- Japan

- /

- Office REITs

- /

- TSE:8957

Tokyu REIT (TSE:8957) Valuation Review After New ¥100 Billion Bond Shelf Registration Filing

Reviewed by Simply Wall St

Tokyu REIT (TSE:8957) just filed a shelf registration to issue up to ¥100 billion in investment corporation bonds, a material financing move that could reshape its capital structure and potential future options.

See our latest analysis for Tokyu REIT.

The bond shelf comes as Tokyu REIT’s share price has climbed to ¥200,600, with a strong year to date share price return of 26.32% and a 1 year total shareholder return of 34.21%. This suggests momentum is still broadly constructive rather than fading.

If this kind of financing move has you rethinking your portfolio mix, it could be a good moment to explore fast growing stocks with high insider ownership for other high conviction ideas.

Yet with Tokyu REIT now trading above consensus targets and screens flagging it as richly valued, investors face a key question: Is this bond-fuelled growth story still a buy, or is future upside already priced in?

Price-to-Earnings of 20.1x: Is it justified?

Tokyu REIT trades on a price-to-earnings ratio of 20.1x, which, at a last close of ¥200,600, points to a rich earnings multiple versus some peers.

The price-to-earnings ratio compares the current share price to annual earnings per share and is a common way to gauge how much investors pay for each unit of profit. For a mature Office REIT, it reflects expectations around rental stability, asset quality and the ability to steadily grow distributions.

On one hand, Tokyu REIT looks slightly expensive against the broader Asian Office REITs universe, where the average sits at 19.8x, suggesting the market is willing to pay a small premium. On the other hand, its 20.1x multiple is below the domestic Office REITs industry average of 22.8x and below a peer average of 21.5x, which implies investors are not pricing in the very top tier of growth or quality despite the strong recent share price performance.

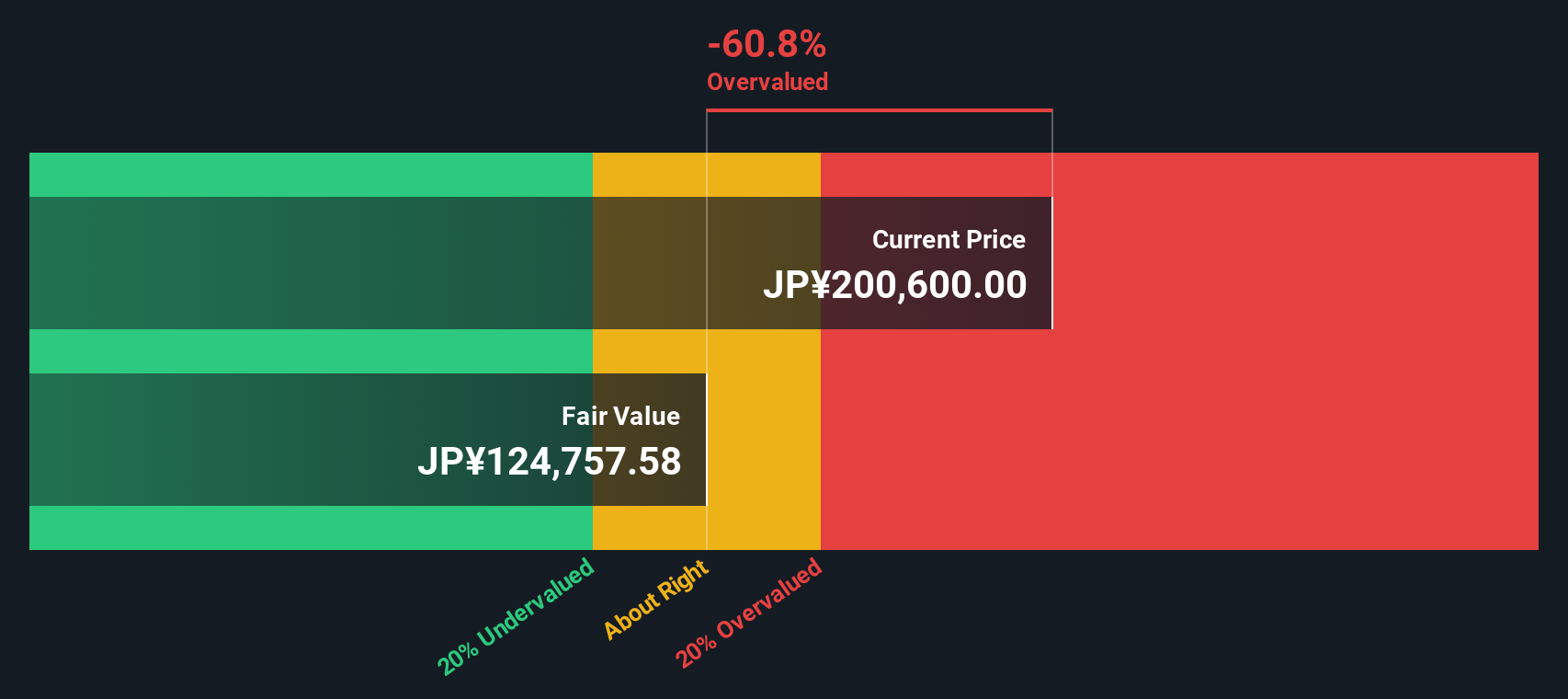

Relative to these benchmarks, the valuation picture is nuanced rather than extreme. It oscillates between modestly cheap and slightly expensive depending on which peer set investors emphasize, while the SWS DCF model flags clear overvaluation versus a fair value estimate of ¥124,133.16.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 20.1x (ABOUT RIGHT)

However, stretched valuation versus fair value and tighter funding conditions if rates rise could quickly cap upside and pressure near term sentiment.

Find out about the key risks to this Tokyu REIT narrative.

Another View: DCF Flags a Different Story

While the earnings multiple looks roughly in line with peers, our DCF model presents a sharper picture and suggests Tokyu REIT is trading well above an estimated fair value of ¥124,133.16. If cash flows are the anchor, has the market already moved too far ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tokyu REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tokyu REIT Narrative

If you take a different view, or simply want to dig into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Tokyu REIT research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at one idea when you can upgrade your whole watchlist. Use the Simply Wall St screener now and look for tomorrow’s opportunities before others move.

- Capture potential mispricings by targeting these 906 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Explore structural trends in healthcare by focusing on these 30 healthcare AI stocks that are changing treatment, diagnosis and longer term healthcare efficiency.

- Research opportunities ahead of the next digital wave with these 81 cryptocurrency and blockchain stocks at the intersection of finance and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokyu REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8957

Tokyu REIT

TOKYU REIT, Inc. was incorporated to invest in real estate on June 20, 2003 under the Law Concerning Investment Trusts and Investment Corporations of Japan (Law No.

Established dividend payer with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026