Why We're Not Concerned Yet About Datasection Inc.'s (TSE:3905) 28% Share Price Plunge

The Datasection Inc. (TSE:3905) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 113% in the last twelve months.

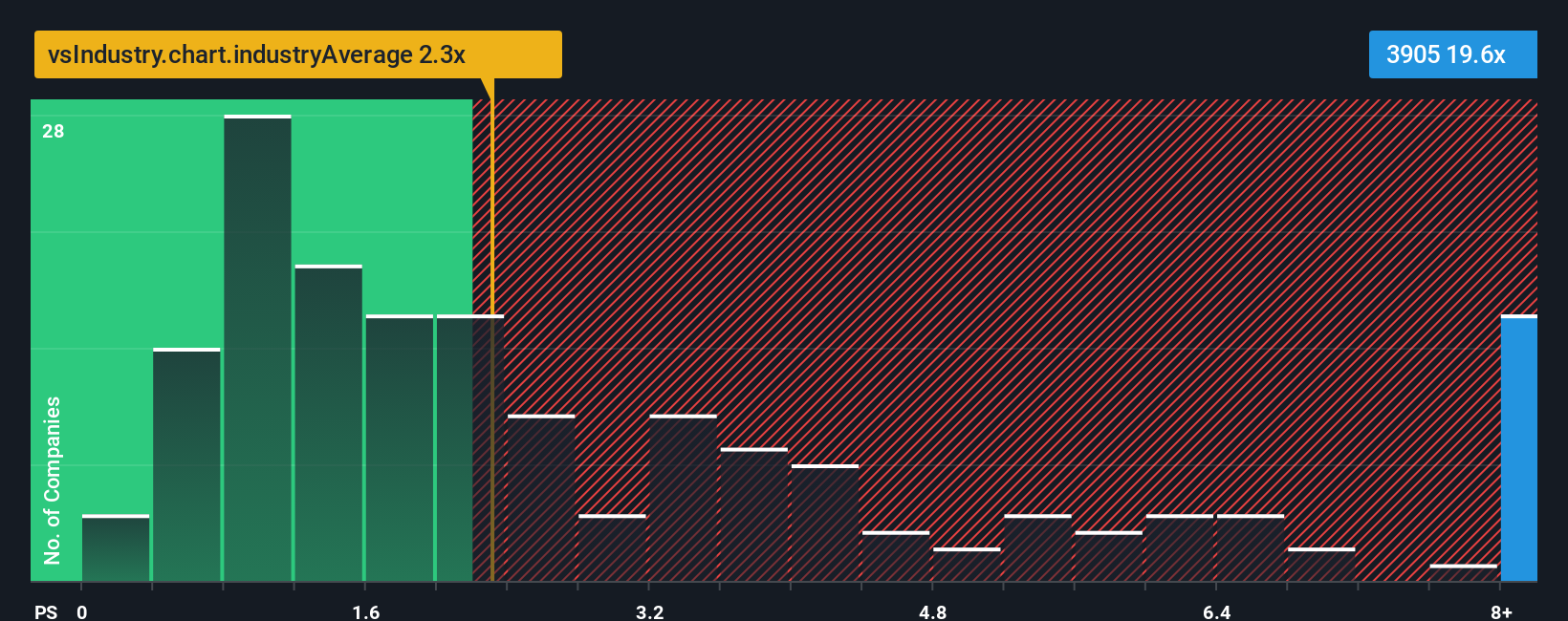

Even after such a large drop in price, you could still be forgiven for thinking Datasection is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 19.6x, considering almost half the companies in Japan's Software industry have P/S ratios below 2.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Datasection

What Does Datasection's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Datasection has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Datasection, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Datasection's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 32%. The strong recent performance means it was also able to grow revenue by 75% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Datasection's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Datasection's shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Datasection maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Datasection (2 are potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on Datasection, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3905

Datasection

Provides solutions for social media analysis, retail marketing, and artificial intelligence development in Japan, Chile, and Colombia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives