- Japan

- /

- Real Estate

- /

- TSE:5535

MIGALO HOLDINGS' (TSE:5535) three-year earnings growth trails the strong shareholder returns

The last three months have been tough on MIGALO HOLDINGS Inc. (TSE:5535) shareholders, who have seen the share price decline a rather worrying 49%. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 183% compared to three years ago. So the recent fall in the share price should be viewed in that context. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

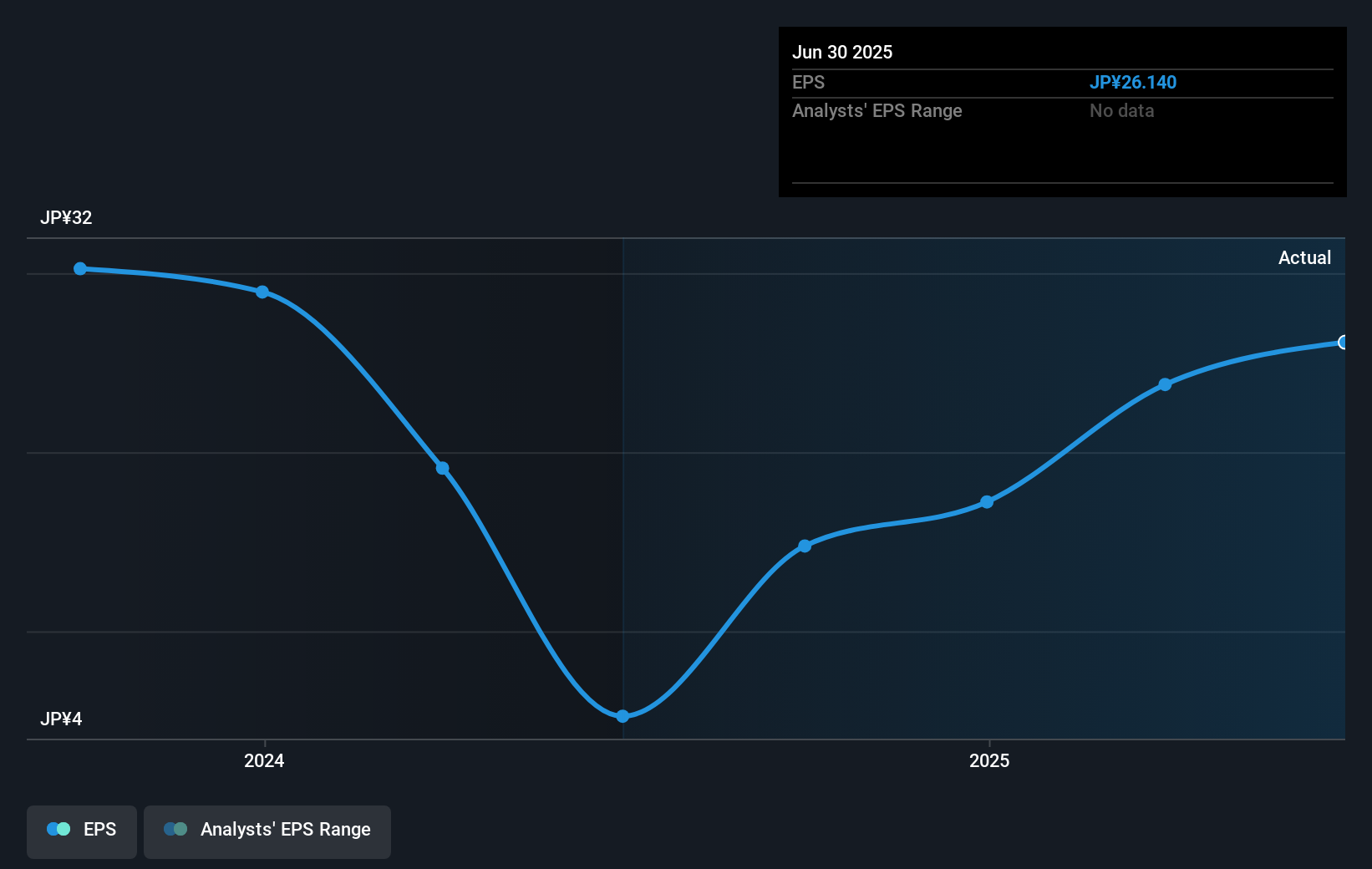

MIGALO HOLDINGS was able to grow its EPS at 9.3% per year over three years, sending the share price higher. In comparison, the 41% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. That's not necessarily surprising considering the three-year track record of earnings growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into MIGALO HOLDINGS' key metrics by checking this interactive graph of MIGALO HOLDINGS's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, MIGALO HOLDINGS' TSR for the last 3 years was 203%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that MIGALO HOLDINGS shareholders have received a total shareholder return of 29% over one year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 24% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand MIGALO HOLDINGS better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with MIGALO HOLDINGS .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5535

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives