JBCC Holdings (TSE:9889) Margin Expansion Reinforces Bullish Narratives on Valuation and Growth

Reviewed by Simply Wall St

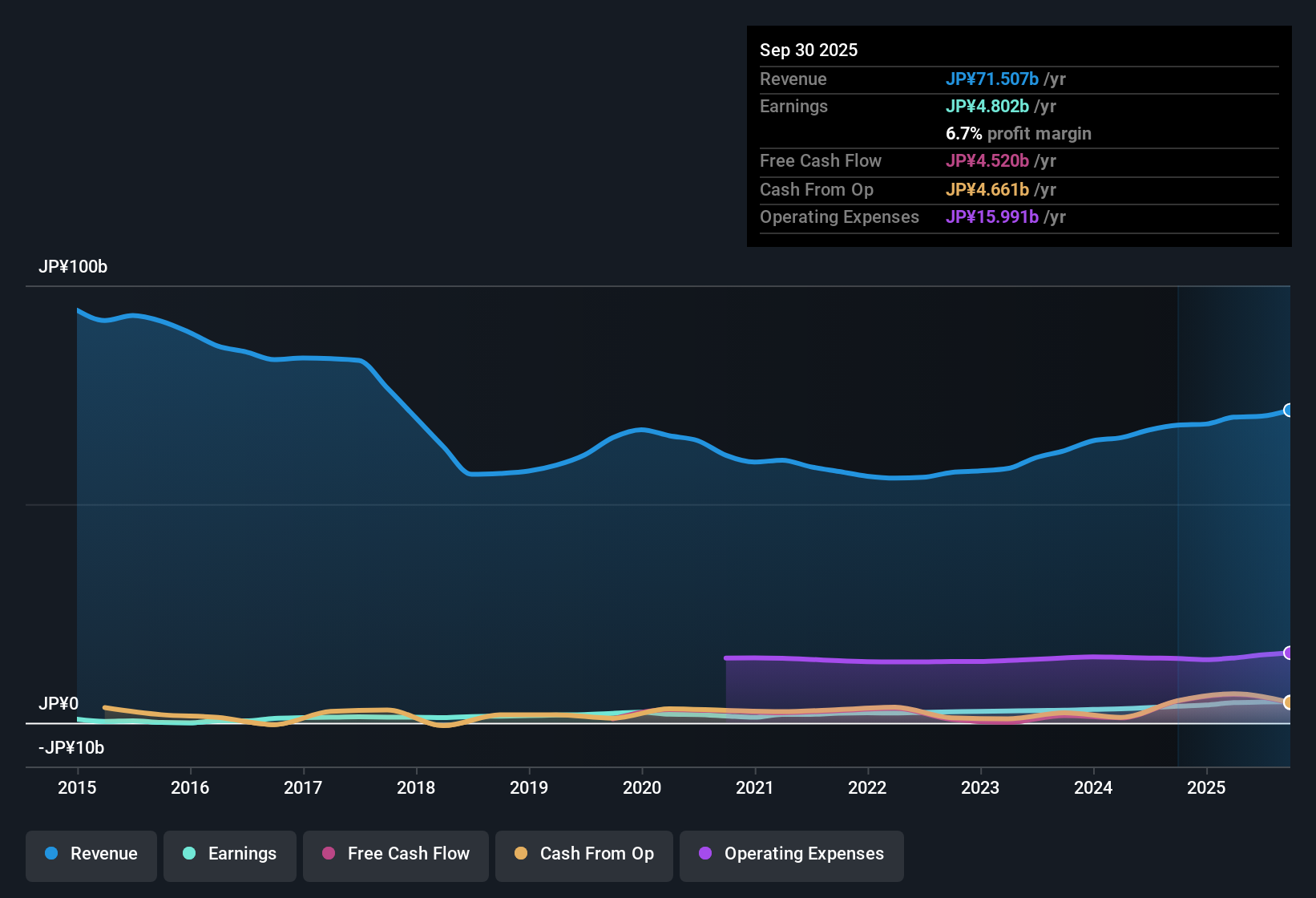

JBCC Holdings (TSE:9889) posted a robust set of results, with annual earnings growth at 26.3% for the most recent year and net profit margins rising to 6.7% from 5.6% a year ago. Forecasts call for earnings to grow 13.2% per year and revenue to increase 6.8% annually, both comfortably ahead of the broader Japanese market. With a five-year earnings growth average of 21.9%, investors are eyeing not only the accelerating profits and improving margins, but also the company’s shares trading below estimated fair value. However, the sustainability of the dividend remains a key watch point.

See our full analysis for JBCC Holdings.Next up, we put these latest figures side-by-side with the most widely discussed narratives, testing where the market story gets reinforced and where it might be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Climb, Outpacing Past Years

- Net profit margins rose to 6.7%, up from 5.6% last year, marking a notable expansion that puts profitability well above recent trends.

- Bullish arguments highlight that this margin improvement, alongside 21.9% compound annual earnings growth over five years, heavily supports optimism about continued operational strength.

- The forecast for 13.2% annualized earnings growth remains substantially above the Japanese market. This reinforces the narrative that JBCC’s sector outperformance has meaningful momentum.

- A five-year record of accelerating profits gives bulls a compelling data-backed case. Margin improvement also adds a fresh dimension to long-term growth.

Dividend Sustainability Under the Microscope

- The main risk flagged in recent filings is whether JBCC’s dividend can be maintained at current levels, despite robust profit growth.

- Bears argue that dividend health is not guaranteed. While current margins and earnings trends appear strong, a single miss in profit trajectory could shift the outlook, particularly without explicit guidance on future payout ratios.

- JBCC’s above-average earnings growth and margin gains reduce immediate concerns, but recurring debate centers on the possibility that high growth phases may not always support stable dividends.

- Profit durability remains under watch by cautious investors who see ongoing payout as vulnerable to cyclical shifts or unforeseen costs not detailed in current filings.

Shares Trading at 35% Discount to DCF Fair Value

- As of the latest data, JBCC shares trade at ¥1,295 compared to a DCF fair value estimate of ¥1,987.88. This implies a 35% discount that is rarely seen among sector peers.

- It is notable that the Price-to-Earnings ratio of 16.8x sits below the Japanese IT industry average of 17.4x but slightly above peer averages. Prevailing market view suggests this pricing dynamic heavily supports ongoing interest from value-focused investors, especially given the company’s growth record.

- With top-line and margin momentum in place, the valuation gap signals potential upside if JBCC continues to deliver on forecasts.

- Investors weighing sector rotation may see JBCC as offering both growth and value, which is considered a rare combination at the current share price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on JBCC Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive earnings growth, doubts remain about the reliability of JBCC’s dividend payouts and whether profits can consistently sustain regular shareholder returns.

If dividend stability is your top priority, check out these 2007 dividend stocks with yields > 3% to discover companies with robust yields and a proven record of dependable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9889

JBCC Holdings

Through its subsidiaries, provides information technology (IT) services in Japan.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives