- Japan

- /

- Semiconductors

- /

- TSE:6723

Why Renesas Electronics (TSE:6723) Is Up 5.3% After Unveiling Industry-First 9,600 MT/s DDR5 RCD

Reviewed by Sasha Jovanovic

- Renesas Electronics recently announced it has delivered the industry's first sixth-generation Registered Clock Driver (RCD) for DDR5 RDIMMs, capable of achieving a record data rate of 9,600 Mega Transfers Per Second and offering backward compatibility, enhanced signal integrity, and advanced diagnostics features.

- This innovation strengthens Renesas' position in memory interface solutions, aiming to address rising demand for high-performance memory in AI, HPC, and next-generation data center applications.

- We'll consider how Renesas’ leap in DDR5 RCD bandwidth could shape its investment narrative and outlook across technology-driven growth segments.

Find companies with promising cash flow potential yet trading below their fair value.

Renesas Electronics Investment Narrative Recap

For anyone considering Renesas Electronics as an investment, the major thesis is tied to how effectively the company turns technical leadership in memory interface solutions into meaningful growth within AI, HPC, and data center markets. The launch of its Gen6 DDR5 RCD does have short-term implications by enhancing Renesas’ product differentiation at a time when margin expansion and demand recovery remain critical themes. The most significant current risk continues to be sluggish demand visibility across key end markets, such as automotive and industrial, which could limit near-term earnings improvement despite product breakthroughs.

Among recent announcements, the October 2025 launch of new RA8M2 and RA8D2 microcontrollers stands out as especially relevant. High-performance MCUs aimed at AI and machine learning reinforce Renesas’ ambitions beyond memory interfaces, supporting company catalysts such as the ongoing expansion of connected devices and robust IIoT demand. While innovation in both memory interfaces and MCUs builds competitive strength, Renesas’ path forward still depends on the pace of actual end-market adoption, especially in critical automotive and industrial segments.

Yet with these gains, investors should keep an eye on weak demand visibility and the risk it poses to...

Read the full narrative on Renesas Electronics (it's free!)

Renesas Electronics' outlook anticipates ¥1,642.0 billion in revenue and ¥275.4 billion in earnings by 2028. This scenario is based on an annual revenue growth rate of 8.9%, with earnings forecast to increase by ¥371.3 billion from the current ¥-95.9 billion.

Uncover how Renesas Electronics' forecasts yield a ¥2417 fair value, a 20% upside to its current price.

Exploring Other Perspectives

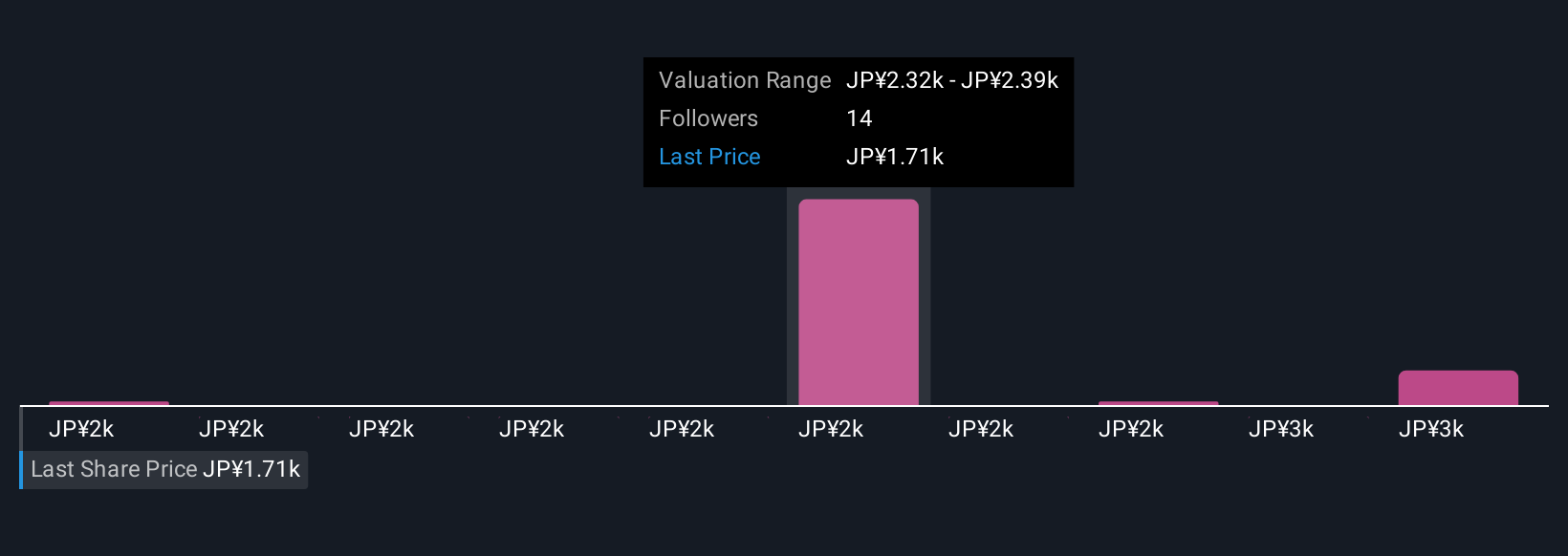

Simply Wall St Community members have shared four fair value estimates for Renesas, ranging from ¥2,000 to ¥2,608 per share. While many see strong technical catalysts ahead, concerns about ongoing softness in automotive and industrial demand could weigh on future results, urging you to consider a range of viewpoints before making a call.

Explore 4 other fair value estimates on Renesas Electronics - why the stock might be worth just ¥2000!

Build Your Own Renesas Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Renesas Electronics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Renesas Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Renesas Electronics' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6723

Renesas Electronics

Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives