Japan's stock markets experienced a robust rebound over a holiday-shortened week, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%. This positive sentiment was bolstered by better-than-expected U.S. economic data and Japan’s stronger-than-anticipated GDP growth in the second quarter, providing a favorable backdrop for high-growth tech stocks. In this environment, identifying promising tech stocks involves looking for companies that can leverage strong economic fundamentals and technological advancements to drive growth.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 51.80% | 61.94% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| SHIFT | 21.58% | 32.81% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.51% | 66.90% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plus Alpha Consulting Ltd (TSE:4071) specializes in providing marketing solutions and has a market cap of ¥74.73 billion.

Operations: The company generates revenue from HR Solutions, which contributed ¥9.27 billion. Segment Adjustment accounted for ¥3.73 billion in the financials.

Plus Alpha Consulting Ltd. demonstrates robust growth with earnings projected to rise 21.87% annually, outpacing the JP market's 8.5%. The company's revenue is forecasted to grow at 16% per year, significantly higher than the market average of 4.3%. Notably, their R&D expenses have been substantial, reflecting a commitment to innovation; for instance, last year they allocated ¥1 billion towards R&D initiatives. Despite some volatility in share prices over the past three months, their high-quality earnings and strong client base position them well in Japan's tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Plus Alpha ConsultingLtd.

Learn about Plus Alpha ConsultingLtd's historical performance.

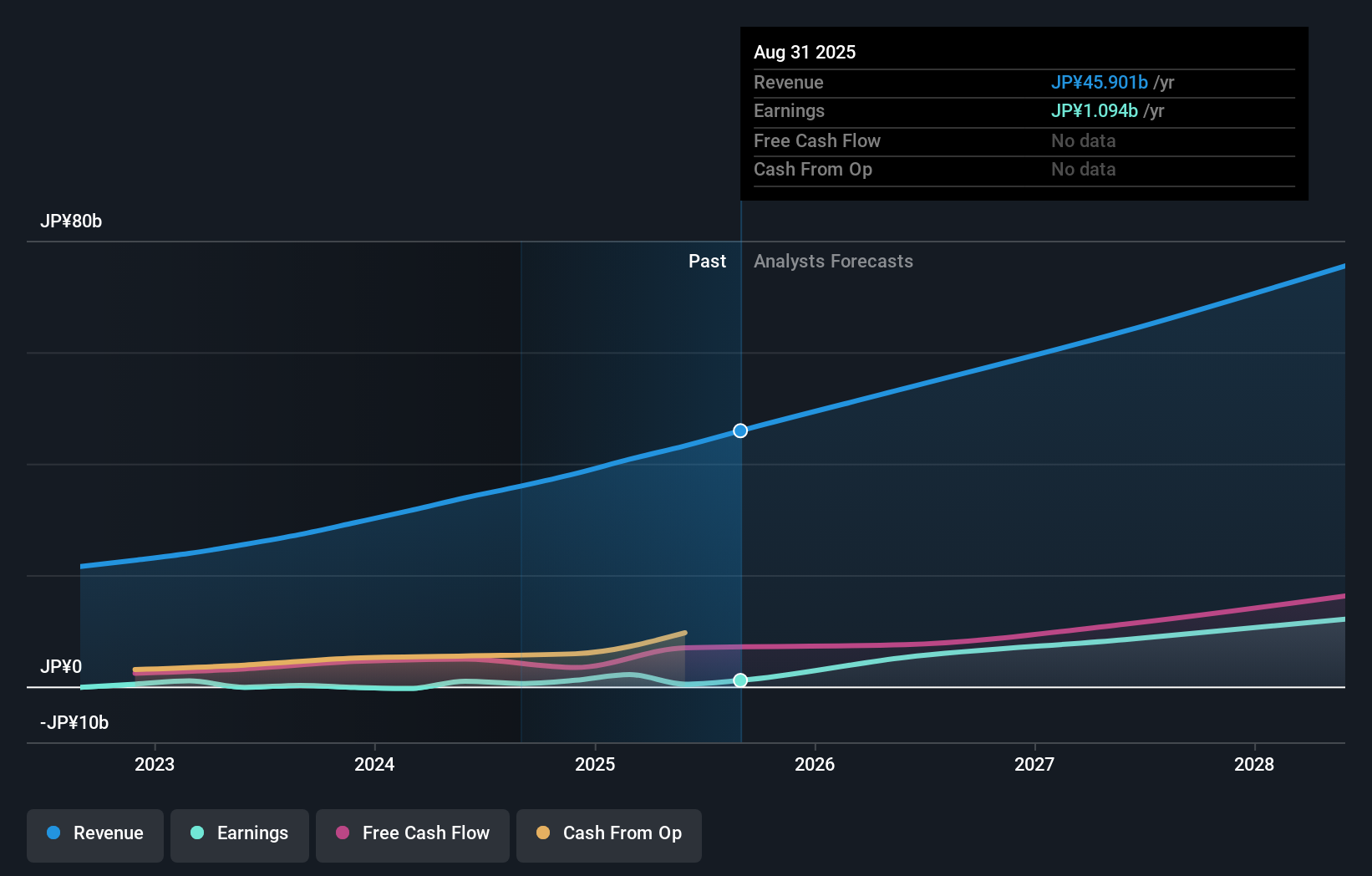

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. engages in the planning, development, and selling of cloud-based solutions in Japan with a market cap of ¥269.71 billion.

Operations: The company generates revenue primarily through its Sansan/Bill One Business, which accounts for ¥29.95 billion, and its Eight Business, contributing ¥3.55 billion.

Sansan, Inc. is experiencing a remarkable phase with earnings projected to grow 35.5% annually, significantly outpacing the JP market's 8.5%. Their revenue growth forecast of 15.8% per year also exceeds the market average of 4.3%. The company has shown a strong commitment to innovation by allocating ¥1 billion towards R&D initiatives last year, underpinning their technology advancements. Recently, Sansan repurchased 141,700 shares for ¥299.95 million under their buyback program announced in July 2024, enhancing shareholder value amidst their robust financial outlook and strategic moves in the tech landscape.

- Unlock comprehensive insights into our analysis of Sansan stock in this health report.

Evaluate Sansan's historical performance by accessing our past performance report.

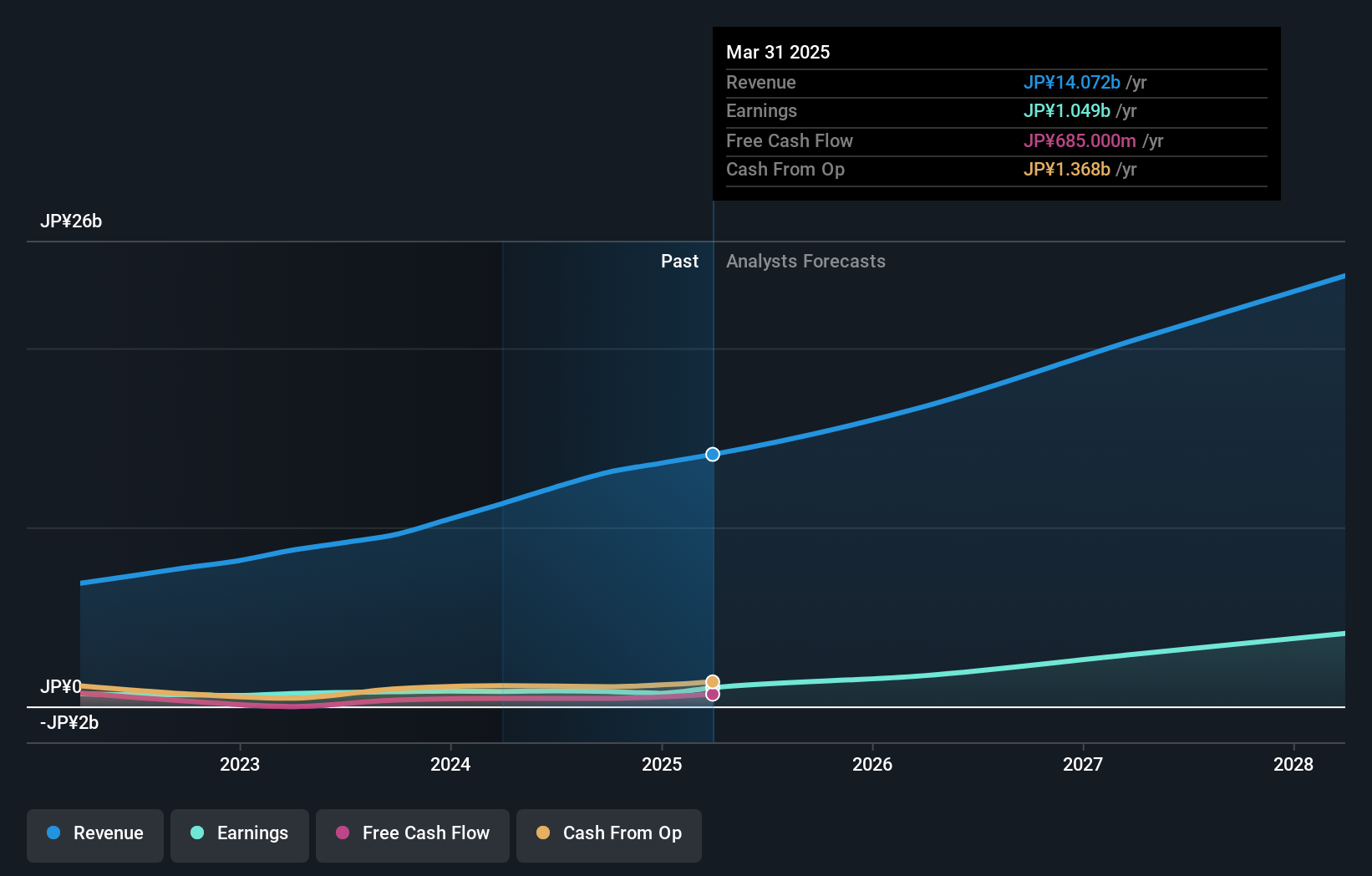

Bengo4.comInc (TSE:6027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bengo4.com, Inc. provides online professional consultancy services in Japan and has a market cap of ¥80.82 billion.

Operations: The company generates revenue primarily through its Media segment, which contributed ¥4.61 billion, and its IT/Solutions segment, which brought in ¥7.62 billion.

Bengo4.comInc. is poised for significant growth with earnings expected to rise 46.8% annually, outpacing the JP market's 8.5%. Revenue is forecasted to grow at a robust 20.8% per year, well above the market average of 4.3%. The company has shown a strong commitment to innovation by investing ¥1 billion in R&D last year, driving technology advancements in their legal tech solutions. Recent board changes and strategic decisions indicate a proactive approach towards future growth and stability in the competitive tech landscape.

- Take a closer look at Bengo4.comInc's potential here in our health report.

Review our historical performance report to gain insights into Bengo4.comInc's's past performance.

Next Steps

- Get an in-depth perspective on all 128 Japanese High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4443

Sansan

Engages in the planning, development, and selling of cloud- based solutions in Japan.

High growth potential with excellent balance sheet.