- Japan

- /

- Telecom Services and Carriers

- /

- TSE:9432

What NTT (TSE:9432)'s Quantum Computing Partnership Could Mean for Optical Innovation and Growth

Reviewed by Sasha Jovanovic

- During the recent NTT R&D Forum in Tokyo, NTT, Inc. and OptQC Corp. announced a collaboration to develop a scalable 1-million qubit optical quantum computer by 2030, integrating NTT’s optical technologies with OptQC’s advancement in quantum hardware.

- This partnership signifies a major step forward for practical, room-temperature quantum computing, leveraging NTT’s established innovation in optical communications to potentially overcome longstanding barriers in quantum technology.

- We’ll explore how NTT’s push to commercialize optical quantum computing with OptQC could influence its longer-term investment outlook and growth story.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

NTT Investment Narrative Recap

NTT shareholders often believe in the long-term shift toward next-generation communications and computing, powered by the company’s unique technology portfolio and legacy network reach. The new quantum computing partnership with OptQC is promising for innovation, but it does not materially change the key short-term catalyst: sustained data center and digital services growth. However, the greatest risk, persistent declines in mobile communications service revenue, especially at DOCOMO, remains, and the news does little to address those underlying pressures.

Among NTT’s recent moves, the increased quarterly dividend to JPY 2.65 per share, paid in November, is most relevant in the current context, as it reflects attempts to reward shareholders while managing profit pressures from legacy business declines. Still, these steady returns are only sustainable if growth businesses continue offsetting structural challenges in the core telecom segment.

By contrast, what shareholders should carefully monitor is NTT’s exposure to prolonged revenue contraction in mobile services, especially as...

Read the full narrative on NTT (it's free!)

NTT's outlook anticipates ¥15,111.0 billion in revenue and ¥1,245.9 billion in earnings by 2028. This scenario is based on a 3.3% annual revenue growth rate and a ¥260.3 billion increase in earnings from the current ¥985.6 billion.

Uncover how NTT's forecasts yield a ¥179 fair value, a 15% upside to its current price.

Exploring Other Perspectives

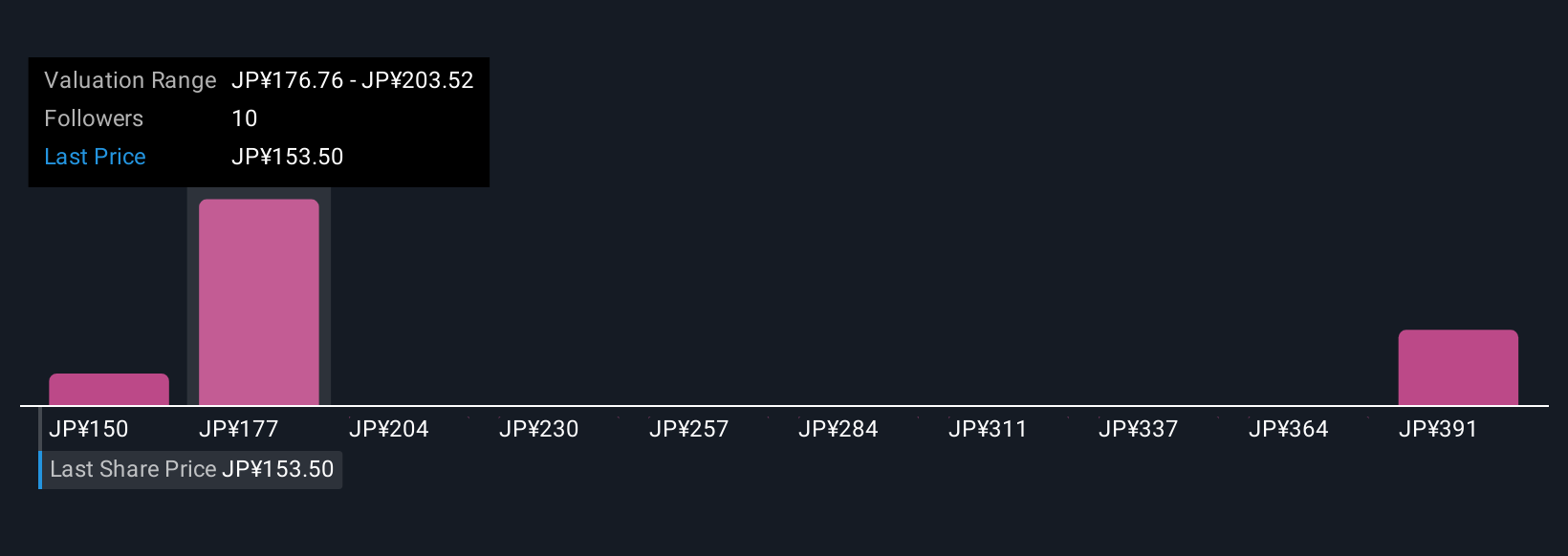

Simply Wall St Community members provided four fair value estimates for NTT ranging from ¥150 to ¥322.29 per share. Given mounting risks around declining mobile revenues, you may want to compare these viewpoints with your own assumptions about future earnings and growth.

Explore 4 other fair value estimates on NTT - why the stock might be worth over 2x more than the current price!

Build Your Own NTT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NTT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NTT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NTT's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9432

NTT

Operates as a telecommunications company in Japan and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026