- Japan

- /

- Semiconductors

- /

- TSE:6525

Kokusai Electric (TSE:6525) Faces Potential $700 Million Share Sale as KKR Lock-Up Nears End

Reviewed by Simply Wall St

- Kokusai Electric is approaching the end of KKR’s lock-up period, set to expire in three weeks, which could result in a significant share sale worth approximately $700 million and potential for increased stock volatility.

- The prospect of a large-scale sell-down by a major shareholder is drawing heightened attention from investors, as they assess the broader implications for liquidity and future trading patterns.

- We’ll explore how the anticipated KKR stock sale could impact Kokusai Electric’s investment narrative and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Kokusai Electric Investment Narrative Recap

To be a shareholder in Kokusai Electric, you need confidence in sustained global investment in advanced semiconductor manufacturing and the company's ability to maintain its leadership in batch ALD equipment, especially as demand in China remains strong. The end of KKR’s lock-up period and their potential $700 million share sale may create volatility, but doesn't alter the fundamental catalyst: robust capital spending in AI and next-generation memory, which continues to underpin the business’s outlook. The primary risk remains Kokusai’s high customer and geographic concentration, especially exposure to Chinese markets, where cyclical demand and regulatory conditions could shift abruptly.

Among recent announcements, Kokusai’s first quarter 2026 earnings showed a sizable drop in both revenue (down 21%) and net income (down 49%) year-on-year, reflecting precisely the cyclical and concentration risks investors have flagged. These results heighten sensitivity to any large share sales or market shocks, emphasizing why near-term volatility should be expected as KKR’s lock-up expires.

In contrast, it’s the dependence on Chinese demand that investors should keep a close eye on, as a sudden downturn could...

Read the full narrative on Kokusai Electric (it's free!)

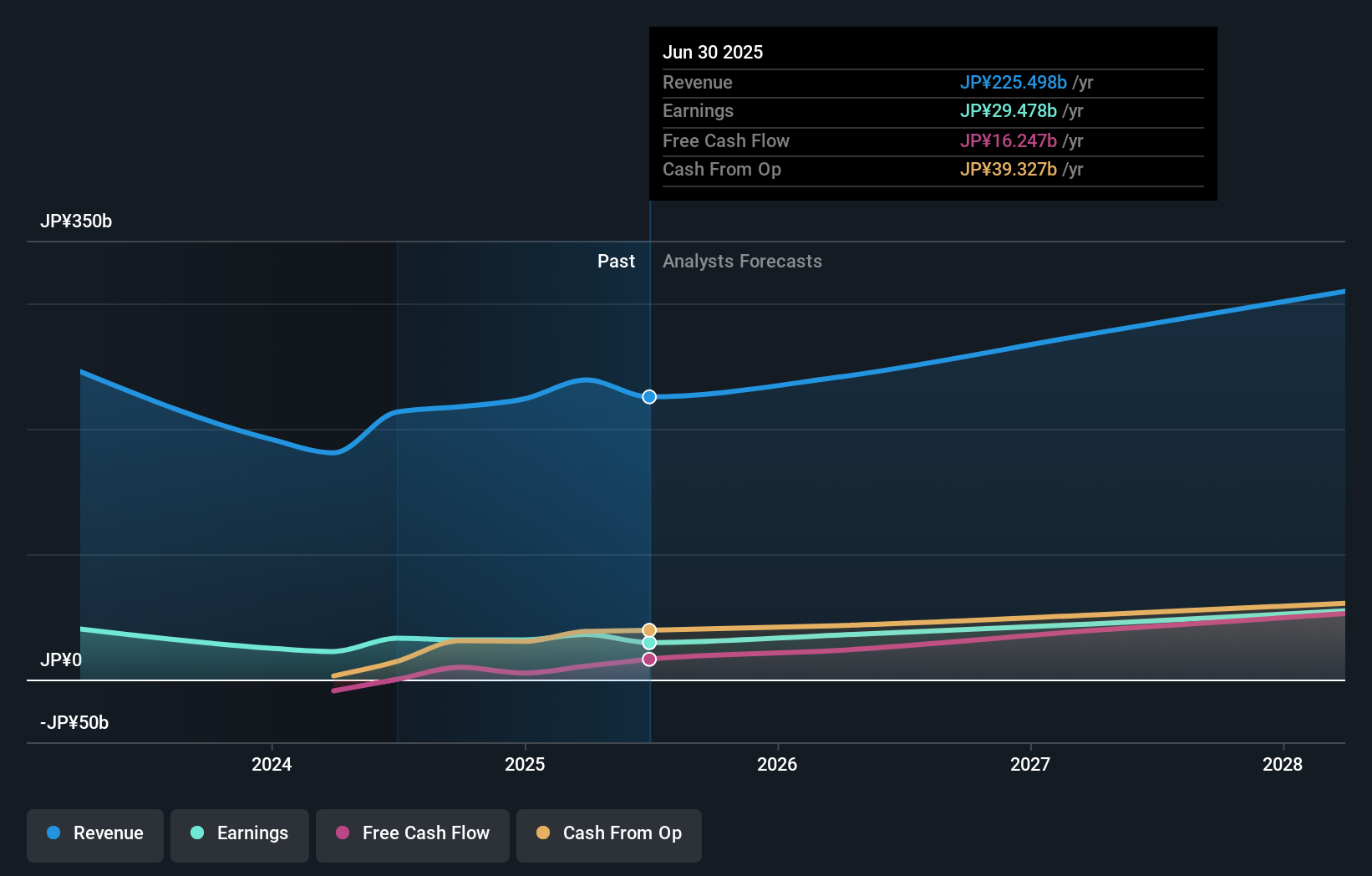

Kokusai Electric's outlook projects ¥314.9 billion in revenue and ¥55.8 billion in earnings by 2028. This assumes 11.8% annual revenue growth and an increase in earnings of ¥26.3 billion from the current ¥29.5 billion.

Uncover how Kokusai Electric's forecasts yield a ¥3737 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Only one community fair value estimate for Kokusai Electric exists, at ¥4,272 per share, from the Simply Wall St Community. As Chinese demand remains the key risk highlighted by analysts, the spectrum of investor opinion could expand as market conditions evolve.

Explore another fair value estimate on Kokusai Electric - why the stock might be worth as much as ¥4272!

Build Your Own Kokusai Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kokusai Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kokusai Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kokusai Electric's overall financial health at a glance.

No Opportunity In Kokusai Electric?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kokusai Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6525

Kokusai Electric

Engages in the development, manufacture, sale, repair, and maintenance of semiconductor manufacturing equipment worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives