- Japan

- /

- Transportation

- /

- TSE:9008

Keio (TSE:9008) Valuation in Focus After Share Buyback and Stock Split Plans

Reviewed by Simply Wall St

Keio (TSE:9008) has set out plans to repurchase up to 3.4 million shares, or around 3% of its share capital, and cancel those shares by March 2026. In addition, the Board discussed a potential stock split that may affect per-share metrics and liquidity.

See our latest analysis for Keio.

Keio’s announcement of a buyback and possible stock split comes after a year of softer trading, with the latest share price at ¥3,743 and a 1-year total shareholder return of -8.3%. While short-term price momentum improved recently, longer-term headwinds are still weighing on performance. Decisive actions like these could start rebuilding investor confidence.

If corporate shakeups are something you watch for, now is a great opportunity to broaden your investing horizons and discover fast growing stocks with high insider ownership

With these bold moves now on the table, investors have to ask whether Keio is trading at a discount that presents a buying opportunity, or if the market has already factored in any potential future growth.

Price-to-Earnings of 11.2x: Is it justified?

Keio’s current price-to-earnings (P/E) ratio stands at 11.2x, significantly below both the overall Japanese market average of 14.2x and the transportation industry average of 12.7x. This suggests the shares may be trading at a discount compared to peers.

The P/E ratio reflects how much investors are willing to pay today for a yen of past or projected future earnings. For a company like Keio, which operates in the mature and stable transportation sector, this metric is widely used to compare valuation across competitors and the broader market.

With Keio’s P/E positioned well below market and industry levels, it suggests the market may be undervaluing the company’s earnings potential. In addition, regression analysis indicates a fair price-to-earnings ratio should be closer to 12.7x, indicating there could be room for the market to re-rate the stock higher if fundamentals improve.

Explore the SWS fair ratio for Keio

Result: Price-to-Earnings of 11.2x (UNDERVALUED)

However, slowing net income growth and lackluster multi-year returns remain concerns that could limit upside and challenge any expectations for a sustained re-rating.

Find out about the key risks to this Keio narrative.

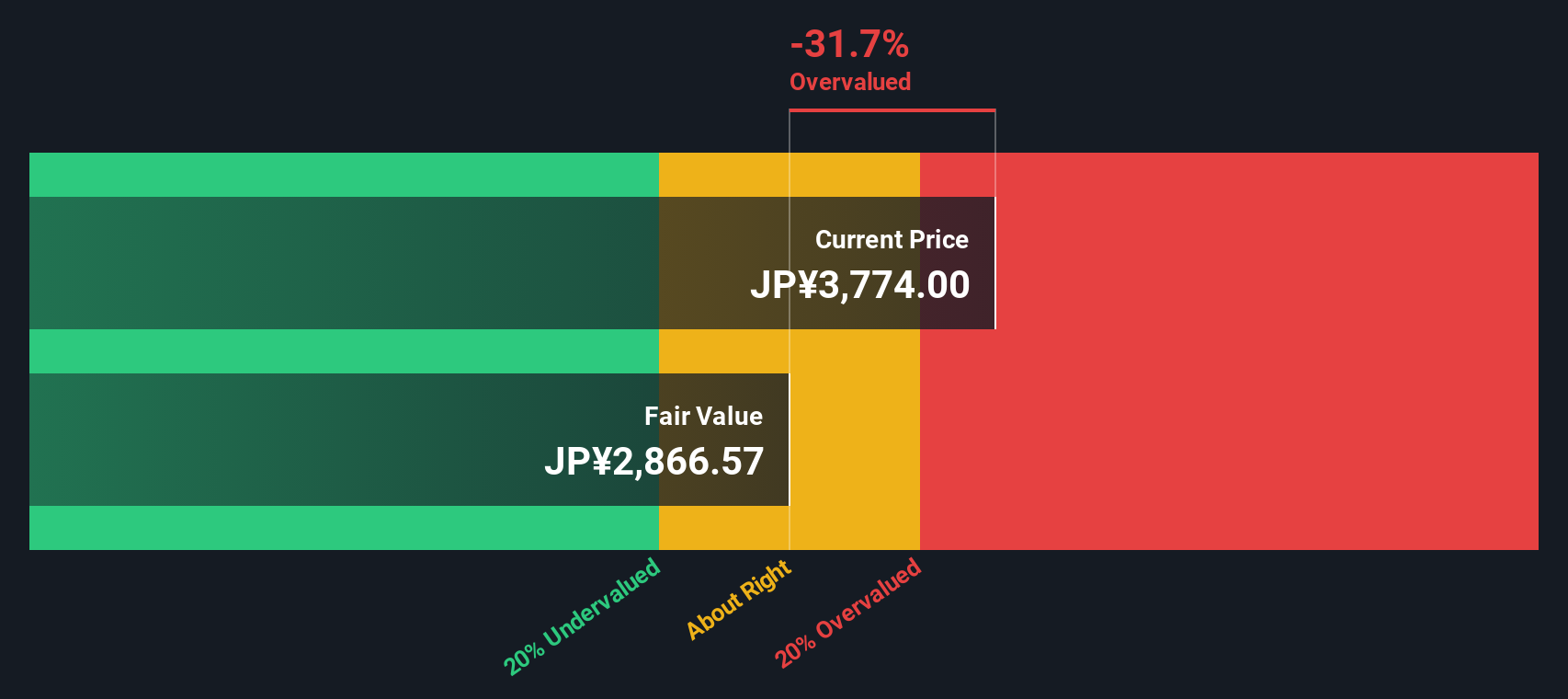

Another View: Discounted Cash Flow Says Overvalued

While the current price-to-earnings ratio points toward undervaluation, our DCF model offers a different perspective. According to this method, Keio is currently trading above its fair value estimate of ¥2,855, which suggests the market might be overestimating the company’s intrinsic worth at this time. Should investors trust earnings multiples or focus on cash flow forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Keio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Keio Narrative

If you want to dive deeper or reach a different conclusion, you have everything you need to build your own take on Keio in just a few minutes. Do it your way

A great starting point for your Keio research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Don’t miss your chance to find standout opportunities where innovation and value meet in today’s market.

- Spot companies at the forefront by checking out these 24 AI penny stocks with real-world applications that are transforming entire industries.

- Capture income potential and add stability to your portfolio by reviewing these 16 dividend stocks with yields > 3% offering generous yields above 3%.

- Future-proof your investments by targeting emerging leaders in computing, starting with these 28 quantum computing stocks advancing tomorrow’s technology today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9008

Fair value second-rate dividend payer.

Market Insights

Community Narratives