- Japan

- /

- Semiconductors

- /

- TSE:7735

What Does SCREEN Holdings' (TSE:7735) Dividend Hike Reveal About Its Long-Term Capital Allocation Plan?

Reviewed by Sasha Jovanovic

- SCREEN Holdings Co., Ltd. announced an increase in its second-quarter dividend to ¥123 per share, up from ¥120 a year earlier, payable on December 1, 2025, while maintaining its earnings guidance for the fiscal year ending March 2026 despite reporting weaker financial results for the recent quarter.

- The company's decision to boost its dividend in the face of a downturn in operating performance reflects a continued prioritization of shareholder returns even amid industry challenges.

- We'll examine how SCREEN Holdings' commitment to maintaining and increasing dividends shapes its broader investment narrative and outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

SCREEN Holdings Investment Narrative Recap

For investors in SCREEN Holdings, staying positive requires confidence in the company’s ability to capture mid- and long-term demand from advanced semiconductor applications such as AI, packaging, and display, even as industry cycles and customer investment trends remain uncertain. The decision to increase dividends, despite a weaker quarter and no change to guidance, is not expected to impact the company’s exposure to short-term volatility in semiconductor capital spending, currently the key catalyst and main risk for earnings visibility. The latest board meeting, where the dividend forecast was left unchanged, is directly connected to the company's continued focus on shareholder returns and provides consistency following the Q2 dividend hike. This action keeps attention firmly on SCREEN Holdings’ ability to weather market downcycles without disrupting payouts, even as industry conditions stay unpredictable. However, investors should also be aware that SCREEN Holdings' heavy reliance on China for sales means a sudden policy or trade shift could...

Read the full narrative on SCREEN Holdings (it's free!)

SCREEN Holdings is projected to reach ¥717.0 billion in revenue and ¥112.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.6% and an increase in earnings of ¥14.5 billion from the current ¥97.9 billion.

Uncover how SCREEN Holdings' forecasts yield a ¥14120 fair value, a 4% downside to its current price.

Exploring Other Perspectives

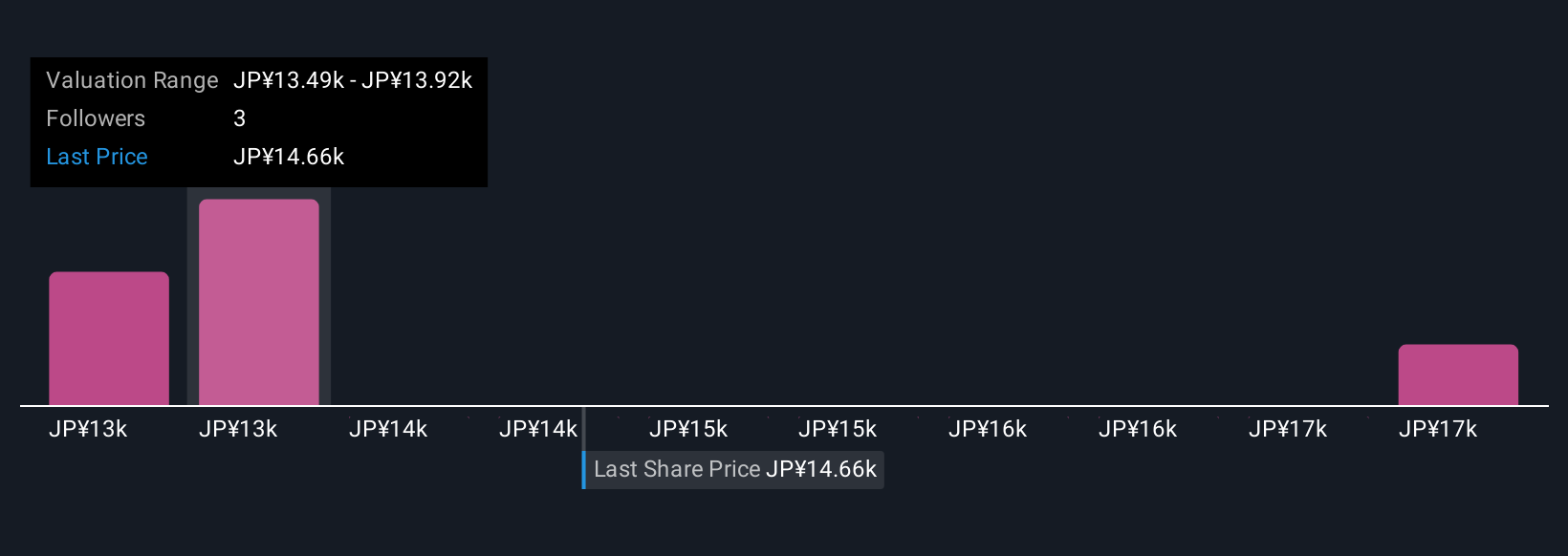

Three private investors in the Simply Wall St Community estimated SCREEN Holdings’ fair value between ¥14,120 and ¥17,423. With projections for only modest growth in core end markets, these contrasting viewpoints invite you to explore how different assumptions about demand trends can shape perspectives on the company’s outlook.

Explore 3 other fair value estimates on SCREEN Holdings - why the stock might be worth as much as 19% more than the current price!

Build Your Own SCREEN Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SCREEN Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SCREEN Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SCREEN Holdings' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7735

SCREEN Holdings

Develops, manufactures, and markets semiconductor production equipment in Japan, Taiwan, South Korea, China, the United States, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives