- Japan

- /

- Semiconductors

- /

- TSE:7735

Is SCREEN Holdings’ Higher Dividend Shaping the Investment Case for SCREEN (TSE:7735)?

Reviewed by Sasha Jovanovic

- SCREEN Holdings announced in the past that its second quarter dividend for fiscal 2026 was raised to ¥123 per share from ¥120 per share last year, with payment on December 1, 2025, and the board confirmed no changes to its full-year dividend forecast.

- Alongside reaffirmed earnings guidance, the combination of a higher dividend and steady outlook signals management's confidence in future financial performance.

- Now, we'll consider how SCREEN Holdings' increase in quarterly dividend informs its investment narrative and earnings outlook.

Find companies with promising cash flow potential yet trading below their fair value.

SCREEN Holdings Investment Narrative Recap

To be a shareholder in SCREEN Holdings, you need to believe in the long-term demand for advanced semiconductor equipment, especially in AI, memory, and display applications. The recent increase in the quarterly dividend reaffirms management’s confidence, but has little material impact on the most important short-term catalyst, the timing and scale of customer investments in new wafer fabrication equipment, or the ongoing risks around exposure to China and industry volatility.

Of the recent announcements, SCREEN Holdings’ unchanged full-year dividend guidance, paired with steady earnings projections for fiscal 2026, stands out as the most relevant. This consistency suggests management sees near-term financials tracking to plan, which supports their resilience through unpredictable industry cycles and helps reinforce the company’s reliability as an investment.

By contrast, investors should also remain aware of how sudden shifts in geopolitical policy could affect SCREEN’s substantial revenue exposure to China and...

Read the full narrative on SCREEN Holdings (it's free!)

SCREEN Holdings' outlook anticipates ¥717.0 billion in revenue and ¥112.4 billion in earnings by 2028. This implies annual revenue growth of 4.6% and an earnings increase of ¥14.5 billion from the current level of ¥97.9 billion.

Uncover how SCREEN Holdings' forecasts yield a ¥14287 fair value, a 14% upside to its current price.

Exploring Other Perspectives

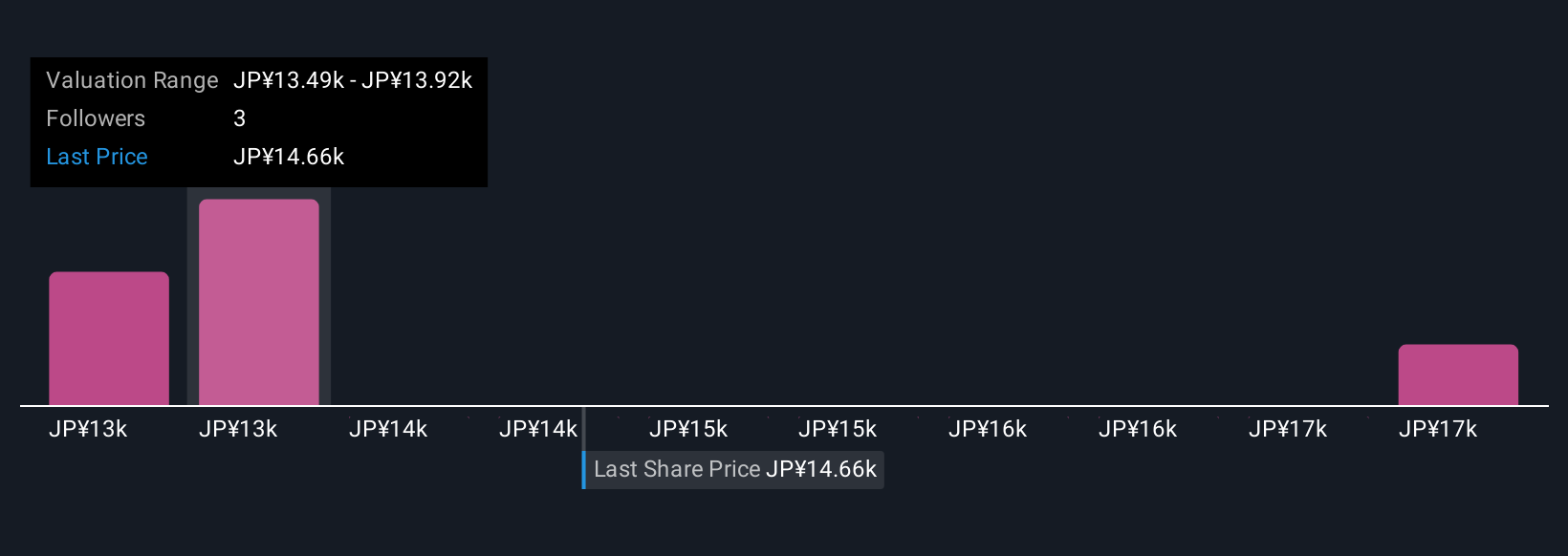

Three Simply Wall St Community fair value estimates range from ¥13,983 to ¥17,423 per share. In light of SCREEN’s Chinese market reliance, these varied opinions signal that investor views on future risks and opportunities are far from uniform.

Explore 3 other fair value estimates on SCREEN Holdings - why the stock might be worth as much as 39% more than the current price!

Build Your Own SCREEN Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SCREEN Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SCREEN Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SCREEN Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7735

SCREEN Holdings

Develops, manufactures, and markets semiconductor production equipment in Japan, Taiwan, South Korea, China, the United States, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives