- Japan

- /

- Electronic Equipment and Components

- /

- TSE:268A

How Investors Are Reacting To Rigaku Holdings (TSE:268A) Expanding R&D Presence With New Taiwan Center

Reviewed by Sasha Jovanovic

- Rigaku Holdings Corporation recently announced the opening of the Rigaku Technology Center Taiwan Co. Ltd. in the Tai Yuen Hi-Tech Industry Park, establishing the new Rigaku Technology Center Taiwan (RTTW) as an engineering base for R&D, customer support, and joint development across semiconductors, materials, and life sciences.

- This move underscores the company's commitment to bolstering customer support and fostering innovation in one of Asia's leading technology hubs.

- We'll explore how enhanced engineering resources for semiconductor and life science clients may reshape Rigaku Holdings' broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is Rigaku Holdings' Investment Narrative?

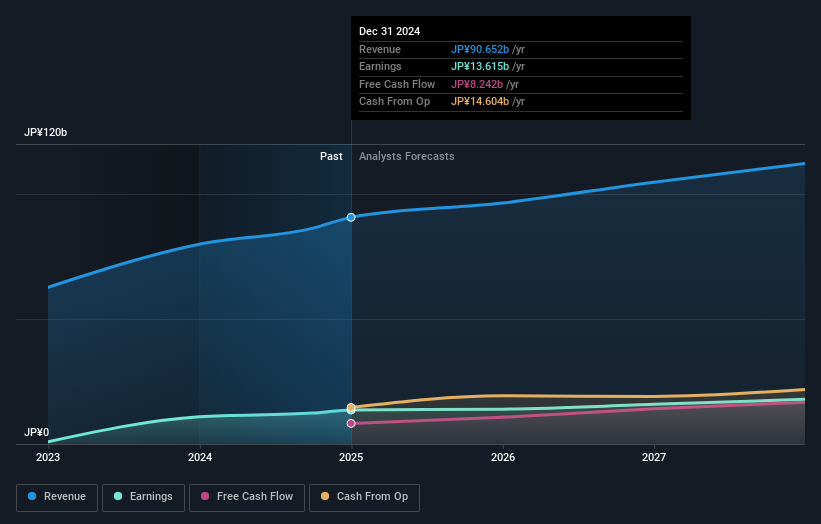

To see Rigaku Holdings as a compelling long-term story, investors typically focus on its ability to expand in fast-evolving sectors like semiconductors and life sciences, where innovation and local partnerships drive future revenue streams. The recent launch of the Rigaku Technology Center Taiwan could feed into this narrative by accelerating product development and deepening ties with key regional customers. For near-term catalysts, the facility might support improved uptake for new offerings like the XHEMIS TX-3000, while also providing a boost to service and support functions in Asia’s tech hub. However, risks remain, especially given revised revenue guidance, exposure to shifts in U.S. policy, and still-challenging demand dynamics in some product lines. The RTTW expansion may soften some operational risks, but is unlikely to fundamentally shift profit growth expectations or valuation in the short run unless it spurs meaningful contract wins or measurable topline acceleration.

On the flip side, the potential for weaker-than-expected demand in core markets is still something to watch closely.

Exploring Other Perspectives

Explore 2 other fair value estimates on Rigaku Holdings - why the stock might be worth just ¥1056!

Build Your Own Rigaku Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigaku Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Rigaku Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigaku Holdings' overall financial health at a glance.

No Opportunity In Rigaku Holdings?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:268A

Rigaku Holdings

Engages in the manufacture and sale of scientific equipment in Japan, the United States, Europe, and Asia.

Excellent balance sheet and fair value.

Market Insights

Community Narratives