- Japan

- /

- Specialty Stores

- /

- TSE:8185

Chiyoda (TSE:8185) One-Off ¥608M Loss Puts Earnings Quality Narrative to the Test

Reviewed by Simply Wall St

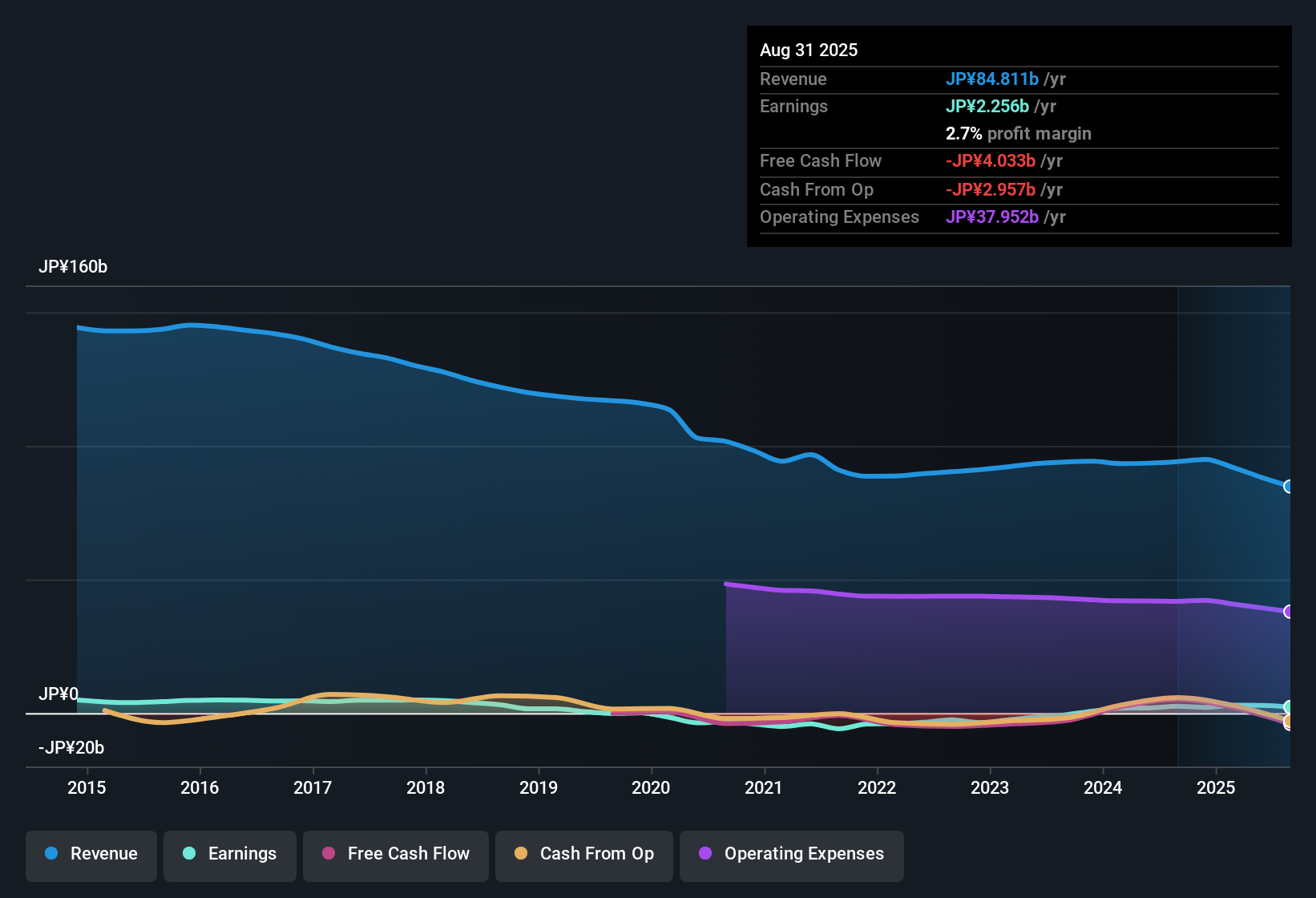

Chiyoda (TSE:8185) reported a net profit margin of 2.7% for the twelve months through August 2025, a slight dip from last year's 2.8%. Results were notably impacted by a one-off loss of ¥608 million, overshadowing otherwise strong five-year earnings growth that averaged 61% per year and reversing the company's trend with negative earnings growth in the most recent period. Looking forward, the market is keeping a close eye on the modest projected earnings growth of 0.62% annually and the marginal revenue decline expected over the next three years, especially given the company's elevated 17.5x price-to-earnings ratio versus peers and signals that shares may be trading above fair value.

See our full analysis for Chiyoda.Next, we’ll see how these numbers stack up against widely followed narratives for Chiyoda. Some market assumptions may hold up while others could be in for a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off ¥608 Million Loss Colors Margin Outlook

- Chiyoda posted a one-off loss of ¥608 million in its most recent 12-month period, exerting a tangible drag on its reported net profit margin of 2.7%, versus 2.8% in the previous year.

- What's surprising is that despite averaging 61% annual earnings growth over the past five years, this single large loss signals volatility and puts pressure on the narrative that Chiyoda’s core profitability is stable.

- The shift from consistent multi-year growth to negative earnings growth this year shows that even strong historical performance can be quickly overshadowed by exceptional charges.

- This sudden setback challenges any view that Chiyoda's margins are resilient regardless of short-term fluctuations.

Guidance Flags Lower Growth and Revenue Slippage

- Management projects just 0.62% average annual earnings growth and a 0.09% per year revenue decline over the next three years, painting a much more subdued future than recent years.

- What’s notable is that this outlook is far less optimistic than previous periods. It introduces tension with any bullish expectations that recent gains can be easily repeated.

- The projected slight decline in revenue, combined with minimal earnings growth, suggests that Chiyoda may be facing sector headwinds or internal limits to expansion.

- This muted guidance lends weight to concerns that momentum has slowed and that investors cannot simply extrapolate past growth into the future.

Valuation Premium Despite DCF Fair Value Gap

- Shares currently trade at 1,122.00 compared to a DCF fair value estimate of 1,102.03, while the 17.5x price-to-earnings ratio stands above peer and sector averages in Japan.

- What stands out is that Chiyoda’s premium valuation persists even with modest growth forecasts and tempered profit margins. This raises questions about how sustainable this market confidence really is.

- Despite the negative earnings growth and lower guidance, shares trade above DCF fair value and command a higher multiple than direct peers, which signals that the market is either expecting a turnaround or overlooking fundamental risks.

- Investors tempted by past outperformance should weigh how these valuation metrics stack up against sector trends and the company’s guidance, especially if macro conditions remain challenging.

- To see how the market’s view stacks up against deeper analysis and the full community perspective, get the complete take on Chiyoda’s story in the consensus narrative. 📊 Read the full Chiyoda Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Chiyoda's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Chiyoda’s modest earnings outlook, declining revenues, and premium valuation highlight the risks of relying on companies where growth has stalled while market optimism persists.

If you're looking for more reliable growth and steadier financial performance, check out stable growth stocks screener to discover companies delivering consistent results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8185

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives