A Look at Simplex Holdings (TSE:4373) Valuation After Upgraded Forecasts and 4-for-1 Stock Split

Reviewed by Simply Wall St

Simplex Holdings (TSE:4373) caught attention after it decided to revise its earnings forecast upward for the fiscal year, citing stronger revenue and operating profit due to steady demand for digital transformation services.

See our latest analysis for Simplex Holdings.

Momentum has been building for Simplex Holdings, with its 1-day and 7-day share price returns both firmly in positive territory following the news of upgraded earnings guidance, a 4-for-1 stock split, and increased authorized shares. After a standout year, with its year-to-date share price now up 87% and the one-year total shareholder return reaching 75%, recent events underscore a shift in investor sentiment toward renewed growth potential.

If company updates like these have you curious about where the next opportunity might be, consider expanding your search with fast growing stocks with high insider ownership.

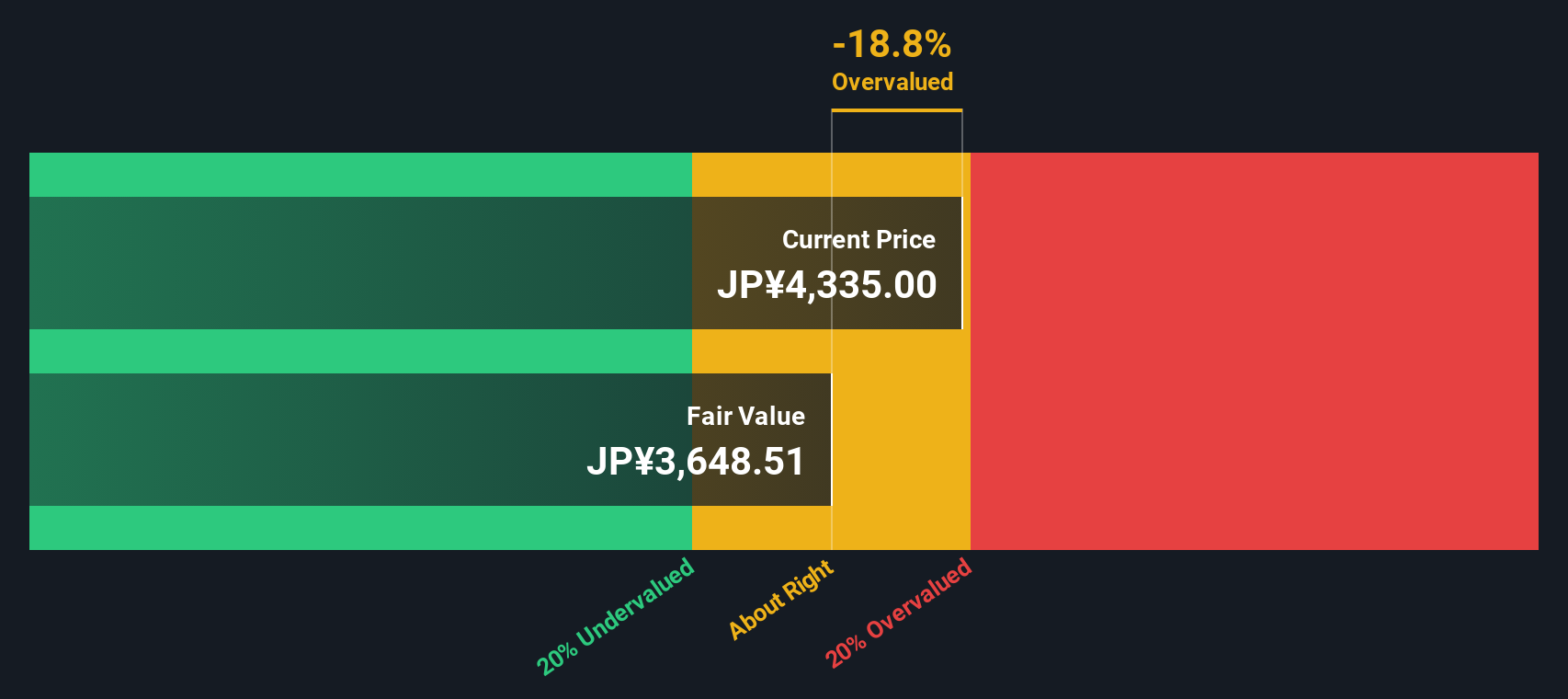

With the stock already surging on the back of upgraded forecasts and positive momentum, the question remains: is Simplex Holdings still undervalued at these levels, or has the market already priced in further growth?

Price-to-Earnings of 25.8x: Is it justified?

With a Price-to-Earnings ratio of 25.8x, Simplex Holdings is trading at a premium compared to both its peers and the broader Japanese IT industry. The latest close was ¥4,515, while similar companies trade at lower multiples and industry averages.

The price-to-earnings multiple measures how much investors are willing to pay today for every ¥1 of current earnings. For technology and IT service firms like Simplex Holdings, this ratio reflects the market’s confidence in future profitability, recurring revenue, and growth potential.

Currently, Simplex Holdings’ P/E ratio stands above the industry average of 17.3x and is also higher than the peer group average of 21.7x. Even compared to the estimated fair P/E ratio of 25.3x, the stock is still on the expensive side. If Simplex’s results do not continue to outperform, this valuation could face downward pressure in the future as the market reevaluates its growth assumptions.

Explore the SWS fair ratio for Simplex Holdings

Result: Price-to-Earnings of 25.8x (OVERVALUED)

However, slowing revenue or net income growth and any further disconnect from analyst targets could quickly shift sentiment, even though the company has strong momentum.

Find out about the key risks to this Simplex Holdings narrative.

Another View: Discounted Cash Flow Analysis

While the market is valuing Simplex Holdings at a higher multiple than its industry peers, our DCF model arrives at a very different conclusion. According to the SWS DCF model, Simplex Holdings’ estimated fair value is ¥3,640.46, which is significantly below its current price of ¥4,515. This suggests that, from a cash flow perspective, the stock may be overvalued and expectations for future performance might already be included in the price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Simplex Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Simplex Holdings Narrative

If you have your own outlook or prefer to dive deeper into the numbers, it only takes a few minutes to craft your own investment story. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Simplex Holdings.

Looking for more investment ideas?

Don’t wait on the sidelines while new opportunities take shape. Get ahead of the curve by targeting high-potential stocks with powerful growth or income stories.

- Capitalize on companies transforming healthcare innovation by seizing the momentum in these 32 healthcare AI stocks before the next breakthrough changes the landscape.

- Benefit from reliable income by locking in attractive yields through these 15 dividend stocks with yields > 3% as part of a smart, resilient portfolio.

- Ride the future of money and tech by catching trends early in these 82 cryptocurrency and blockchain stocks, where digital assets and blockchain are rewriting the rules.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4373

Flawless balance sheet with solid track record.

Market Insights

Community Narratives