- Japan

- /

- Semiconductors

- /

- TSE:6963

A Look at ROHM (TSE:6963) Valuation Following Board-Approved Interim Dividend and Year-End Outlook

Reviewed by Simply Wall St

ROHM (TSE:6963) held a board meeting to approve an interim dividend, with management also considering the forecast for the year-end payout. Dividends often impact how investors assess a company’s stability and future returns.

See our latest analysis for ROHM.

ROHM’s announcement of an interim dividend seems to have caught investors’ attention, fueling a sharp 5.49% share price jump in a single day despite a choppy week. While momentum has cooled over the past month, the company’s strong year-to-date share price return of 39.46% and an even higher 43.12% one-year total shareholder return suggest a revival of confidence after a tougher multi-year run.

If dividend news like this makes you wonder what else is gaining momentum, now could be the perfect moment to discover fast growing stocks with high insider ownership.

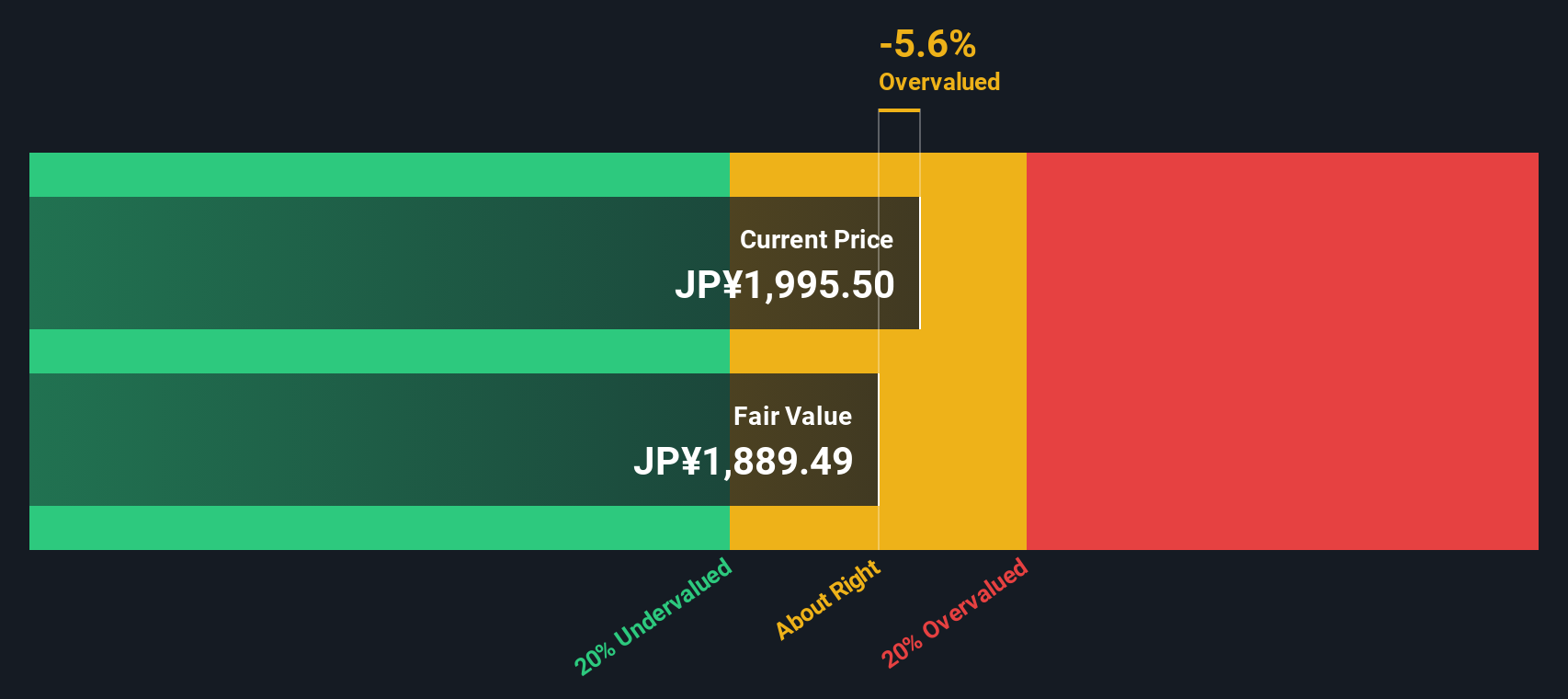

With shares surging on the dividend update, investors now face a pivotal question: Is ROHM undervalued and primed for further gains, or has the market already priced in the company’s next chapter of growth?

Most Popular Narrative: 5% Undervalued

ROHM's last close of ¥2,094 sits just below the most widely tracked narrative’s fair value estimate of ¥2,204. Market watchers are weighing what fundamental changes might power this modest gap in valuation.

Strategic partnerships and organizational restructuring target enhanced sales, better customer alignment, and increased profitability through cost reductions and improved efficiencies. The company faces revenue challenges due to declines in industrial and automotive segments, inventory issues, and unachieved cost reductions impacting profitability.

Curious what assumptions could justify this pricing edge? The narrative hinges on transformation plans with high hopes for future margins, ambitious cost cuts, and a leap in earnings. Find out what makes these forecasts stand out. See how much is riding on ROHM’s execution and industry recovery.

Result: Fair Value of ¥2,204 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inventory adjustments and ongoing declines in key industrial segments could continue to put pressure on both revenue and margins, testing ROHM’s recovery thesis.

Find out about the key risks to this ROHM narrative.

Another View: What Does Our DCF Model Suggest?

While many investors focus on fair value estimates drawn from market multiples, our SWS DCF model offers a different perspective. According to this approach, ROHM (¥2,094) currently trades above our DCF-based fair value of ¥1,106.58. This may hint at potential overvaluation if future cash flows do not meet forecasts. Does this more cautious outlook make you rethink the opportunity, or does it highlight room for growth if management delivers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ROHM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ROHM Narrative

If you see things differently or want to dig into the numbers on your own terms, you can shape your own narrative for ROHM in just a few minutes. Do it your way.

A great starting point for your ROHM research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity never sleeps, and the next big winner could be just a click away. Don’t let these powerful research angles pass you by. Level up your search and stay ahead of the crowd.

- Uncover growth potential by scanning these 857 undervalued stocks based on cash flows, which highlights stocks trading below their intrinsic worth with room for upside.

- Boost your income strategy and target consistent returns with these 15 dividend stocks with yields > 3%, focusing on companies offering dividends above 3%.

- Seize the future of medicine by reviewing these 32 healthcare AI stocks and see which leaders are harnessing artificial intelligence to reshape the healthcare landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6963

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives