- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6981

Why Murata Manufacturing (TSE:6981) Is Up 6.9% After Launching High-Voltage MLCCs for SiC MOSFETs

Reviewed by Sasha Jovanovic

- On December 2, 2025, Murata Manufacturing announced the launch and mass production of a multilayer ceramic capacitor (MLCC) with 15nF capacitance, 1.25kV rated voltage, and C0G performance, designed to meet the needs of SiC MOSFETs in electric vehicles and high-performance devices.

- This development highlights Murata's response to the increasing demand for advanced components that support greater efficiency and reliability in next-generation power supply and automotive applications.

- We'll explore how Murata's entry into high-voltage MLCCs for SiC MOSFETs shapes the company's broader investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Murata Manufacturing's Investment Narrative?

For anyone considering Murata Manufacturing as an investment, the big picture centers on the company's ability to deliver innovative electronic components that cater to future-focused markets such as electric vehicles and high-efficiency power systems. The recent move to mass produce a compact, high-voltage C0G MLCC tailored to the emerging SiC MOSFET segment could positively influence Murata’s short-term catalysts, particularly as electric vehicle adoption accelerates and design complexities in power electronics increase. Previously, risks included slow revenue growth, share price volatility, and a high price-to-earnings ratio compared to industry peers. Now, with this MLCC launch addressing a technical bottleneck in EV powertrains, Murata may mitigate some competitive threats and strengthen its value proposition among automotive OEMs. However, market response, adoption rates, and ongoing margin pressures remain front of mind following this product release.

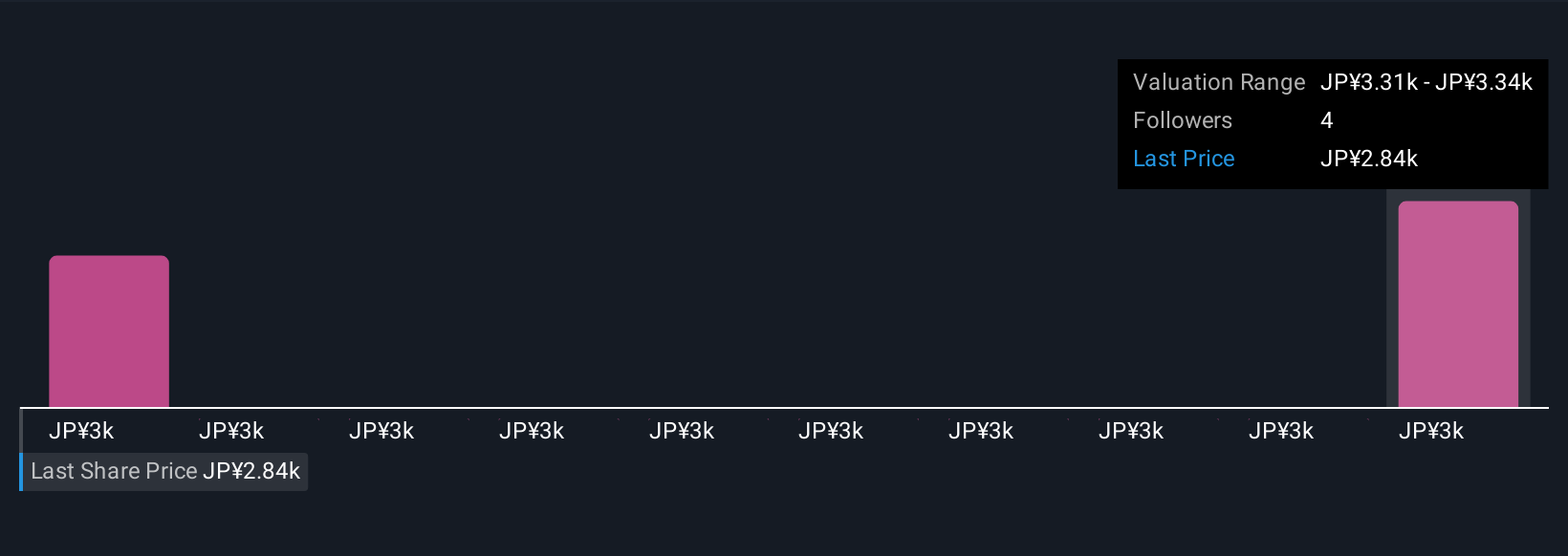

But investors should not ignore ongoing cost and margin pressures that could temper the near-term upside. Murata Manufacturing's shares have been on the rise but are still potentially undervalued by 14%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Murata Manufacturing - why the stock might be worth as much as 16% more than the current price!

Build Your Own Murata Manufacturing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Murata Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Murata Manufacturing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Murata Manufacturing's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6981

Murata Manufacturing

Develops, manufactures, and sells ceramic-based passive electronic components and solutions in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026