- Japan

- /

- Specialty Stores

- /

- TSE:3660

The 14% return delivered to istyle's (TSE:3660) shareholders actually lagged YoY earnings growth

While istyle Inc. (TSE:3660) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 19% in the last quarter. But at least the stock is up over the last year. But to be blunt its return of 14% fall short of what you could have got from an index fund (around 23%).

The past week has proven to be lucrative for istyle investors, so let's see if fundamentals drove the company's one-year performance.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

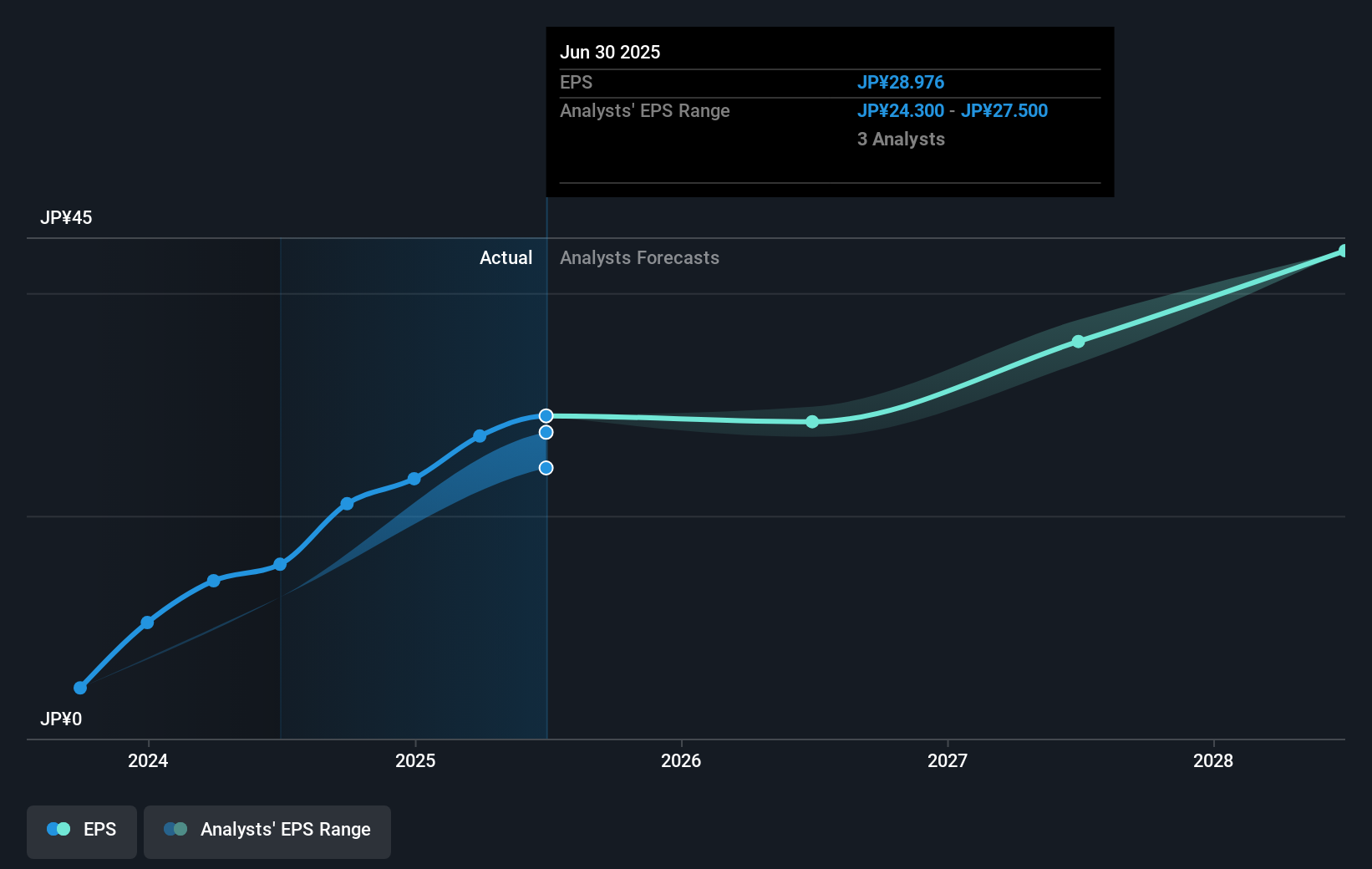

During the last year istyle grew its earnings per share (EPS) by 85%. It's fair to say that the share price gain of 14% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about istyle as it was before. This could be an opportunity.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how istyle has grown profits over the years, but the future is more important for shareholders. This free interactive report on istyle's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

istyle provided a TSR of 14% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 0.8% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand istyle better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with istyle (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if istyle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3660

istyle

Operates a beauty portal site @cosme in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives