- Japan

- /

- Semiconductors

- /

- TSE:6323

3 Global Stocks Estimated To Be Undervalued By Up To 29.9%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rising consumer inflation and robust corporate earnings, indices like the S&P 500 and Nasdaq Composite have reached new highs, driven by strong performance in key sectors. Amidst this economic environment, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Surgical Science Sweden (OM:SUS) | SEK148.40 | SEK294.49 | 49.6% |

| SpiderPlus (TSE:4192) | ¥499.00 | ¥994.04 | 49.8% |

| RVRC Holding (OM:RVRC) | SEK45.68 | SEK90.96 | 49.8% |

| Polaris Holdings (TSE:3010) | ¥216.00 | ¥428.07 | 49.5% |

| Hugel (KOSDAQ:A145020) | ₩351500.00 | ₩698441.84 | 49.7% |

| HDC Hyundai Development (KOSE:A294870) | ₩23200.00 | ₩46090.66 | 49.7% |

| Grupo Hotelero Santa Fe. de (BMV:HOTEL *) | MX$3.60 | MX$7.18 | 49.9% |

| Green Oleo (BIT:GRN) | €0.79 | €1.57 | 49.8% |

| ATON Green Storage (BIT:ATON) | €2.13 | €4.22 | 49.5% |

| Atea (OB:ATEA) | NOK143.00 | NOK284.22 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

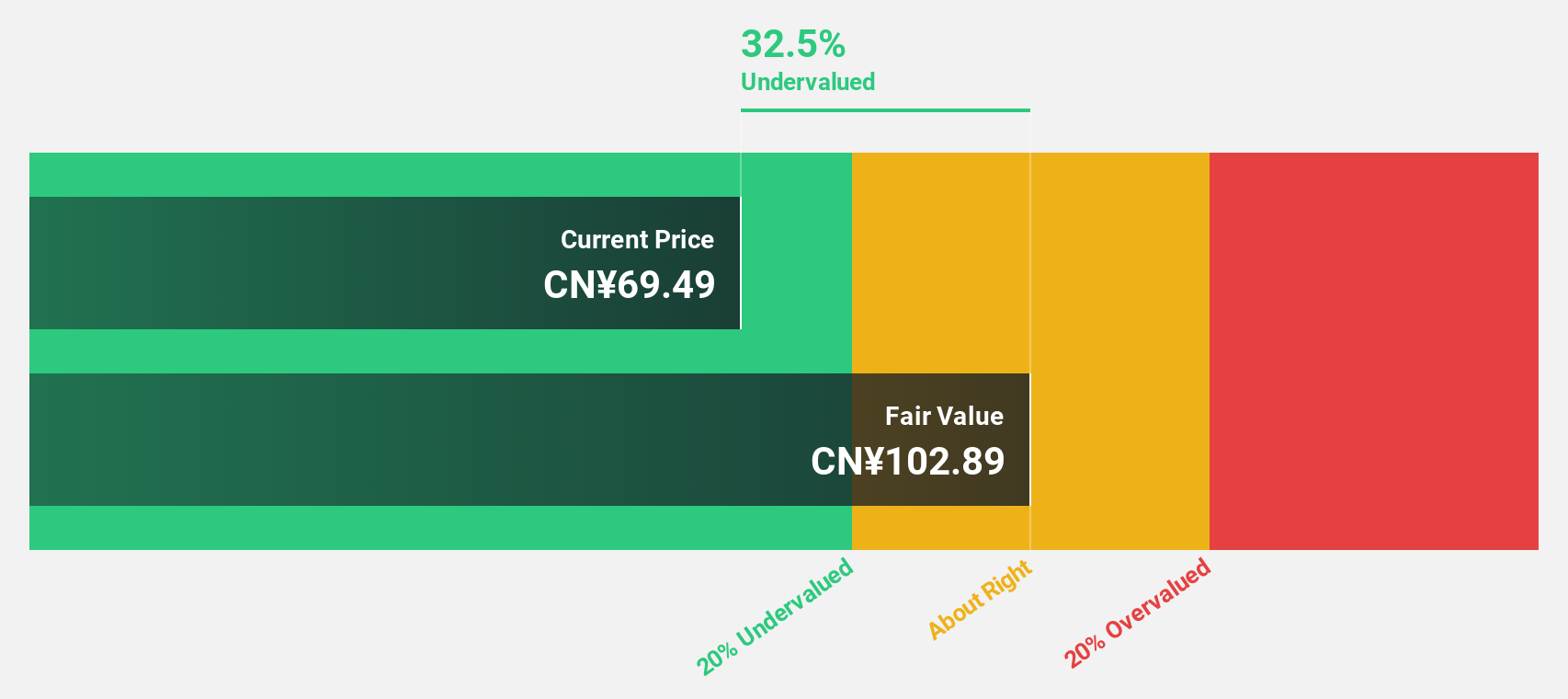

Eyebright Medical Technology (Beijing) (SHSE:688050)

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector, focusing on developing and manufacturing ophthalmic medical devices, with a market cap of CN¥13.62 billion.

