- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A108490

High Growth Tech Stocks In Asia Featuring ROBOTIS And Two Others

Reviewed by Simply Wall St

Amid the mixed performance of major global indices and a temporary trade truce between the U.S. and China, attention has turned to Asia's tech sector as it navigates these dynamic economic conditions. In this environment, high growth potential can often be found in companies that are strategically positioned to leverage technological advancements and adapt to evolving market demands, such as those featured in our discussion on ROBOTIS and two other promising tech stocks in Asia.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 32.80% | 35.57% | ★★★★★★ |

| Suzhou TFC Optical Communication | 33.73% | 34.36% | ★★★★★★ |

| Accton Technology | 24.08% | 28.54% | ★★★★★★ |

| Zhongji Innolight | 28.22% | 29.75% | ★★★★★★ |

| Fositek | 36.93% | 47.79% | ★★★★★★ |

| Eoptolink Technology | 37.03% | 32.46% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

ROBOTIS (KOSDAQ:A108490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ROBOTIS Co., Ltd. is a South Korean company that specializes in providing robotic solutions, with a market cap of ₩3.59 trillion.

Operations: The company generates revenue primarily through the development, manufacturing, and sale of personal robots, amounting to ₩31.71 billion.

ROBOTIS, a burgeoning force in Asia's tech sector, has demonstrated robust financial performance with an annual revenue growth of 41.5% and earnings growth forecast at 79.5% per year. This growth trajectory is significantly above the Korean market averages of 10.1% for revenue and 27.9% for earnings, positioning ROBOTIS favorably against its peers. The company's recent strategic moves include a KRW 100 billion follow-on equity offering aimed at fueling further expansion and innovation within its robotics solutions segment—a key driver of future business prospects in an increasingly automated industry landscape. Moreover, ROBOTIS turned profitable this year after overcoming previous financial hurdles, as evidenced by a substantial turnaround from a net loss to KRW 1.27 billion in net income for the first half of the year alone. This pivot underscores not only improved operational efficiencies but also enhanced product acceptance in competitive markets such as advanced robotics systems used across various industries including healthcare and manufacturing—sectors that are critical to Asia’s technological ascendancy.

- Take a closer look at ROBOTIS' potential here in our health report.

Evaluate ROBOTIS' historical performance by accessing our past performance report.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both domestically and internationally, with a market capitalization of CN¥9.87 billion.

Operations: The company focuses on industrial bulk material handling and mobile Internet sectors. It serves both domestic and international markets, contributing to its market capitalization of CN¥9.87 billion.

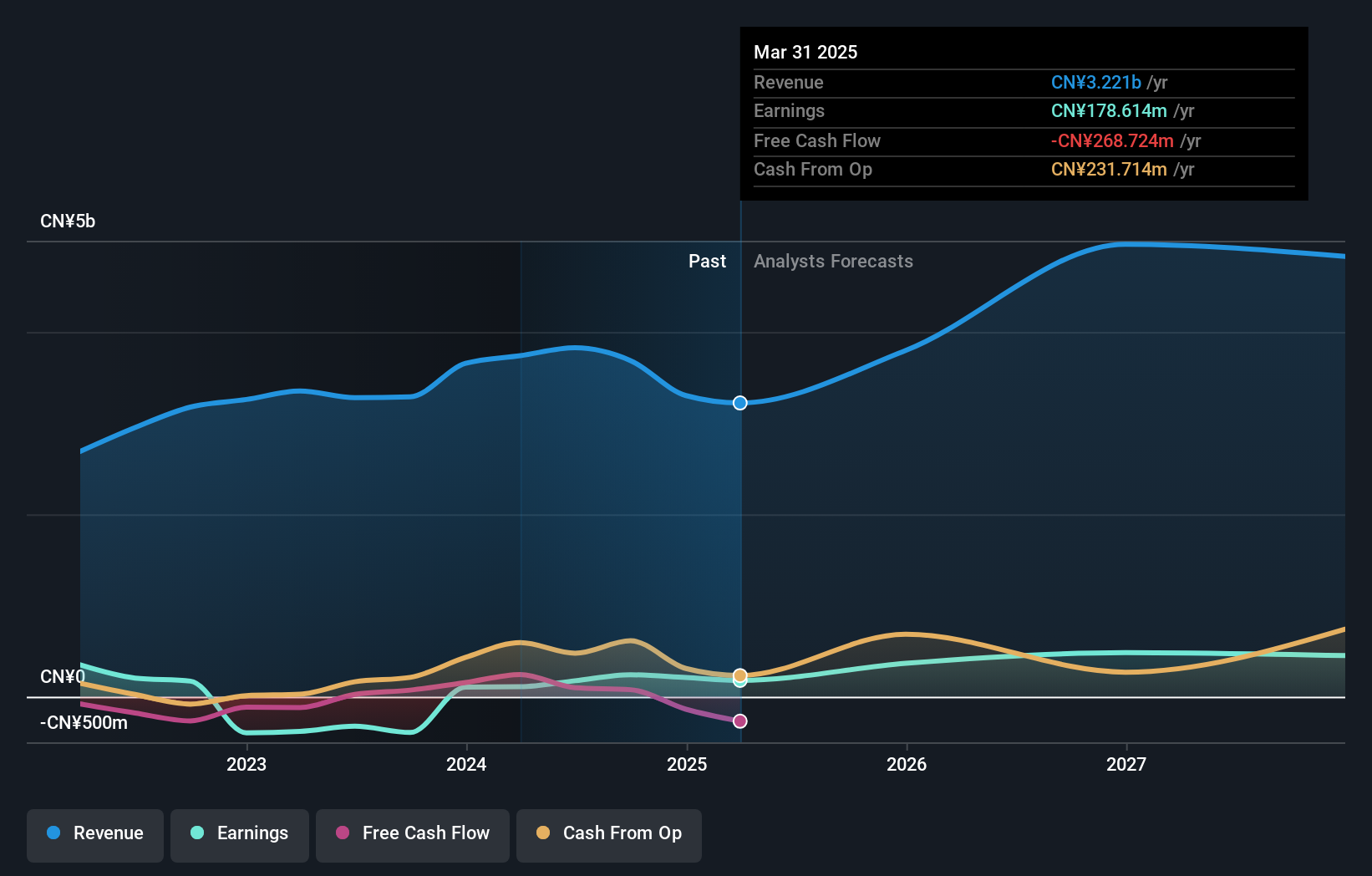

Wuxi Boton Technology, navigating through a challenging year with a 24.7% dip in earnings, contrasts sharply with its industry's 16.4% growth. Despite this, the company's revenue is expected to climb at an annual rate of 14.9%, outpacing the Chinese market forecast of 14.3%. This resilience is underscored by significant corporate governance changes and strategic amendments to its bylaws aimed at streamlining operations. Looking ahead, Wuxi Boton is poised for a rebound with projected earnings growth of 27.8% annually, signaling robust potential amidst ongoing adjustments and market dynamics.

- Delve into the full analysis health report here for a deeper understanding of Wuxi Boton Technology.

Explore historical data to track Wuxi Boton Technology's performance over time in our Past section.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: I'LL Inc. is a Japanese company specializing in system solutions, with a market cap of ¥61.07 billion.

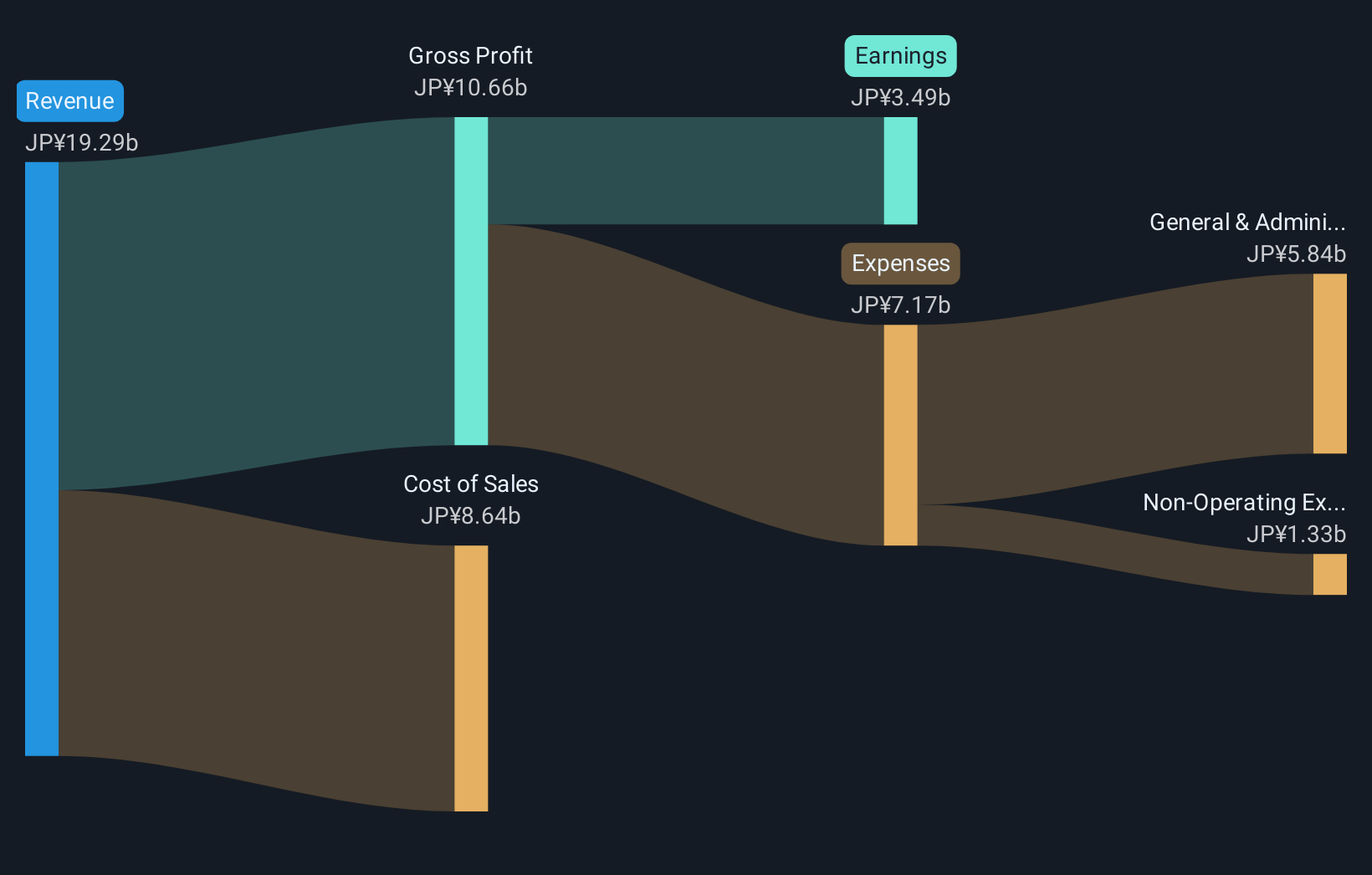

Operations: I'LL Inc. generates revenue primarily from its computer services segment, which reported earnings of ¥19.29 billion. The company focuses on providing system solutions within Japan.

I'LL Inc. is distinguishing itself in the high-growth tech sector in Asia with a robust forecast for revenue and earnings growth, outpacing the Japanese market's expectations. The company's revenue is projected to increase by 8.4% annually, significantly ahead of Japan's overall market growth rate of 4.5%. This financial trajectory is complemented by an anticipated annual earnings increase of 9%, showcasing a strong upward trend compared to the broader industry performance. Strategic initiatives, including increased dividends and aggressive guidance for future sales and profits as outlined in their recent corporate meetings, underscore I'LL’s commitment to maintaining momentum amidst competitive market dynamics. With R&D expenses consistently aligned with industry innovation demands, I'LL remains poised to capitalize on emerging technological trends, ensuring its position at the forefront of tech development in Asia.

- Dive into the specifics of I'LL here with our thorough health report.

Review our historical performance report to gain insights into I'LL's's past performance.

Next Steps

- Click through to start exploring the rest of the 171 Asian High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A108490

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives