- Japan

- /

- Transportation

- /

- TSE:9076

Assessing Seino Holdings (TSE:9076) Valuation After Strong H1 Results and New Interim Dividend Approval

Reviewed by Simply Wall St

Seino Holdings (TSE:9076) just wrapped up a board meeting where management approved an interim dividend. This follows strong growth in both revenue and profit for the first half of 2025. Investors have been watching for signals like these, particularly given the company’s focus on maintaining a consistent dividend payout alongside solid financial results.

See our latest analysis for Seino Holdings.

Seino Holdings’ share price has held steady above ¥2,100 lately despite a turbulent year. After declining nearly 8% since January, the stock recently regained some ground as the market absorbed its strong first-half results, sustained dividend, and news of the convertible bond adjustment. For longer-term shareholders, the three-year total return sits at an impressive 114%, highlighting the company’s ability to deliver value over time. Shifting momentum suggests investor optimism may be returning.

If Seino’s resilience has you rethinking your strategy, this could be the right moment to broaden your search and uncover fast growing stocks with high insider ownership.

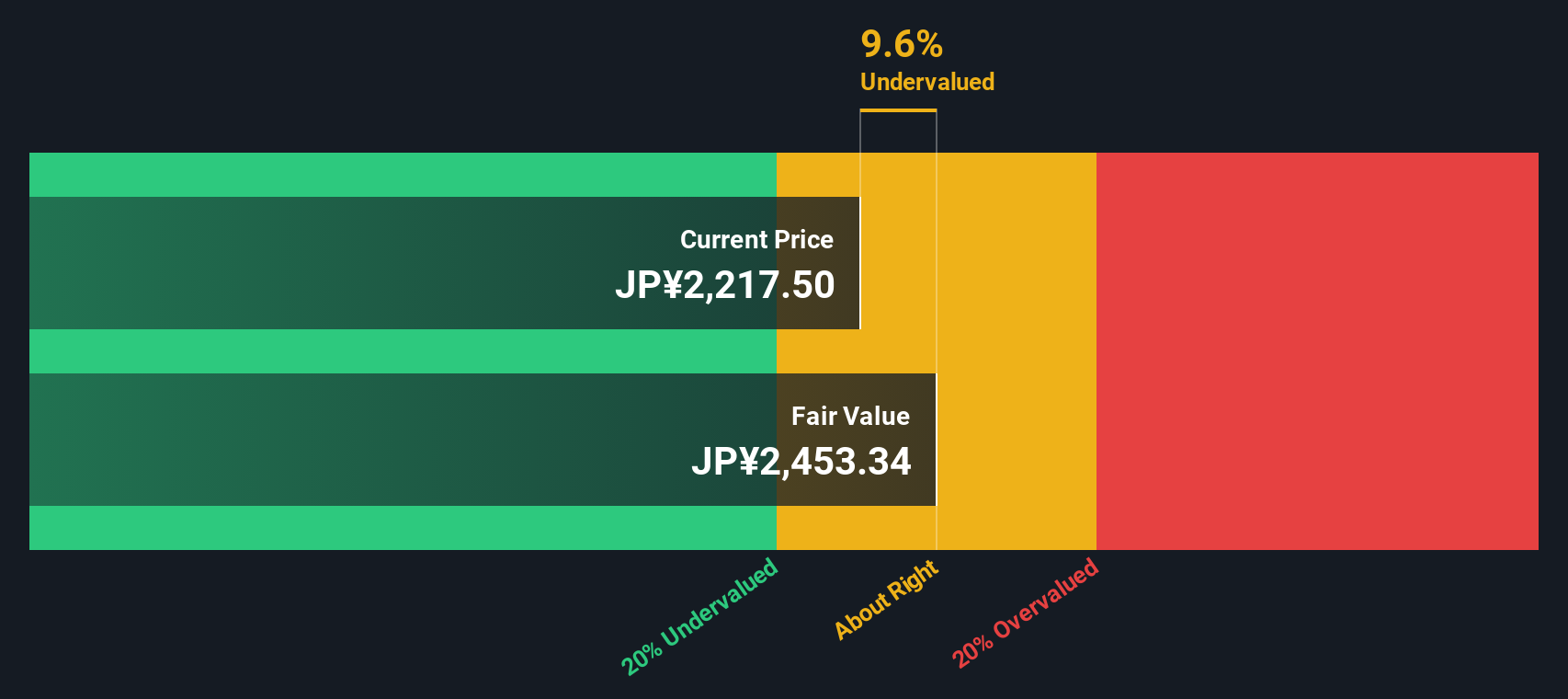

With shares now trading at a modest discount to analyst targets and recent profits surging, the big question for investors is clear: is Seino Holdings undervalued, or is the market already pricing in the next phase of growth?

Price-to-Earnings of 15x: Is it justified?

Seino Holdings is currently trading at a price-to-earnings (P/E) ratio of 15x, which gives valuable insight into how the market is valuing the company relative to its recent earnings. With the stock closing at ¥2,187, investors appear to be weighing recent earnings growth and future profit sustainability against the price they are paying per share.

The price-to-earnings ratio shows how much investors are willing to pay for each ¥1 of net income. In the transportation sector, this figure can reflect confidence in a company's ability to generate steady profits, even through economic cycles and industry shifts.

At 15x, Seino's P/E ratio is higher than the Japanese Transportation industry average of 12.6x. When compared to our estimated fair P/E of 14.6x, the current multiple appears slightly elevated, potentially signaling that the market expects continued momentum or that recent rapid earnings growth still carries weight. However, relative to the peer group average of 18.2x, Seino is more moderately valued and this suggests a balance between optimism and caution. The fair ratio provides an additional anchor and may imply that the market could recalibrate toward that level if expectations shift.

Explore the SWS fair ratio for Seino Holdings

Result: Price-to-Earnings of 15x (ABOUT RIGHT)

However, slowing revenue growth, combined with recent share price volatility, could quickly challenge the current optimism surrounding Seino Holdings’ valuation.

Find out about the key risks to this Seino Holdings narrative.

Another View: What About the SWS DCF Model?

Looking at Seino Holdings through our SWS DCF model, the results tell a slightly different story. The current share price of ¥2,187 is about 10.5% below our fair value estimate of ¥2,442. This suggests Seino might actually be undervalued, even as multiples seem elevated. Could the market be overlooking hidden value, or is this margin simply risk compensation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seino Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seino Holdings Narrative

If you have a different perspective, or would rather base your view on your own analysis, you can build a personalized narrative for Seino Holdings in just a few minutes. Do it your way.

A great starting point for your Seino Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities pass you by. Step up and tap into market trends other investors might miss using the Simply Wall St Screener.

- Benefit from stable income streams as you check out these 15 dividend stocks with yields > 3% powered by consistent, high-yield payouts above 3%.

- Unlock potential in rapidly expanding sectors by targeting these 27 AI penny stocks gaining momentum from explosive growth in artificial intelligence.

- Grow your portfolio’s edge by scouting these 885 undervalued stocks based on cash flows that remain overlooked despite strong fundamental cash flows and future promise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9076

Seino Holdings

Provides transportation services in Japan and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives