- Japan

- /

- Real Estate

- /

- TSE:8864

Airport Facilities (TSE:8864) Margins Slide on ¥3.3B One-Off Loss, Raising Profit Quality Concerns

Reviewed by Simply Wall St

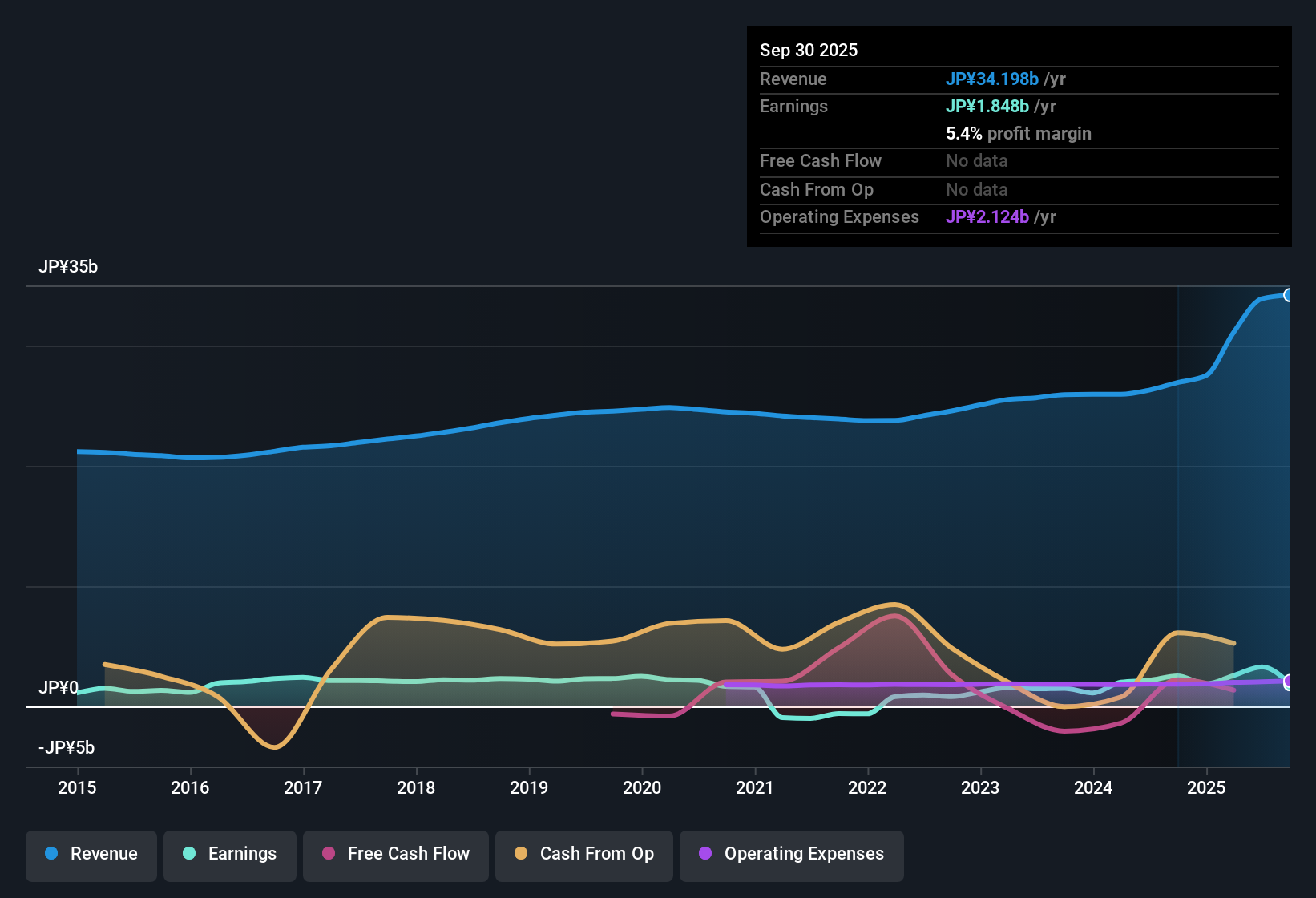

Airport Facilities (TSE:8864) posted a net profit margin of 5.4%, dropping from 9.4% the previous year, as its latest twelve-month results were hit by a one-off loss of ¥3.3 billion. Despite the margin pressure, the company is forecasting 16.1% annual earnings growth, easily outpacing the Japanese market’s 7.9% expectation. However, projected revenue growth of 3.5% lags the market’s 4.5% average. With valuation signals looking mixed and a current share price of ¥1,030 standing well above an estimated fair value of ¥118.51, investors will be weighing the upside of strong forecasted profit growth against recent earnings quality concerns.

See our full analysis for Airport Facilities.Next, we will see how the latest numbers stack up against the most talked-about narratives and which stories might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Forecasted Profit Growth Dwarfs Market, but Revenue Trails Sector

- Annual earnings growth is projected at 16.1%, outpacing the Japanese market average of 7.9%. Revenue is expected to rise by just 3.5%, compared to the market's 4.5% pace.

- Reloaded expectations for robust profit expansion heavily support the bullish case, yet bulls must reconcile that slower top-line growth.

- Bulls spotlight the company’s 16.1% forecasted earnings growth to justify optimism, but the anticipated 3.5% revenue growth trails market averages and may struggle to sustain outperformance if margin pressures persist.

- While actual profit margin compression has made headlines, the advance profit growth estimate is substantially higher than sector peers. This suggests operational leverage if costs or other headwinds ease from this year’s one-off losses.

One-Off ¥3.3B Loss Hits Margins and Raises Profit Quality Risks

- The latest twelve months included a one-off loss totaling ¥3.3 billion, which contributed to net profit margin declining from 9.4% to 5.4% year over year.

- Critics highlight that bearish concerns about profit quality appear validated by the drag from non-recurring charges and ongoing margin pressure.

- Bears cite the ¥3.3 billion one-off hit and lower margins as red flags, asserting this earnings base may not reflect true operating health, especially with dividend sustainability in question according to risk disclosures.

- Despite bullish hopes for margin normalization, bears point to sustained margin declines versus the prior year as evidence that operational headwinds remain a major near-term challenge.

Valuation Caught Between Peer Discount and DCF Fair Value Warning

- Trading at a P/E of 28x, which is less than half the peer average of 60.3x but over double the Japanese real estate sector’s 10.8x, Airport Facilities’ share price of ¥1,030 stands nearly 8.7x above its DCF fair value estimate of ¥118.51.

- What’s surprising is that while some might see relative undervaluation against peers as a draw, the sharp premium to DCF fair value of ¥118.51 and a price well above sector averages offer a cautionary check.

- Bulls may highlight the peer-relative discount on P/E as a bright spot, yet the yawning gap to the DCF fair value keeps valuation risk firmly in focus for fundamental investors.

- The sector’s cyclical momentum is not enough to offset the premium pricing, meaning valuation-sensitive buyers may wait for mean reversion or a reset in forward profits before jumping in.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Airport Facilities's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Airport Facilities forecasts robust profit growth, ongoing margin pressure, lower-quality earnings from one-off losses, and a premium valuation present major challenges for fundamental investors.

For those seeking opportunities without such valuation uncertainty, check out these 831 undervalued stocks based on cash flows where companies trade closer to their intrinsic worth and offer a stronger margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8864

Airport Facilities

Engages in the real estate, area heating and cooling, water supply and drainage service, and other businesses in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives