity through power generation, transmission, and distribution systems in Japan.

Fair value with acceptable track record.

Market Insights

Community Narratives