- Japan

- /

- Electronic Equipment and Components

- /

- TSE:5344

Maruwa (TSE:5344): Assessing Valuation After Downward Earnings Guidance Revision for FY2026

Reviewed by Simply Wall St

MaruwaLtd (TSE:5344) has updated its outlook for the fiscal year ending March 2026, lowering projected net sales and operating profit compared to its earlier guidance. This type of earnings revision often prompts investors to reassess their expectations.

See our latest analysis for MaruwaLtd.

Following the updated guidance, MaruwaLtd shares showed resilience, climbing 15.1% over the past week despite a lowered outlook and recent dividend boost. Even so, the stock’s momentum has faded this year, with a year-to-date share price return of -10.1%. However, long-term holders have still enjoyed a dynamic run, as its five-year total shareholder return stands at a remarkable 339.7%.

If today’s market moves have you thinking about broadening your search, this is a great moment to discover fast growing stocks with high insider ownership.

Against that backdrop, investors are left debating whether MaruwaLtd's current valuation underappreciates its long-term growth potential, or if the market has already accounted for any upside in advance. Could this be a buying opportunity, or is future growth already priced in?

Price-to-Earnings of 29.5x: Is it justified?

MaruwaLtd's current price-to-earnings ratio stands at 29.5x, setting a high bar compared both to peers and to its own growth outlook. This suggests the market is already paying up for anticipated profit gains.

The price-to-earnings (P/E) ratio reflects the amount investors are willing to pay for each yen of the company's earnings. For mature companies in the tech hardware sector, a high P/E signals expectations of above-average future growth or premium profitability.

Currently, MaruwaLtd trades at a premium not only to the JP Electronic industry average (14.9x), but also above the estimated fair price-to-earnings ratio (26.6x). This indicates the stock may be overvalued relative to both its sector and a fair valuation baseline. These ratios imply that, barring an unexpected step-change in future profits, investors may be factoring in optimistic growth assumptions ahead of what analysts or models suggest is justified.

Explore the SWS fair ratio for MaruwaLtd

Result: Price-to-Earnings of 29.5x (OVERVALUED)

However, unexpected revenue slowdowns or rising costs could quickly challenge bullish assumptions that are supporting MaruwaLtd's elevated valuation.

Find out about the key risks to this MaruwaLtd narrative.

Another View: What Does Our DCF Model Say?

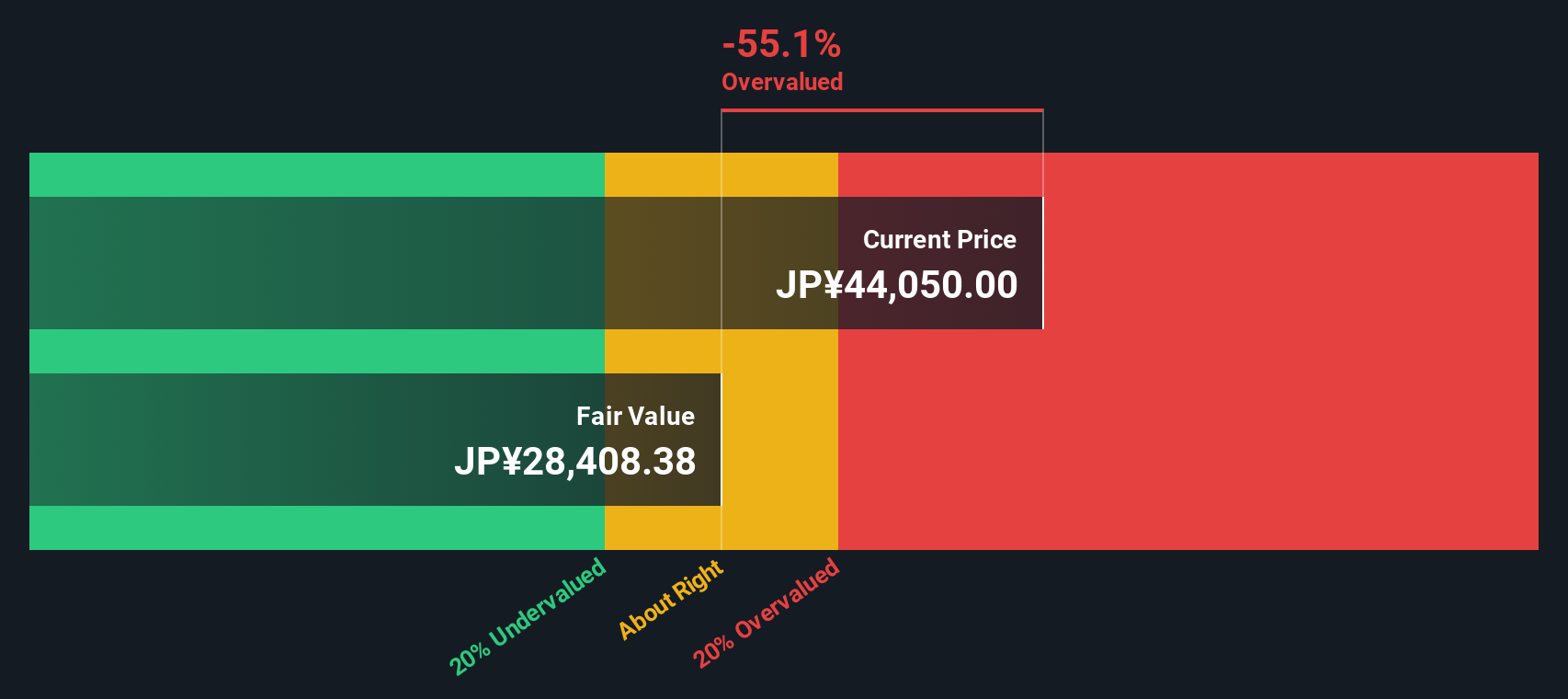

While MaruwaLtd looks expensive on a price-to-earnings basis, our SWS DCF model paints a different picture. The stock is currently trading well above its estimated fair value of ¥28,261. This suggests the market may be pricing in much more growth than the DCF would justify. Is this optimism warranted, or does it signal caution ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MaruwaLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MaruwaLtd Narrative

If you'd rather draw your own conclusions or believe another angle deserves attention, it takes just a few minutes to craft your own view. Do it your way.

A great starting point for your MaruwaLtd research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio by targeting stocks in emerging sectors and resilient niches. Act now to get ahead of the crowd before the next big winner breaks out.

- Capture lucrative opportunities by reviewing these 865 undervalued stocks based on cash flows that are currently trading below their intrinsic worth.

- Capitalize on healthcare’s AI momentum and see which companies are transforming patient care with these 32 healthcare AI stocks.

- Streamline your search for top-yield choices by checking out these 14 dividend stocks with yields > 3% currently offering strong dividends over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5344

MaruwaLtd

Produces and sells ceramics and electronic parts in Japan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives