- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6861

Keyence (TSE:6861): Evaluating Valuation After Leadership Shift and Dividend Policy Update

Reviewed by Simply Wall St

Keyence (TSE:6861) is shaking things up with significant board-approved leadership changes, naming Tetsuya Nakano as its next President starting late December. The company also announced an increase to its interim dividend and revised dividend forecasts.

See our latest analysis for Keyence.

Following this boardroom shakeup and a boost to the interim dividend, investors have been weighing Keyence’s momentum. Despite upbeat moves on the management and dividend front, the 1-year total shareholder return stands at -19.1%, with the share price recently at ¥55,000 and down almost 13% year-to-date. Short-term sentiment has faded a bit, but these structural changes could set the stage for renewed growth.

If you’re curious about other technology leaders making bold moves, consider exploring the full range of opportunities in our high growth tech and AI stocks screener. See the full list for free.

With the stock trading well below its analyst target price and new leadership in place, the question becomes whether Keyence is presenting a value opportunity, or if the market has already factored in future growth prospects.

Price-to-Earnings of 32.6x: Is it Justified?

Keyence is currently trading at a price-to-earnings (P/E) ratio of 32.6x, which means investors are paying a premium compared to its peers and the broader market. With a last close of ¥55,000, the company's valuation stands out as significantly higher than similar companies in the JP Electronic industry.

The price-to-earnings ratio shows how much investors are willing to pay for each yen of Keyence's earnings. For a technology leader like Keyence, the P/E ratio reflects both current profitability and expectations for future earnings growth. Typically, a high P/E suggests the market expects robust profit expansion or significant operational advantages.

However, Keyence's P/E of 32.6x exceeds the JP Electronic industry average of 14.9x and surpasses the peer group average of 18.4x by a wide margin. Even compared to the estimated fair P/E of 26x, the current multiple suggests that the market may be assigning an ambitious growth premium that could face scrutiny if expectations are not met. This difference sets a clear benchmark that investors will be watching closely.

Explore the SWS fair ratio for Keyence

Result: Price-to-Earnings of 32.6x (OVERVALUED)

However, slower revenue growth or missed profit targets could challenge the current premium valuation and reduce investor optimism going forward.

Find out about the key risks to this Keyence narrative.

Another View: What Does Our DCF Suggest?

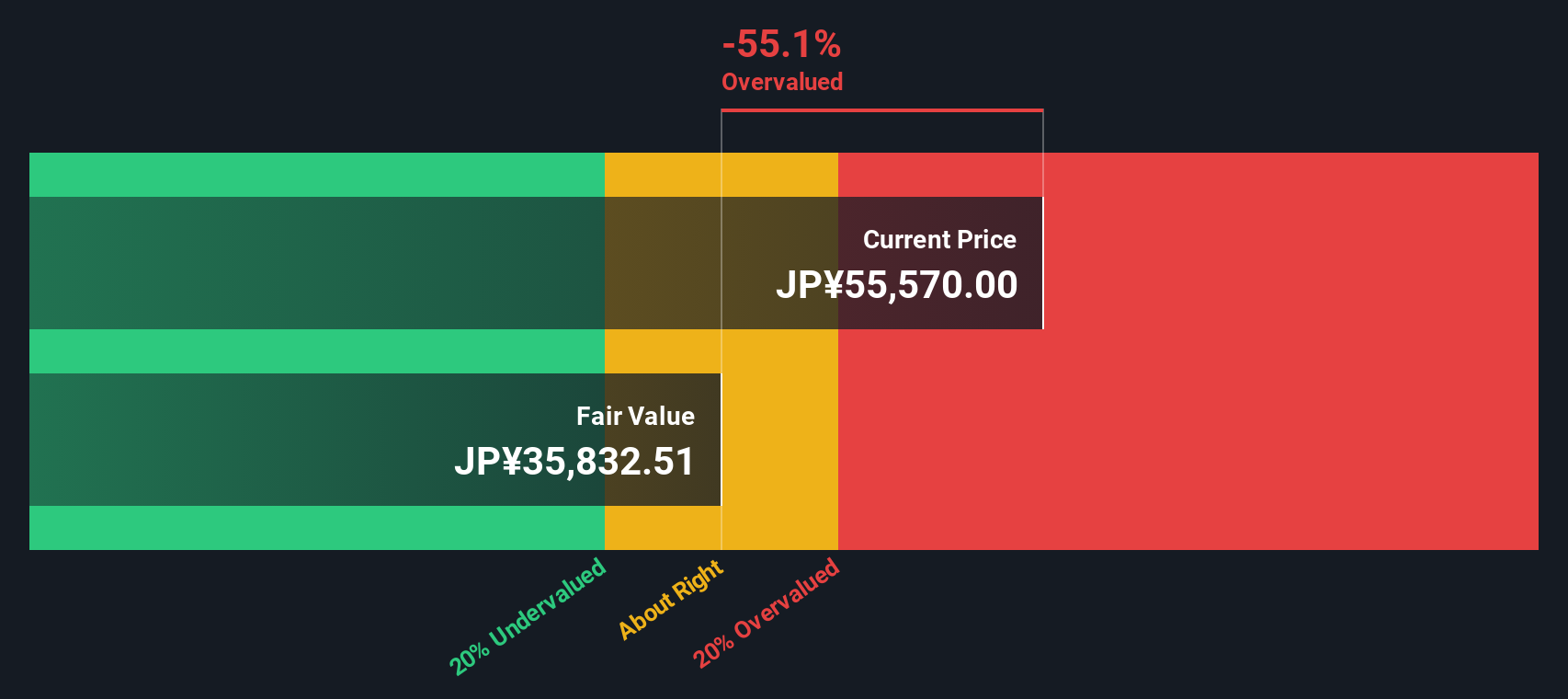

While the price-to-earnings ratio points to an expensive stock, the SWS DCF model offers a different angle. According to our analysis, Keyence’s current share price is significantly higher than its estimated fair value, which signals the stock may be overvalued by this method as well. Does this put more pressure on the growth story, or is the market simply looking further ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Keyence for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Keyence Narrative

If you’d rather draw your own conclusions or want to interpret the data in your own way, you can create a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Keyence.

Looking for More Smart Investment Ideas?

Make your next move count by using our top screeners to uncover stocks with strong growth, resilient dividends, and disruptive potential before everyone else does.

- Capture higher yields and steadier income by tapping into these 16 dividend stocks with yields > 3% with yields over 3% and robust fundamentals.

- Benefit from rapid tech advances by checking out these 25 AI penny stocks in artificial intelligence. These companies are outpacing the competition and setting new industry benchmarks.

- Maximize your capital by uncovering undervalued gems through these 876 undervalued stocks based on cash flows. These are selected based on their powerful cash flows and future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keyence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6861

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives