A Look at OBIC (TSE:4684) Valuation Following Board-Approved Share Buyback Program

Reviewed by Simply Wall St

OBICLtd (TSE:4684) just announced a board-approved share buyback program with plans to repurchase up to 6 million shares by March 2026. The company is prioritizing capital efficiency and returning profits to its shareholders.

See our latest analysis for OBICLtd.

OBICLtd’s board-approved buyback comes shortly after a recent dividend increase, sending a clear signal that the company is focused on rewarding shareholders and managing capital prudently. That focus has drawn attention, especially as the stock’s share price return is up 7.1% year-to-date, though the 1-year total shareholder return is slightly in the red at -4.5%. Despite some recent pullback, longer-term investors have still seen healthy gains over the past three and five years. This suggests momentum could be set to shift.

If these capital moves pique your interest, it might be the perfect moment to broaden your approach and discover fast growing stocks with high insider ownership

With OBICLtd’s shares recently rising but still trading about 11% below consensus analyst targets, the question now is whether the market is overlooking the company’s future growth or if all the good news is already priced in.

Price-to-Earnings of 31.1x: Is it justified?

At a price-to-earnings (PE) ratio of 31.1x, OBICLtd shares are trading at a notable premium compared to both peers and broader market benchmarks. This elevated multiple raises questions about whether the company’s current growth profile truly warrants the price investors are paying.

The price-to-earnings ratio measures what investors are willing to pay today for each yen of current earnings. A higher PE ratio usually reflects strong confidence in future profit growth or superior business quality, but it can also suggest that expectations are elevated and may be hard to meet. For software companies like OBICLtd, investors often factor in anticipated recurring revenue and healthy profit margins.

Currently, OBICLtd’s 31.1x PE is well above the JP IT industry average of 17.2x and also higher than its own peer group’s 25.8x average. In addition, this valuation sits above the estimated Fair Price-to-Earnings Ratio of 28.3x, highlighting an even greater premium than what historical relationships suggest could be justified. The market could be banking on continued robust earnings or a unique edge in its business model, but the pricing is clearly rich versus peers and its fair ratio.

Explore the SWS fair ratio for OBICLtd

Result: Price-to-Earnings of 31.1x (OVERVALUED)

However, any slowdown in revenue or profit growth, or a shift in market sentiment toward software valuations, could quickly alter the current outlook.

Find out about the key risks to this OBICLtd narrative.

Another View: What Does Our DCF Model Say?

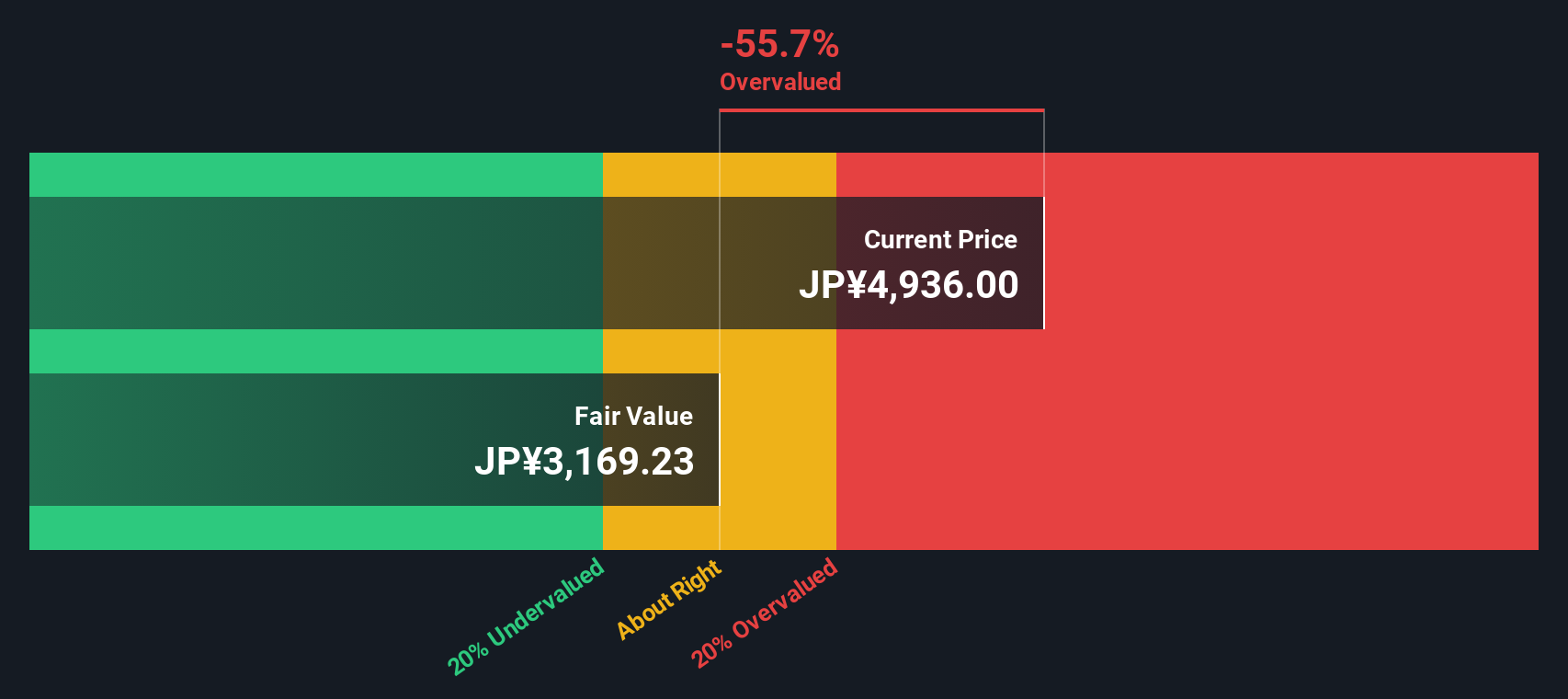

While the price-to-earnings ratio points to OBICLtd being overvalued, our SWS DCF model tells a similar story. The stock is trading meaningfully above its estimated fair value of ¥3,163, suggesting potential downside if market expectations reset. Could the fundamentals catch up, or does this highlight a risk to watch?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OBICLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OBICLtd Narrative

If you see things differently, or want to dive deeper into the numbers yourself, you can easily craft your own perspective in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding OBICLtd.

Looking for more investment ideas?

Don't miss out on the stocks making waves in today's market. Now is the time to expand your watchlist and catch opportunities others might overlook.

- Boost your income potential and explore these 16 dividend stocks with yields > 3% offering attractive yields over 3% for your portfolio.

- Act early on cutting-edge breakthroughs by scanning these 24 AI penny stocks that are transforming entire industries with artificial intelligence innovation.

- Start strong with these 3575 penny stocks with strong financials which show resilient financials and standout performance at affordable entry prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4684

OBICLtd

Provides system integration, system support, office automation, and package software services in Japan.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives