Digital Arts (TSE:2326) Margin Decline Challenges Bullish Growth Narrative Despite Strong Revenue Outlook

Reviewed by Simply Wall St

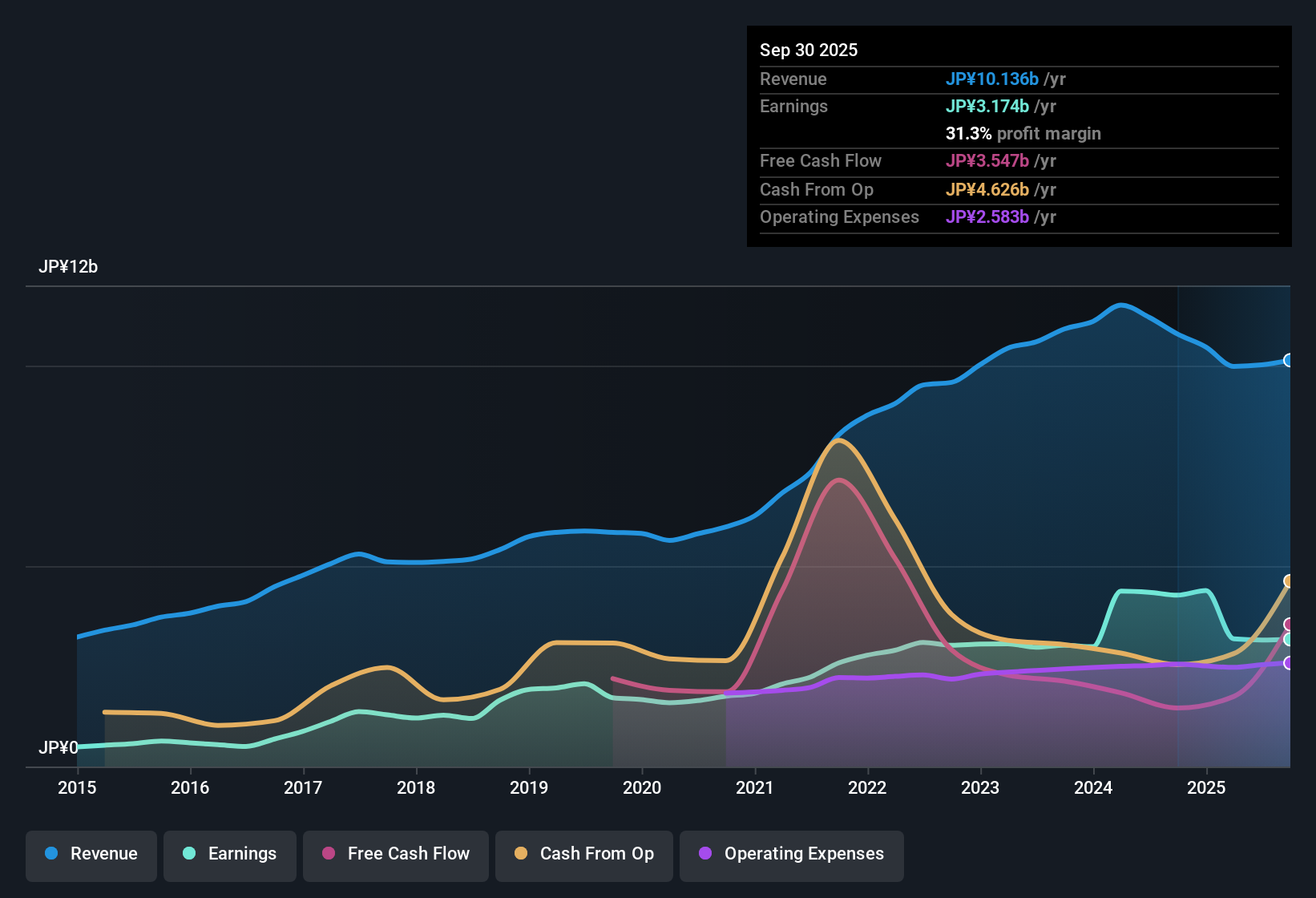

Digital Arts (TSE:2326) delivered annual earnings growth of 12.5% over the past five years, with a net profit margin of 31.3%, down from last year's 39.6%. Analysts expect earnings to rise 23.8% per year and revenue to expand by 20% annually in the coming years, both well ahead of the broader Japanese market. While investors are watching the impact of a recent margin dip, the overall growth outlook remains a key attraction.

See our full analysis for Digital Arts.Next, we will see how these headline numbers compare to the narrative driving sentiment in the community and what that could mean for future expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slides Below Historical Highs

- Net profit margin stands at 31.3%, which is a marked decrease from last year's 39.6%.

- Recent margin contraction places a spotlight on the ability to defend profits. This directly tests the prevailing optimistic scenario that expects Digital Arts to benefit from sector tailwinds.

- Even with margins slipping roughly 8 percentage points, forecasts remain aggressive at 23.8% annual earnings growth. This suggests that bulls expect new business and sustained demand to more than offset near-term profitability pressure.

- The pace of revenue expansion projected at 20% per year further reinforces optimism; however, the margin dip serves as a reality check for those assuming linear profit scaling as the company grows.

Share Price Sits Well Above DCF Fair Value

- Shares are currently priced at 7,550.00, which is significantly above the DCF fair value estimate of 2,940.12.

- The gap between market price and modeled intrinsic worth highlights the debate about how much growth optimism is already reflected in the stock. This stands in contrast to the narrative that sector optimism alone justifies today's valuation.

- With a price-to-earnings ratio of 32.2x compared to an industry average of 21x, the stock trades at a premium that amplifies the risk if high forecasts are not met.

- This valuation premium could be rationalized by outsized growth projections, but any evidence of slower execution or further margin pressure may heighten downside risk for new investors.

Growth Forecasts Outpace the Japanese Market

- Earnings are forecast to rise 23.8% annually, nearly triple the 7.9% per year expected for the overall Japanese market. Revenue growth at 20% per year also exceeds the market’s 4.5%.

- While sector outperformance on growth is a core part of the bullish investment story, it faces two important tests: whether Digital Arts can maintain top-tier growth as peers catch up, and whether investors are willing to pay a continued premium after recent margin compression.

- The stock’s forward-looking valuation and robust projections justify enthusiasm, but translating sector momentum and headline growth into durable returns remains the key challenge for both skeptics and supporters.

- Market participants betting on digital security leaders are especially sensitive to shifts in profit quality or competitive intensity, which could quickly change the risk-reward equation.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Digital Arts's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid sales gains, Digital Arts faces an elevated valuation and slipping profit margins. This could leave new shareholders exposed if growth stalls.

If you’re seeking more value for your money, check out these 837 undervalued stocks based on cash flows for stocks that currently trade at more attractive prices with lower downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2326

Digital Arts

Develops and markets internet security software and appliances in Japan, the United States, Europe, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives