- Japan

- /

- Electronic Equipment and Components

- /

- TSE:8141

Shinko Shoji (TSE:8141) Headline Profit Lifted by ¥2.2B One-Off Gain, Raising Earnings Quality Concerns

Reviewed by Simply Wall St

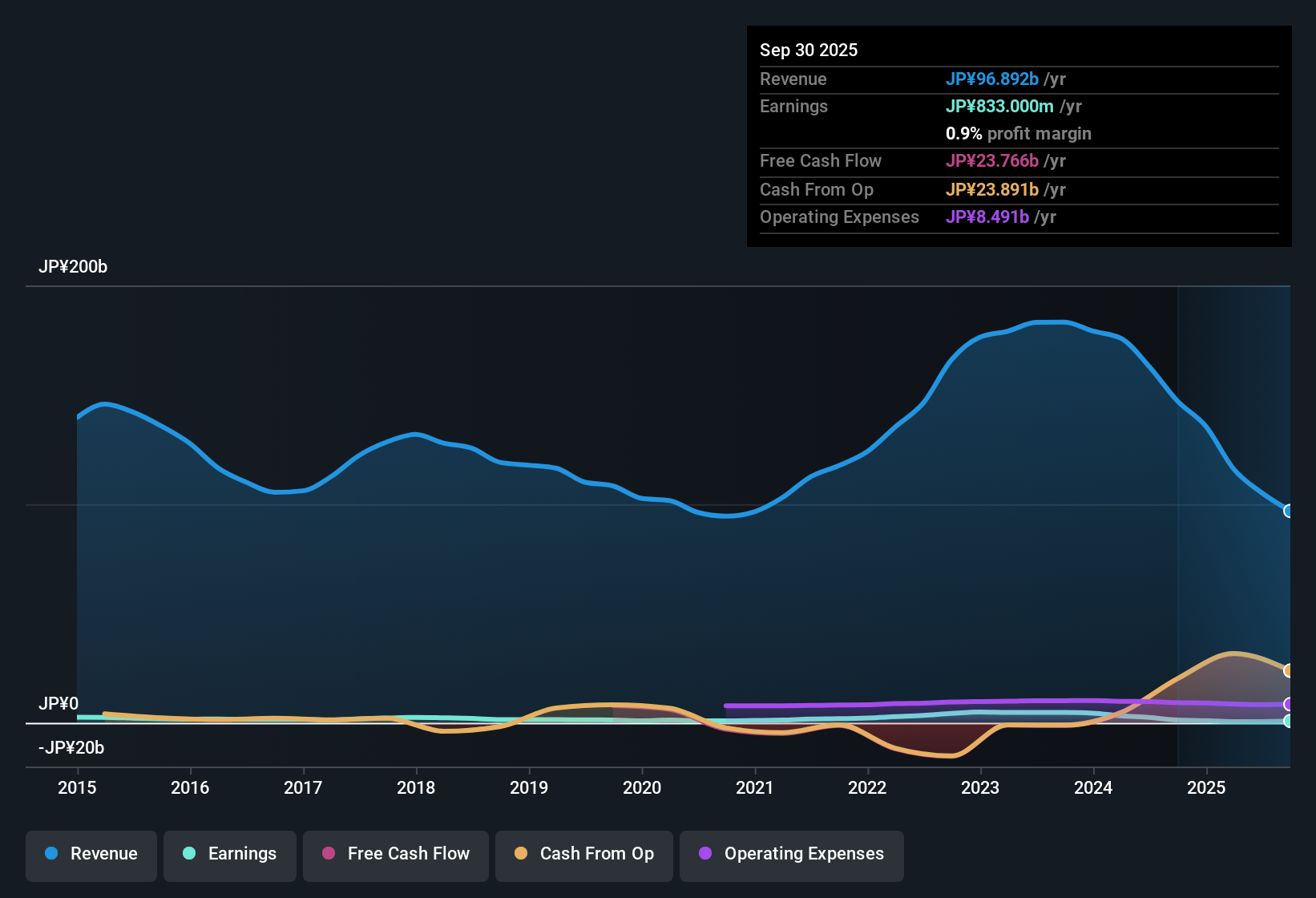

Shinko Shoji (TSE:8141) saw its earnings decline by an average of 2.8% per year over the past five years, with the latest annual period showing another year of negative earnings growth. Net profit margins remained at 0.9%, matching last year’s level, while reported earnings were boosted by a sizable ¥2.2 billion one-off gain that does not reflect ongoing operations. Shares currently trade at a Price-To-Earnings ratio of 35.4x, which is well above both the Japanese electronic industry average of 15.6x and the peer median of 8.9x. However, a discounted cash flow analysis suggests the share price of ¥1,019 is below its estimated fair value of ¥18,378.87. The overall picture is one where a positive discounted cash flow value signal stands in contrast to weak earnings trends and expensive earnings multiples, pointing to a complex outlook for investors watching both value and sustainability.

See our full analysis for Shinko Shoji.Next, we will see how the numbers line up with prevailing market narratives. Some long-held views may be reinforced, while others will be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Masks Ongoing Profit Picture

- The latest period’s reported earnings include a ¥2.2 billion one-off gain, a sizable amount compared to the company's underlying performance.

- This strongly supports the view that headline profits are boosted by non-recurring items, making it difficult to judge the business's trend based solely on recent figures.

- The one-off gain has a significant impact on this year’s result, making it harder to assess recurring earnings power.

- Critics highlight this abnormal gain as evidence that sustainable profitability may be overestimated, especially with net profit margins still low at 0.9%.

Profit Margins Hold at 0.9%

- Net profit margins remained unchanged at 0.9%, showing no improvement over the previous year despite the large one-off boost to earnings.

- This is unexpected for those anticipating operational progress, as profitability stayed flat even with the extra gain, highlighting that underlying margin challenges persist.

- Unchanged margin levels suggest ongoing cost or pricing pressures that have yet to subside, regardless of extraordinary gains.

- Optimistic investors may have anticipated stronger operational leverage, but this data indicates the core business continues to face challenges.

DCF Value Signal at Odds with Price-to-Earnings Premium

- The share price of ¥1,019 is well below the DCF fair value estimate of ¥18,378.87, yet the stock trades at a 35.4x Price-To-Earnings ratio compared to an industry average of 15.6x and a peer median of 8.9x.

- Overvaluation risk is a dominant concern, as the positive indication from discounted cash flow contrasts with weak growth tendencies and an earnings multiple that is high for the sector.

- Investors must weigh the low market price relative to DCF value against the valuation premium on earnings, particularly with subdued growth expectations.

- The market may be cautious, factoring in concerns about earnings quality and sustainability despite the mathematical value indication.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shinko Shoji's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shinko Shoji’s inconsistent earnings growth, reliance on a one-off gain, and expensive valuation highlight persistent challenges in delivering reliable and sustainable performance.

If you’re seeking investments with a stronger foothold, use our stable growth stocks screener (2101 results) to discover companies that consistently deliver steady earnings and resilient growth no matter the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8141

Shinko Shoji

Engages in the import, export, and sale of electronic components in Japan, rest of Asia, North America, and Europe.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives