- Japan

- /

- Electronic Equipment and Components

- /

- TSE:4062

Assessing Ibiden (TSE:4062) Valuation Following Nikkei 225 Entry and Dividend Strategy Upgrades

Reviewed by Simply Wall St

Ibiden Ltd (TSE:4062) just landed a spot in the Nikkei 225 Index, an event that tends to spark investor interest. This milestone, combined with its revamped progressive dividend policy and updated guidance, shows a clear focus on shareholder value.

See our latest analysis for IbidenLtd.

The momentum behind IbidenLtd has clearly accelerated in recent months, as excitement around its Nikkei 225 inclusion, refreshed dividend outlook, and upbeat guidance has coincided with a 34% one-month share price return and an impressive 176% gain year-to-date. In summary, the stock’s strong upward move in 2025 continues a remarkable long-term trend, with a five-year total shareholder return of 216% reflecting durable growth and rising market confidence.

If Ibiden’s rapid ascent has you looking for more in the market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With such rapid gains and a wave of positive news, investors are left to wonder if Ibiden’s current share price is undervalued given its ambitious outlook, or if the market has already factored in all of its future growth potential.

Price-to-Earnings of 53x: Is it justified?

IbidenLtd’s current share price translates into a high price-to-earnings (P/E) ratio of 53x, which stands well above both the industry norm and its closest peers. This significant valuation means the market is pricing in much stronger future growth or profitability than the sector average.

The price-to-earnings ratio is a key metric that tells investors how much they are paying for each unit of current earnings. Technology stocks often command higher P/E ratios, with investors betting that today’s profits are only a starting point in a longer-term earnings trajectory.

Compared to the Japanese electronics industry average of 14.9x and a peer average of 34.3x, IbidenLtd’s P/E sits at a substantial premium. The market is expecting earnings to expand quickly, and if profit growth stalls, this valuation could attract scrutiny. According to our analysis, the fair P/E for IbidenLtd stands at 35x, meaning the current multiple is stretched beyond where the market could settle if growth does not keep up.

Explore the SWS fair ratio for IbidenLtd

Result: Price-to-Earnings of 53x (OVERVALUED)

However, rapid share price gains could reverse if profit growth slows. Additionally, analysts' price targets, which are currently below market, could spark investor caution.

Find out about the key risks to this IbidenLtd narrative.

Another View: Discounted Cash Flow Perspective

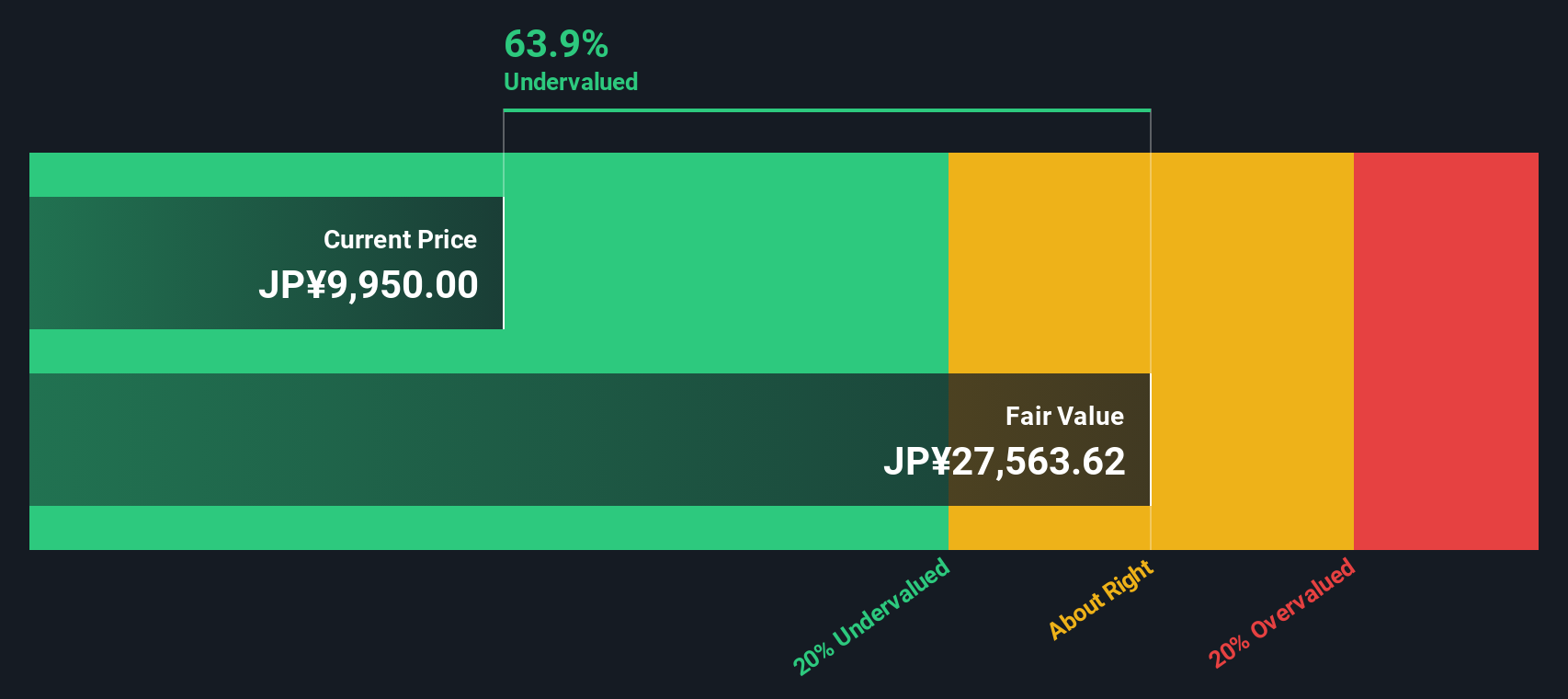

To challenge the high price-to-earnings ratio, let's look at IbidenLtd through the lens of our DCF model. Surprisingly, it suggests the shares are trading around 51% below our estimate of fair value, which points to significant undervaluation. Can this bottom-up approach uncover hidden value that traditional multiples might miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IbidenLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IbidenLtd Narrative

If you want to dig into the numbers for yourself and see things from your own perspective, it’s quick and easy to build your own view in just a few minutes, so why not Do it your way

A great starting point for your IbidenLtd research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open and look for hidden gems. Take a moment to check these handpicked opportunities and give your portfolio an edge before the market catches on.

- Capture tomorrow’s medical breakthroughs by starting your search with these 32 healthcare AI stocks, which is powering advancements in diagnostics, patient care, and biotech innovation.

- Boost your future returns by targeting these 874 undervalued stocks based on cash flows, which are priced well below their intrinsic value and offer compelling upside and potential market outperformance.

- Accelerate your gains in the digital finance race by checking out these 82 cryptocurrency and blockchain stocks, which is shaping payment technology and blockchain ecosystems worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4062

IbidenLtd

Manufactures and sells electronic and ceramics products in Japan, Asia, North America, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives