- Japan

- /

- Specialty Stores

- /

- TSE:7419

Nojima (TSE:7419) Delivers 50% Earnings Growth, Challenging Bearish Narratives on Profitability

Reviewed by Simply Wall St

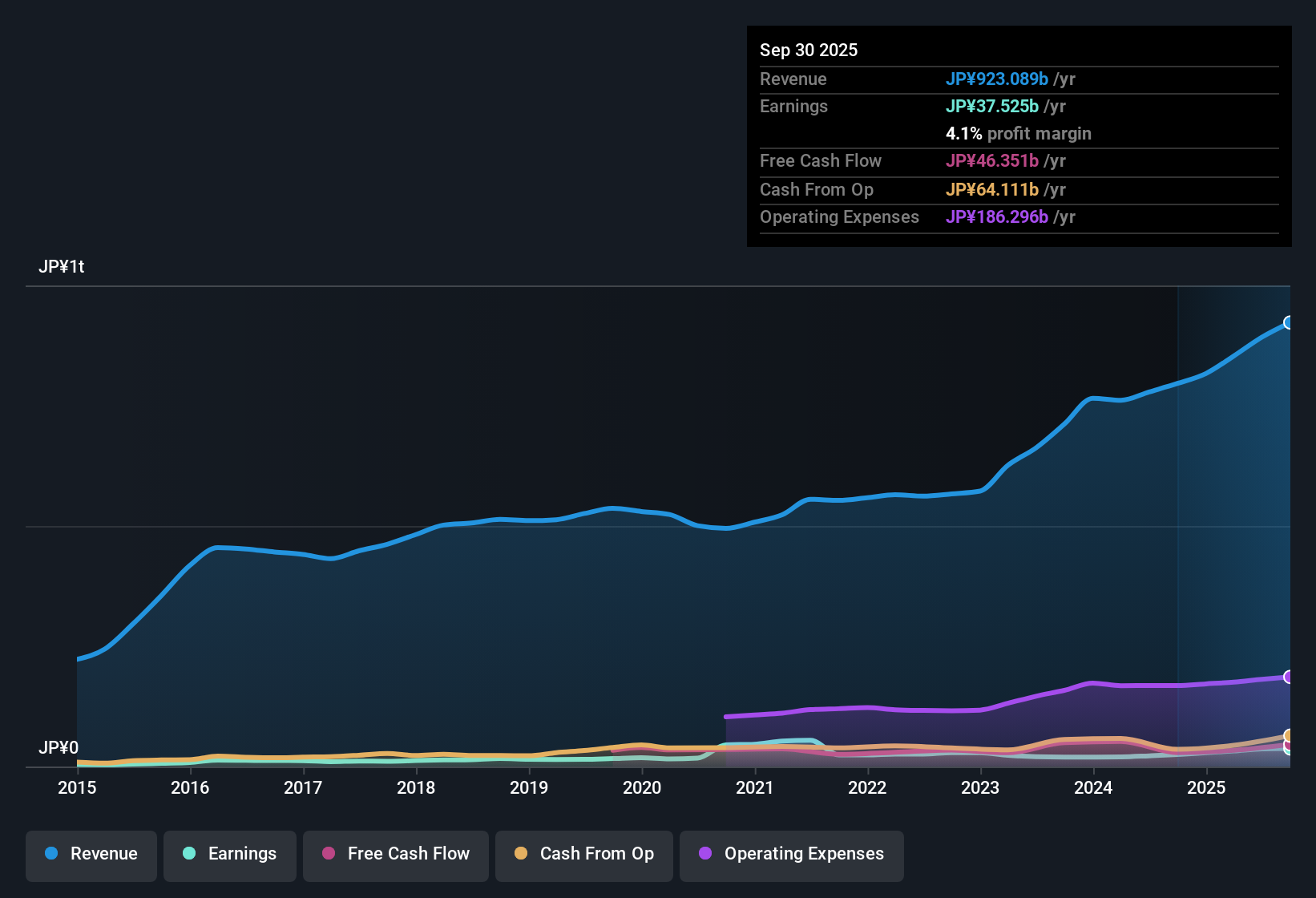

Nojima (TSE:7419) delivered standout earnings growth of 50.2% over the past year, a sharp turnaround from its 5-year average decline of 9.8% per year. Net profit margins also improved to 4.1%, up from last year’s 3.1%. With a price-to-earnings ratio of just 8.7x, which is far below its peers and the sector average, and shares trading at ¥1139, well under the DCF-based fair value estimate of ¥2259.52, the company looks attractively valued. However, there is uncertainty ahead, as the outlook for revenue and earnings growth remains unclear and share price stability has been lacking in recent months.

See our full analysis for Nojima.Next, we will break down how these figures compare to the dominant narratives in the market, highlighting where consensus matches the data and where surprises emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stand Firm Despite Sector Pressures

- Nojima’s net profit margin increased to 4.1%, up from 3.1% a year earlier, defying expectations for squeezed profitability in Japan’s specialty retail sector.

- Momentum in margin improvement supports investor hopes for durable profits, as bulls highlight the company’s ability to enhance operational quality even as many rivals contend with rising costs.

- This shift heavily supports the bullish case that Nojima’s underlying quality is not just a one-off, but a sign of improved efficiency as margin expansion outpaces industry-average gains.

- With sector-wide cost inflation and online competition rising, investors looking for stable, cash-generative names see this margin trend as reinforcing Nojima’s role as a dependable outlier among Japanese electronics retailers.

Price Multiple Flashes Deep Value Signal

- The company’s price-to-earnings ratio is just 8.7x, significantly below the peer average of 15.6x and the Japanese specialty retail industry’s 13.6x. Its share price at ¥1139 remains well under the DCF fair value of ¥2259.52.

- Valuation-conscious investors argue a multiple this low, paired with improved margins, signals the market has not fully priced in the recovery potential.

- The wide discount to sector norms and to calculated fair value gives bulls room to press the view that Nojima’s shares are undervalued relative to lasting earning power.

- At the same time, caution builds among skeptics who note that, despite obvious value, true catalysts to re-rate the stock have yet to emerge. Value buyers may require patience.

Lack of Forward Growth Clarity Keeps Risk Front of Mind

- While recent year-over-year profit growth was strong, filings highlight a key risk: management offers no clear outlook for future revenue or earnings growth, leaving investors questioning the sustainability of recent positive trends.

- The prevailing analysis underscores that, without forward-looking guidance or visible demand drivers, market confidence is fragile even with healthy backward-looking metrics.

- Share price volatility in the last three months, against otherwise robust margin and value figures, reflects how investors remain sensitive to any signals about future momentum.

- Analysts warn that, in absence of strong forward cues, Nojima’s stock could continue to see rapid swings as the market digests incoming data quarter by quarter.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nojima's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nojima’s lack of clear forward growth guidance and recent share price volatility highlight the risk of uncertain earnings momentum for investors seeking stability.

If you want more consistent performance and greater earnings predictability, focus on stable growth stocks screener (2098 results) to discover companies with steadier revenue and profit trends in all market climates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nojima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7419

Nojima

Operates digital home electronics retail stores in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives