Here's What We Like About Densan System Holdings' (TSE:4072) Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Densan System Holdings Co., Ltd. (TSE:4072) is about to trade ex-dividend in the next three days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Accordingly, Densan System Holdings investors that purchase the stock on or after the 27th of June will not receive the dividend, which will be paid on the 10th of September.

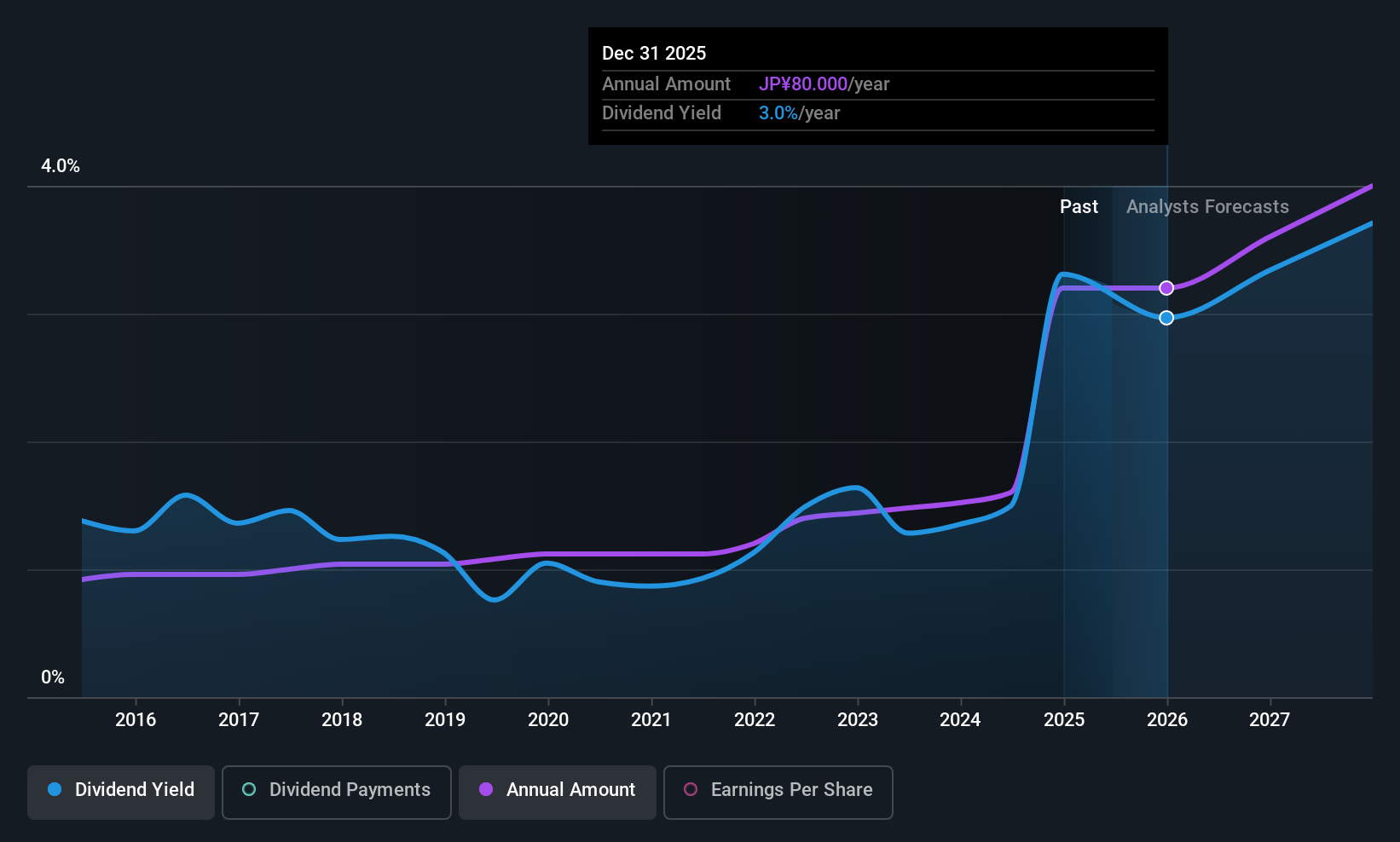

The company's next dividend payment will be JP¥40.00 per share. Last year, in total, the company distributed JP¥80.00 to shareholders. Looking at the last 12 months of distributions, Densan System Holdings has a trailing yield of approximately 3.0% on its current stock price of JP¥2696.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately Densan System Holdings's payout ratio is modest, at just 34% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. What's good is that dividends were well covered by free cash flow, with the company paying out 18% of its cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

See our latest analysis for Densan System Holdings

Click here to see how much of its profit Densan System Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at Densan System Holdings, with earnings per share up 2.1% on average over the last five years. Recent growth has not been impressive. Yet there are several ways to grow the dividend, and one of them is simply that the company may choose to pay out more of its earnings as dividends.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, Densan System Holdings has lifted its dividend by approximately 14% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

Is Densan System Holdings worth buying for its dividend? Earnings per share have been growing moderately, and Densan System Holdings is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. It might be nice to see earnings growing faster, but Densan System Holdings is being conservative with its dividend payouts and could still perform reasonably over the long run. There's a lot to like about Densan System Holdings, and we would prioritise taking a closer look at it.

Keen to explore more data on Densan System Holdings's financial performance? Check out our visualisation of its historical revenue and earnings growth.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4072

Densan System Holdings

Provides information and collection agency services in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives