As global markets grapple with fluctuating consumer sentiment and economic uncertainties, Asian tech stocks have shown resilience, particularly as easing U.S.-China trade tensions provide a more favorable backdrop for growth. In this dynamic environment, identifying promising high-growth tech stocks involves assessing their adaptability to market shifts and their potential to leverage technological advancements effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.13% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.08% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 30.75% | 31.56% | ★★★★★★ |

| ASROCK Incorporation | 29.29% | 31.08% | ★★★★★★ |

| Fositek | 36.92% | 48.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.88% | 35.34% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★☆☆

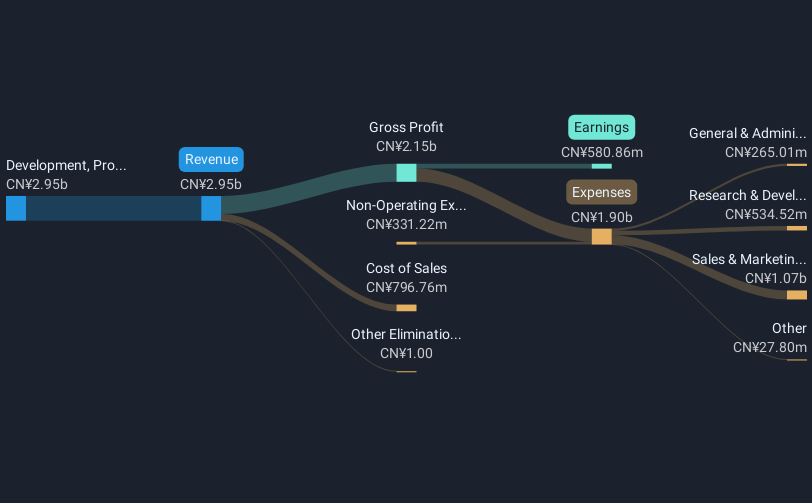

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China with a market capitalization of CN¥38.16 billion.

Operations: The company primarily generates revenue through the development, production, and sale of insulin and related products, amounting to CN¥3.85 billion.

Gan & Lee Pharmaceuticals has demonstrated robust financial and operational growth, with a notable 59.4% increase in earnings over the past year, outpacing its industry's average. The company's commitment to innovation is evident in its R&D investments, which have positioned it as a leader in developing treatments for metabolic diseases. Recent strategic moves include appointing Dr. Ting Jia as CMO to spearhead global clinical strategies and signing significant agreements with Brazilian health entities, ensuring long-term revenue streams from insulin products critical for diabetes care. These initiatives not only enhance Gan & Lee's market position but also align with broader health system resilience goals, potentially setting new standards in pharmaceutical supply chains across emerging markets.

- Get an in-depth perspective on Gan & Lee Pharmaceuticals' performance by reading our health report here.

Understand Gan & Lee Pharmaceuticals' track record by examining our Past report.

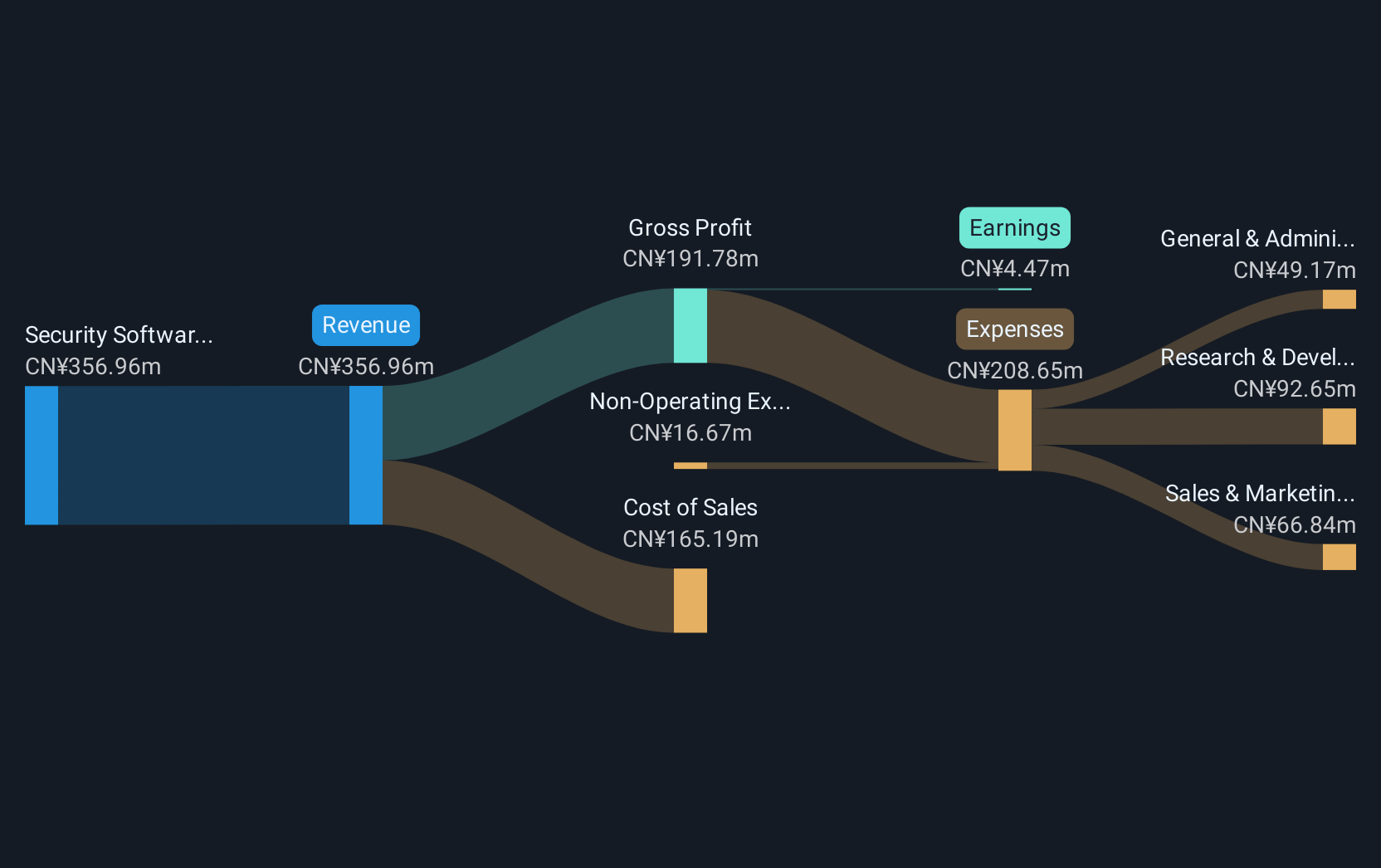

Integrity Technology Group (SHSE:688244)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Integrity Technology Group Inc. is a network security enterprise offering solutions in China, with a market cap of CN¥3.11 billion.

Operations: Integrity Technology Group Inc. specializes in providing network security solutions within China.

Integrity Technology Group, navigating through a challenging fiscal period, reported a significant downturn with sales dropping to CNY 142.29 million from CNY 172.94 million year-over-year and net losses widening to CNY 54.85 million from CNY 31.58 million. Despite these setbacks, the company is poised for recovery with projected revenue growth of 24.7% annually, outstripping the Chinese market's average of 14.4%. This optimism is bolstered by forecasts suggesting profitability within three years, supported by strategic shifts likely aimed at enhancing product offerings and market adaptability in the fast-evolving tech landscape.