Operations: The company generates revenue primarily from its Medical Products segment, amounting to CN¥1.46 billion.

Estimated Discount To Fair Value: 29.9%

Eyebright Medical Technology (Beijing) is trading at CN¥72.37, significantly below its estimated fair value of CN¥103.21, presenting a potential undervaluation based on cash flows. Despite a recent dividend decrease to CNY 0.35 per share, the company forecasts robust revenue growth of 22.9% annually and earnings growth of 24.3%, both outpacing the Chinese market averages. Analysts anticipate a substantial stock price increase of 65.8%.

- Our comprehensive growth report raises the possibility that Eyebright Medical Technology (Beijing) is poised for substantial financial growth.

- Get an in-depth perspective on Eyebright Medical Technology (Beijing)'s balance sheet by reading our health report here.

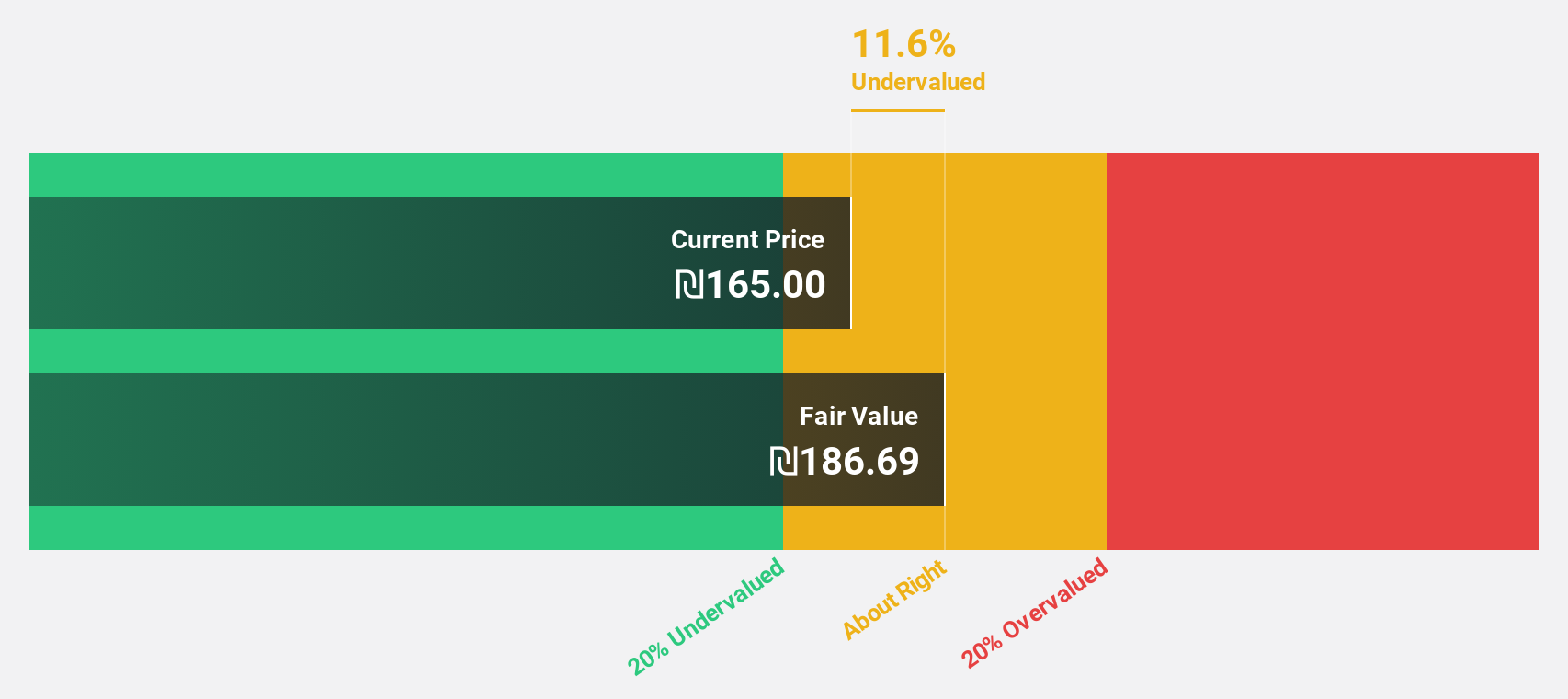

Nayax (TASE:NYAX)

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants across various regions, with a market cap of ₪5.78 billion.

Operations: The company's revenue primarily comes from its Internet Software and Services segment, which generated $331.16 million.

Estimated Discount To Fair Value: 18.5%

Nayax is trading at ₪156.5, below its estimated fair value of ₪191.96, suggesting undervaluation based on cash flows. The company recently became profitable and forecasts strong earnings growth of 57.4% annually, outpacing the Israeli market average. Revenue is expected to grow by 22.3% per year, supported by strategic partnerships like the one with Lynkwell for EV charging solutions across North America and reaffirmed guidance for significant revenue increases in 2025.

