- Japan

- /

- Wireless Telecom

- /

- TSE:9434

Why SoftBank (TSE:9434) Is Down 6.6% After $500 Billion Stargate AI Data Center Expansion Announcement

Reviewed by Sasha Jovanovic

- Last week, the Stargate partnership, comprising OpenAI, Oracle, SoftBank, and the White House, announced plans to invest US$500 billion over four years to build 10 gigawatts of AI data center capacity in the U.S., with five additional data centers now slated for construction and one already in operation.

- This initiative highlights SoftBank's deepening involvement in large-scale AI infrastructure, positioning the company at the center of a pivotal transformation in U.S. artificial intelligence operations.

- We’ll now examine how SoftBank’s role in the landmark Stargate AI infrastructure project may reshape its growth narrative and risks.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SoftBank Investment Narrative Recap

To be a SoftBank shareholder, you need confidence in its ability to harness next-generation digital infrastructure and AI as growth engines while managing intense competition and controlling rising costs in its domestic telecom business. While the Stargate announcement spotlights SoftBank’s ambition in US-based AI data centers, the capital intensity and long-term payback make it less likely to shift the near-term focus, the biggest catalyst remains enterprise AI monetization in Japan, and the principal risk continues to be margin pressure from cost inflation and price competition at home.

Of its recent announcements, the March 5 expansion with SambaNova at a new AI data center in Japan most directly ties to the Stargate news, underlining SoftBank’s push to build and commercialize advanced AI infrastructure. The rollout of these high-performance facilities supports SoftBank’s catalyst of targeting Japan-based enterprises with proprietary AI models and commercial GPU-as-a-service, potentially accelerating recurring revenue growth in its core market.

On the other hand, investors should be aware that high upfront data center investments may strain SoftBank’s cash flows and elevate debt, especially if...

Read the full narrative on SoftBank (it's free!)

SoftBank’s outlook anticipates ¥7,548.0 billion in revenue and ¥650.7 billion in earnings by 2028. This scenario requires a 4.2% annual revenue growth rate and a ¥149.5 billion increase in earnings from the current ¥501.2 billion level.

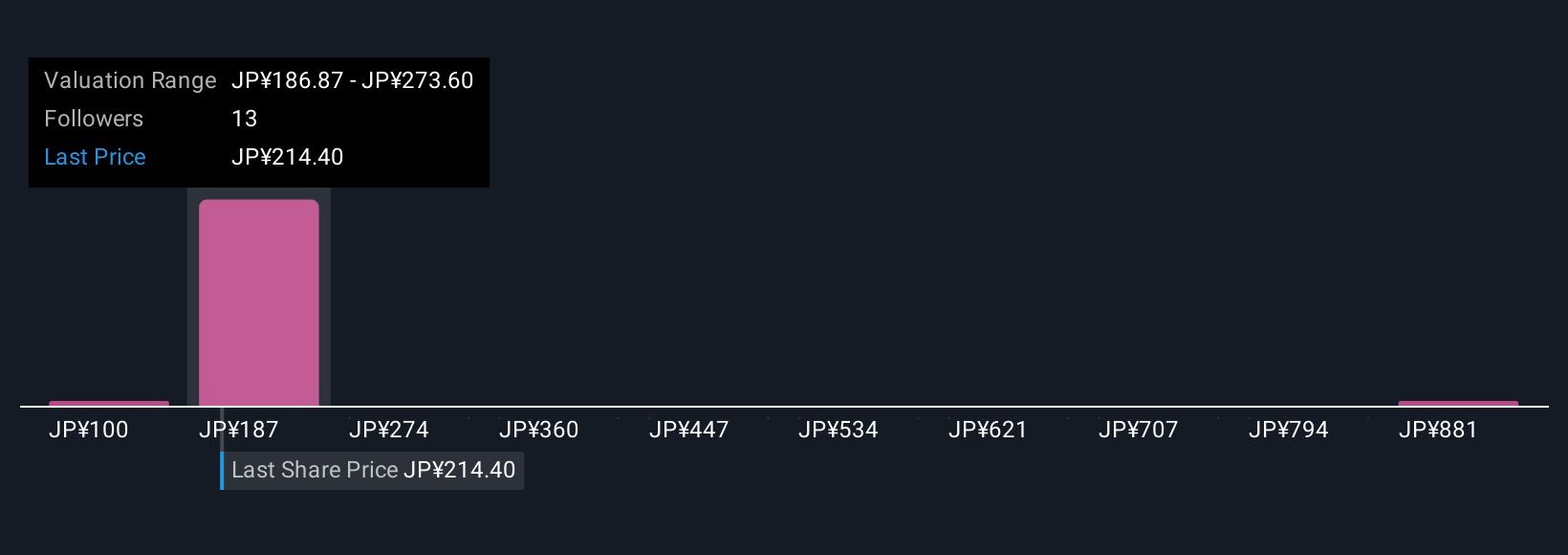

Uncover how SoftBank's forecasts yield a ¥235 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Five Community members estimate SoftBank’s fair value between ¥100.14 and ¥967.44, reflecting vast differences in outlook and conviction. Rising costs and compressed margins at home continue to weigh on short-term performance, so consider multiple viewpoints before deciding.

Explore 5 other fair value estimates on SoftBank - why the stock might be worth less than half the current price!

Build Your Own SoftBank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoftBank research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SoftBank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoftBank's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9434

SoftBank

Provides mobile communications and fixed-line telecommunications and ISP services in Japan.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success