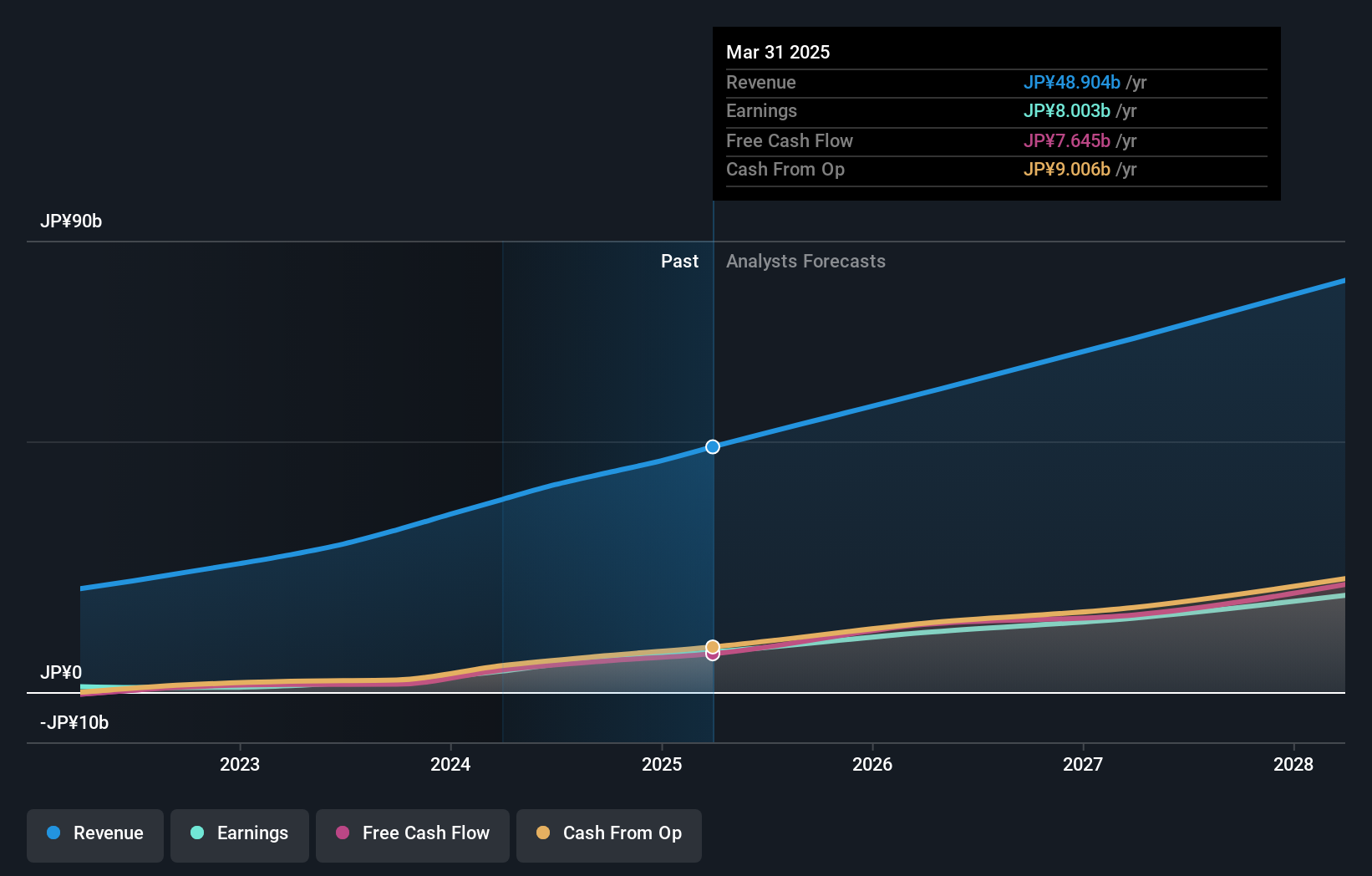

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rakus Co., Ltd. and its subsidiaries offer cloud services in Japan, with a market capitalization of ¥435.40 billion.

Operations: The company specializes in providing cloud services in Japan. With a market capitalization of ¥435.40 billion, it operates through various revenue streams without detailed segment information available.

Rakus Co., Ltd. is making significant strides in the competitive tech landscape of Asia, evidenced by a robust sales performance with recent monthly figures consistently above JPY 4,900 million. The company's strategic alliance with Plus Alpha Consulting aims to enhance its SaaS offerings, potentially boosting customer satisfaction and market share. Notably, Rakus's forward-looking financials are promising; it anticipates a revenue growth of 15.8% annually and earnings growth at an impressive 23.3% per year, outpacing the Japanese market averages significantly. This growth trajectory is underpinned by high-quality past earnings and an aggressive R&D investment strategy that aligns with its expansion goals in cloud services and back-office solutions, marking it as a dynamic player in Asia's high-growth tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Rakus.

Gain insights into Rakus' past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 187 Asian High Growth Tech and AI Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688244

Integrity Technology Group

A network security enterprise, provides network security solutions in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives