- Japan

- /

- Transportation

- /

- TSE:9009

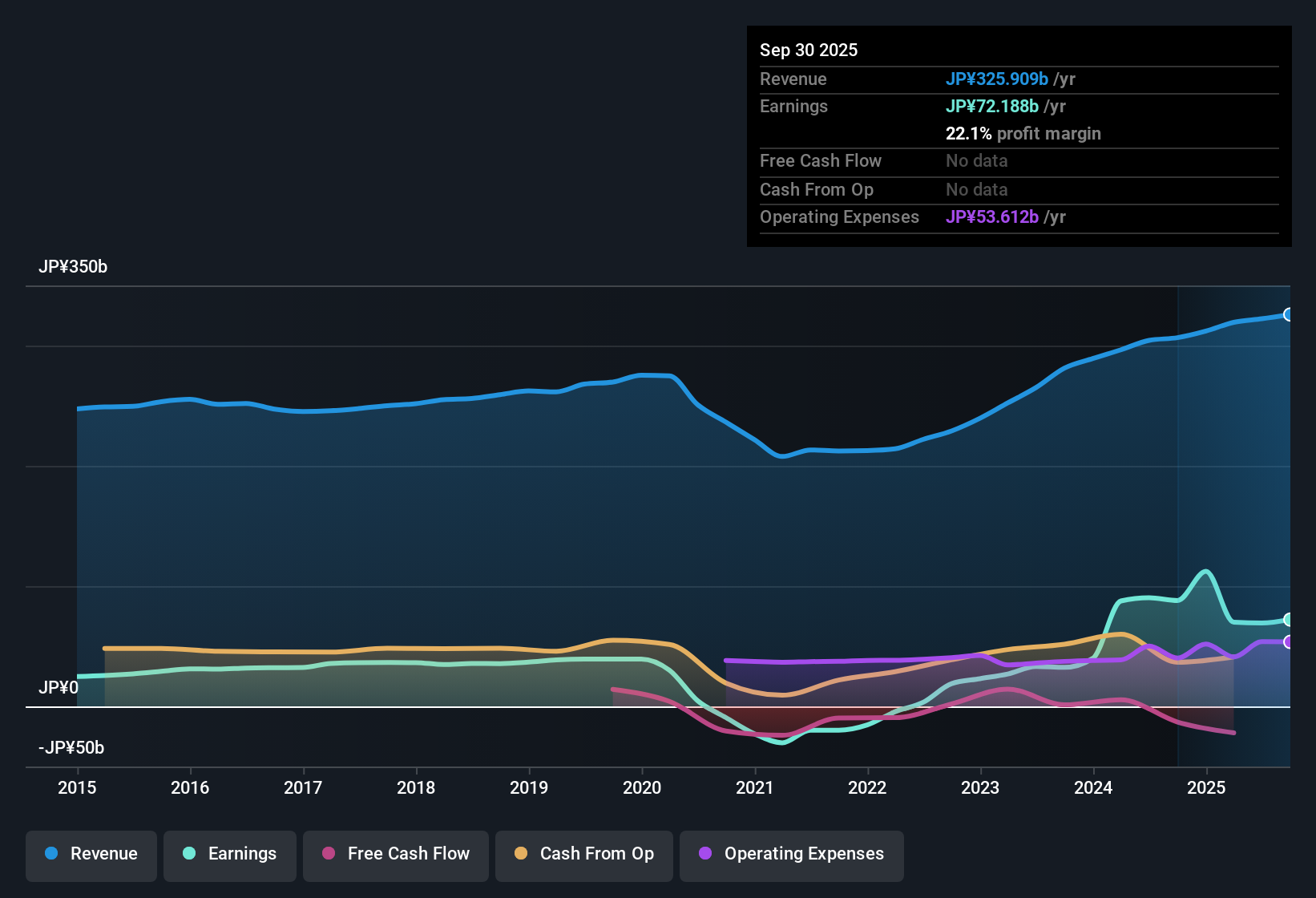

Keisei Electric Railway (TSE:9009) Profit Margins Fall as One-Off Gain Distorts Earnings Quality

Reviewed by Simply Wall St

Keisei Electric Railway (TSE:9009) reported net profit margins of 22.1%, down from 28.7% a year ago, highlighting a notable decline in profitability. The latest twelve months were boosted by a one-off gain of ¥41.4 billion, which inflates recent earnings figures but will not repeat going forward. Despite attractive relative valuation metrics, with a Price-To-Earnings ratio of 8.2x compared to the industry’s 12.4x, investors are maintaining a cautious stance. Revenues are forecast to grow just 2.7% annually and earnings are projected to fall 3.1% per year over the next three years.

See our full analysis for Keisei Electric Railway.Next, we will compare these numbers with Simply Wall St’s most widely followed community narratives to see where the findings line up and where investor expectations might be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gains Cloud Underlying Profitability

- Net profit margins dropped to 22.1%, but the most recent period was artificially boosted by a one-time ¥41.4 billion gain. This gain will not continue and distorts the true, ongoing earning power.

- It is notable that, despite this temporary windfall, recent profitability masks a declining trend:

- The margin dropped sharply compared to last year’s 28.7%, which highlights that the underlying business is less profitable even before considering next year’s likely step-down.

- The absence of further similar gains means future years may see results revert closer to core earnings, challenging the view that strong recent figures are sustainable.

Growth Lags Market Despite Defensive Profile

- Revenue is forecast to rise only 2.7% per year, well below the Japanese market’s average of 4.5%. This suggests Keisei is growing slower than peers even while demand for core services remains steady.

- Resilience is often cited as a strength, but growth headwinds remain significant:

- Market watchers highlight that, although Keisei’s stable operations and commuter base offer downside protection, the slow top-line expansion could limit upside versus more dynamic sector peers.

- The modest revenue outlook makes the company more attractive to investors prioritizing stable defensive stocks, but less appealing for those seeking above-market growth opportunities.

Discount Valuation Offsets Weak Outlook

- Keisei trades at a 8.2x Price-to-Earnings multiple, substantially below the industry average of 12.4x and peer average of 12.3x. However, its current share price of ¥1,228 sits considerably above the DCF fair value estimate of ¥408.22.

- The interaction between fundamentals and valuation creates a mixed investment case:

- Bulls can point to the relative discount in P/E as a margin of safety, but the weak growth outlook and gap to fair value temper enthusiasm for near-term appreciation.

- Market sentiment, according to prevailing analysis, frames Keisei as a classic defensive buy. Nevertheless, investors are paying a price that assumes some premium for stability rather than robust future upside.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Keisei Electric Railway's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Keisei’s declining profitability, slow growth outlook, and shares trading far above fair value all raise concerns about its ability to deliver attractive returns in the future.

Want better value for your money? Check out these 831 undervalued stocks based on cash flows to find stocks trading below intrinsic value, offering stronger upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keisei Electric Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9009

Keisei Electric Railway

Engages in the provision of public railway transportation services for local communities in Japan.

Fair value with low risk.

Market Insights

Community Narratives