Fujitsu’s Multi‑AI Agent Supply Chain Initiative Could Be A Game Changer For Fujitsu (TSE:6702)

Reviewed by Sasha Jovanovic

- In late November and early December 2025, Fujitsu Limited announced a new multi‑AI agent collaboration technology for secure, cross‑company supply chain optimization, initiated plans for 2026 field trials with Rohto Pharmaceutical and the Institute of Science Tokyo, and held a board meeting to consider a tender offer and business integration agreements.

- This push to embed agentic AI into real‑world supply chains, with an eye to rolling it into Fujitsu’s Uvance Dynamic Supply Chain services by the end of fiscal 2026, could reshape how the company is viewed as an enabler of resilient and governed data collaboration across industries.

- We’ll now examine how Fujitsu’s multi‑AI agent supply chain initiative may influence its investment narrative built around Uvance and AI.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fujitsu Investment Narrative Recap

To hold Fujitsu, you generally need to believe it can turn its Uvance and AI initiatives into steady, higher quality earnings while managing slower forecast growth and Japan-heavy exposure. The new multi AI agent supply chain technology potentially supports the near term AI catalyst, but does not yet change the key risk that international revenue and competitiveness could lag, particularly as hardware pressure and contract lumpiness remain central concerns for the business.

The December 2025 announcement around multi AI agent collaboration in supply chains directly feeds into Fujitsu’s Uvance Dynamic Supply Chain push, giving more substance to the AI and data collaboration narrative that many investors are watching. It sits alongside the existing AI infrastructure collaborations, such as the expanded NVIDIA partnership, which together highlight how Fujitsu is trying to ensure AI is a meaningful, rather than marginal, contributor to future contracts and service margins.

Yet beneath the AI momentum, investors should be aware of the risk that ongoing weakness in international revenue could still...

Read the full narrative on Fujitsu (it's free!)

Fujitsu's narrative projects ¥3,829.0 billion revenue and ¥339.8 billion earnings by 2028. This requires 2.6% yearly revenue growth and about ¥129.4 billion earnings increase from ¥210.4 billion today.

Uncover how Fujitsu's forecasts yield a ¥4423 fair value, a 10% upside to its current price.

Exploring Other Perspectives

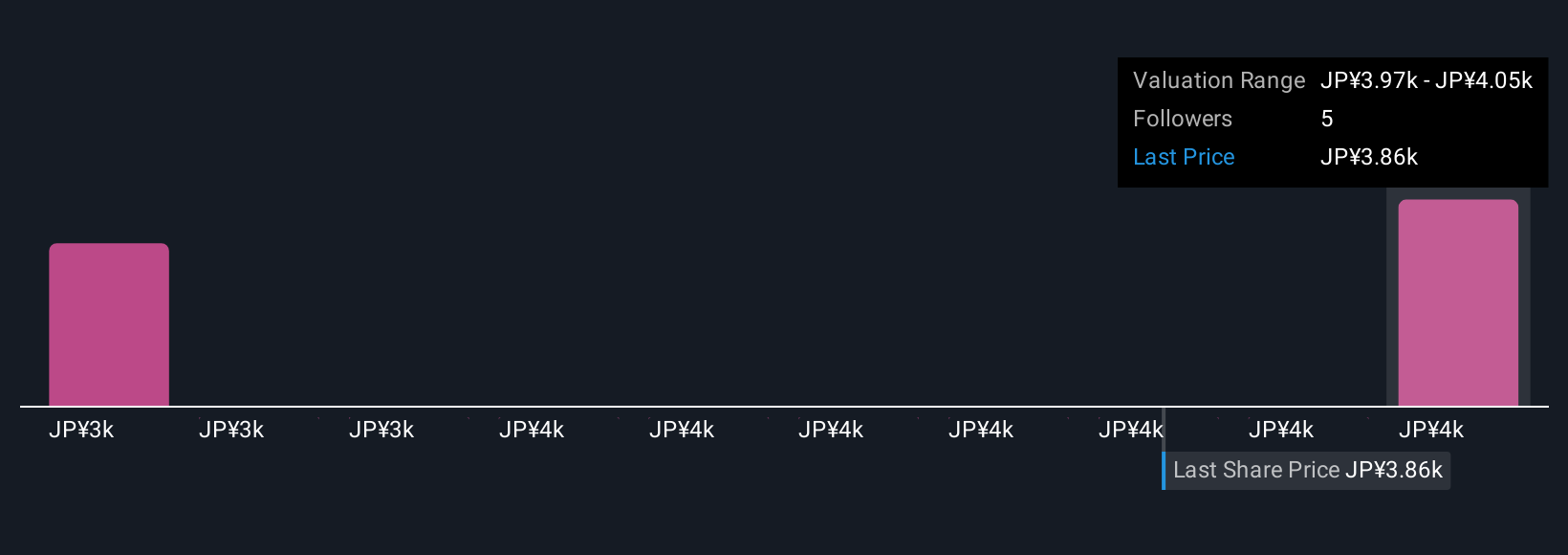

Two Simply Wall St Community fair value estimates span roughly ¥3,330 to ¥4,420 per share, highlighting just how far apart individual views can be. As you weigh these opinions, consider how much confidence you have in Fujitsu’s ability to turn its Uvance and AI initiatives into resilient earnings despite slower forecast growth and reliance on large, sometimes lumpy, contracts.

Explore 2 other fair value estimates on Fujitsu - why the stock might be worth 18% less than the current price!

Build Your Own Fujitsu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fujitsu research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Fujitsu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fujitsu's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6702

Fujitsu

Engages in providing digital services in Japan, Europe, Americas, the Asia Pacific, East Asia, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026