- The growth report we've compiled suggests that Nayax's future prospects could be on the up.

- Navigate through the intricacies of Nayax with our comprehensive financial health report here.

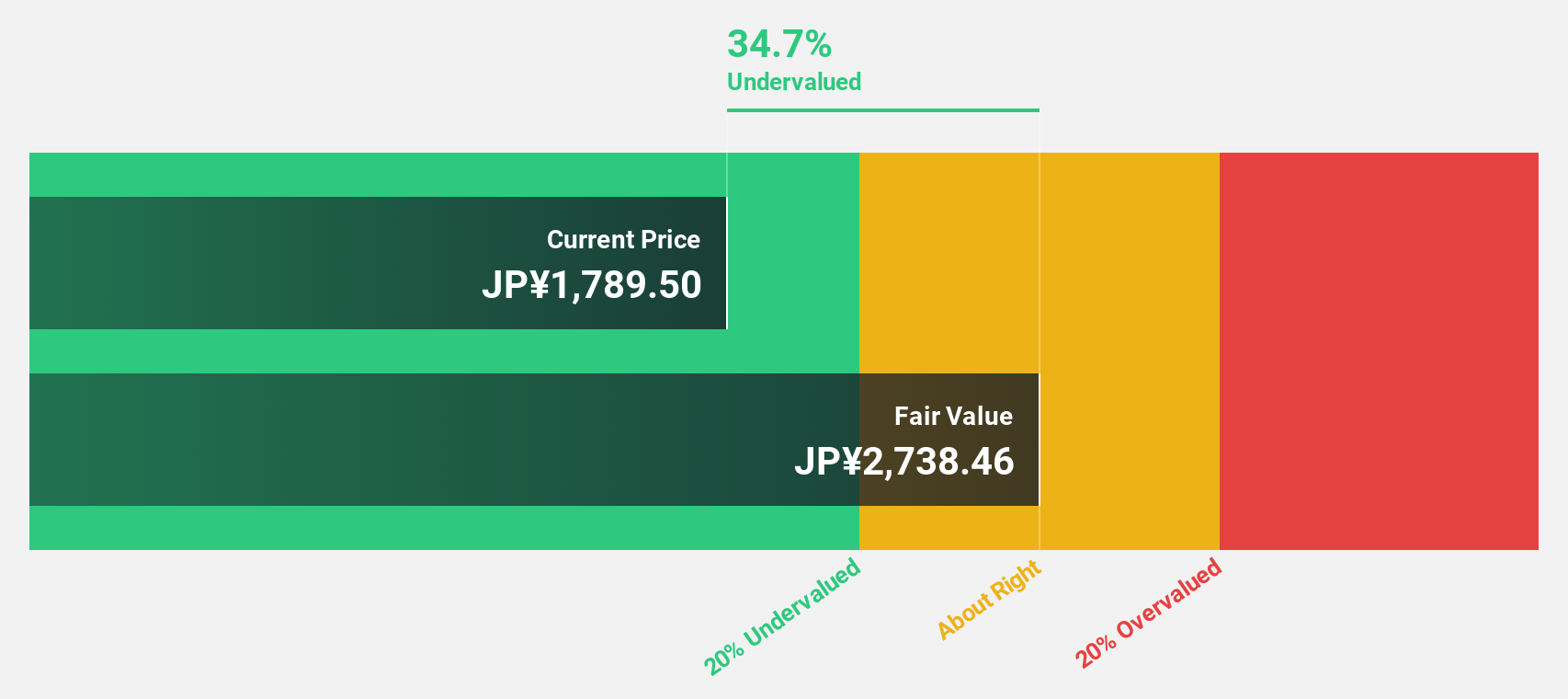

Rorze (TSE:6323)

Overview: Rorze Corporation specializes in designing, developing, manufacturing, and selling automation systems for semiconductor and flat panel display production globally, with a market cap of ¥339.54 billion.

Operations: Revenue Segments (in millions of ¥): Semiconductor production automation systems ¥68,000; Flat panel display production automation systems ¥12,500.

Estimated Discount To Fair Value: 25.7%

Rorze is trading at ¥1992, below its estimated fair value of ¥2681.68, reflecting undervaluation based on cash flows. Despite a recent decline in profit margins to 15.7% from 23.4%, earnings are forecast to grow at 16% annually, outpacing the Japanese market's growth rate of 7.6%. The company recently completed a share buyback worth ¥1.98 billion, potentially enhancing shareholder value amidst high volatility in its share price over the past three months.

- Insights from our recent growth report point to a promising forecast for Rorze's business outlook.

- Click here to discover the nuances of Rorze with our detailed financial health report.

Summing It All Up

- Delve into our full catalog of 469 Undervalued Global Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6323

Rorze

Engages in the design, development, manufacture, and sale of automation systems for the semiconductor and flat panel display production worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives