A Look at Systena (TSE:2317)’s Valuation After Upgraded Earnings and Dividend Guidance

Reviewed by Simply Wall St

Systena (TSE:2317) just raised its earnings outlook and bumped up its year-end dividend forecast, with the company crediting better performance in higher-value growth areas and a solid stream of project wins.

See our latest analysis for Systena.

Backed by upbeat earnings guidance and a higher dividend forecast, Systena’s momentum has truly picked up. The one-year total shareholder return sits at 57.8 percent, outpacing the market and signaling that confidence in its growth strategy is building. Short-term share price returns have also been robust, adding to the positive sentiment around recent project wins and management’s focus on higher-value segments.

If you’re inspired by Systena’s recent run, now is a good moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares rallying and guidance rising, the question remains, is Systena still undervalued at today’s levels or is the market already pricing in all that future growth? Could this be a buying opportunity, or is everything already reflected?

Price-to-Earnings of 18.5x: Is it justified?

Systena’s share price currently reflects a price-to-earnings (P/E) ratio of 18.5x, which positions it as a relatively attractive value opportunity when measured against both its peers and the broader industry.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of company earnings. In sectors like software, a lower P/E can indicate undervaluation, especially for companies demonstrating strong growth and consistent profitability.

Systena’s P/E of 18.5x is well below the industry average of 20.8x and significantly below the peer group average of 60.8x. Relative to the estimated “Fair” P/E of 22.1x, there is clear upside potential if the market starts rewarding Systena for its earnings growth and quality. This gap suggests that the stock may be currently underappreciated by the market, with valuation levels capable of moving upward as positive trends play out.

Explore the SWS fair ratio for Systena

Result: Price-to-Earnings of 18.5x (UNDERVALUED)

However, Systena’s rally could slow if the market reassesses its growth outlook or if analysts’ price targets remain below current trading levels.

Find out about the key risks to this Systena narrative.

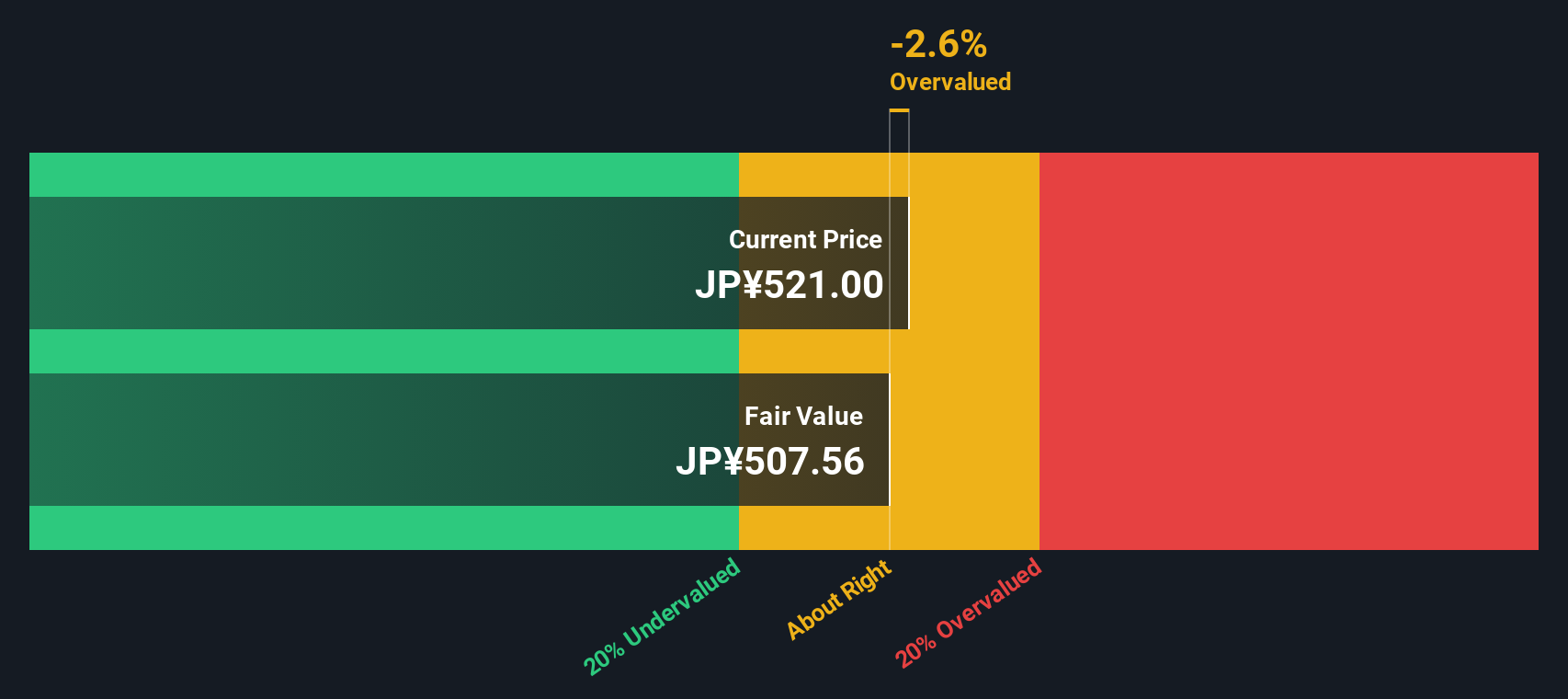

Another View: DCF Suggests a Cautious Stance

While Systena looks undervalued based on its price-to-earnings ratio, our DCF model tells a different story. The shares are currently trading above the model's estimated fair value, which hints at potential overvaluation if the projected growth fails to materialize. Which approach gets it right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Systena for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Systena Narrative

If you think there’s another angle to Systena’s story or want to dig deeper into the numbers yourself, you can craft your own analysis in just a few minutes: Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Systena.

Looking for more investment ideas?

Take charge of your portfolio and unlock even more high-potential stocks, sector opportunities, and niche market gems in seconds with these tailored screeners.

- Amplify your returns by targeting solid income opportunities through these 20 dividend stocks with yields > 3% with attractive yields and proven financial strength.

- Tap into the future of medicine by using these 33 healthcare AI stocks to spot trailblazers who combine artificial intelligence with healthcare innovation.

- Supercharge your watchlist and seize opportunities that others might miss with these 839 undervalued stocks based on cash flows based on strong fundamentals and discounted cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2317

Systena

Engages in the solution and framework design, IT service, business solution, and cloud businesses in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives