Should Yamato Holdings' (TSE:9064) Dividend Stability Guide Investor Decisions After New 2026 Earnings Outlook?

Reviewed by Sasha Jovanovic

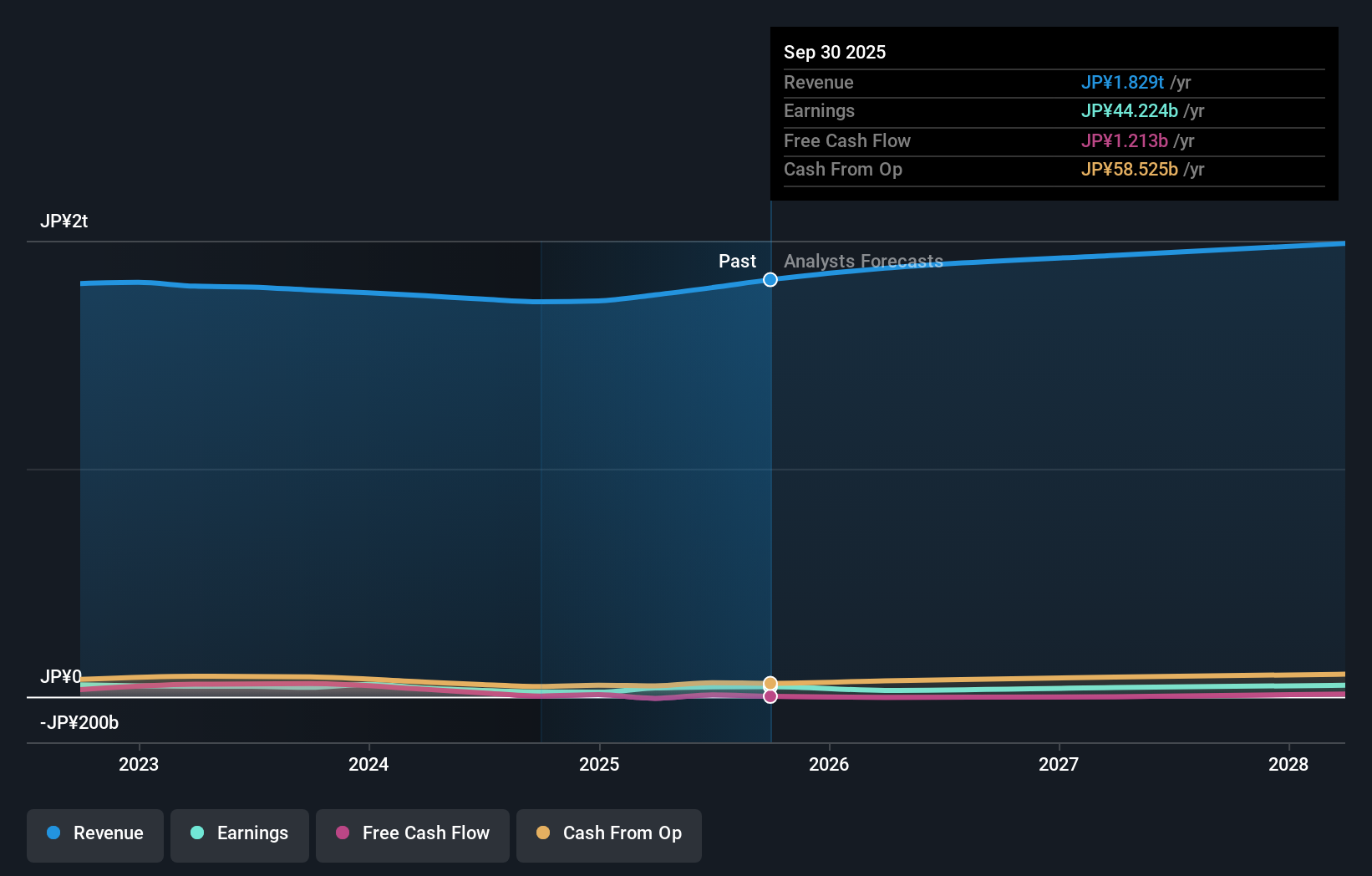

- Yamato Holdings recently announced its earnings guidance for the fiscal year ending March 2026, projecting operating revenue of ¥1.88 trillion, operating profit of ¥40 billion, and maintaining a dividend of ¥23 per share, with payments scheduled to begin on December 10, 2025.

- This affirmation of both earnings and dividend stability offers investors a clearer outlook on Yamato's financial expectations amid a period of operational visibility.

- We’ll explore how Yamato’s reaffirmed dividend policy shapes the company’s investment narrative for the year ahead.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Yamato Holdings' Investment Narrative?

If you're considering Yamato Holdings as part of your portfolio, the big picture hinges on faith in the company’s ability to sustain steady profits and defend its dividend, while managing short-term operational challenges. The latest earnings guidance and confirmation of a stable JPY 23 dividend per share reinforce the company's message of stability, which may soothe concerns about near-term volatility and profit margin recovery after a year that featured large one-off gains. For now, this news does not shift the most important short-term catalysts, margin expansion, cost controls, or organic revenue growth remain front and center. However, risks like an inexperienced management team and low projected return on equity are unresolved, and continued dividend coverage remains an open question given only modest free cash flow. The market seemed unperturbed after the news, suggesting most risks and catalysts are fundamentally unchanged in the short term.

Yet, investors should be mindful that an inexperienced management team might bring uncertainty down the line. Yamato Holdings' shares are on the way up, but they could be overextended by 7%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Yamato Holdings - why the stock might be worth as much as 7% more than the current price!

Build Your Own Yamato Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yamato Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Yamato Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yamato Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9064

Yamato Holdings

Provides logistics shipping services in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives