- Japan

- /

- Real Estate

- /

- TSE:5535

MIGALO HOLDINGS Inc. (TSE:5535) CEO Sei Nakanishi, the company's largest shareholder sees 14% reduction in holdings value

Key Insights

- Significant insider control over MIGALO HOLDINGS implies vested interests in company growth

- A total of 2 investors have a majority stake in the company with 51% ownership

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

To get a sense of who is truly in control of MIGALO HOLDINGS Inc. (TSE:5535), it is important to understand the ownership structure of the business. With 56% stake, individual insiders possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As market cap fell to JP¥22b last week, insiders would have faced the highest losses than any other shareholder groups of the company.

In the chart below, we zoom in on the different ownership groups of MIGALO HOLDINGS.

Check out our latest analysis for MIGALO HOLDINGS

What Does The Institutional Ownership Tell Us About MIGALO HOLDINGS?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

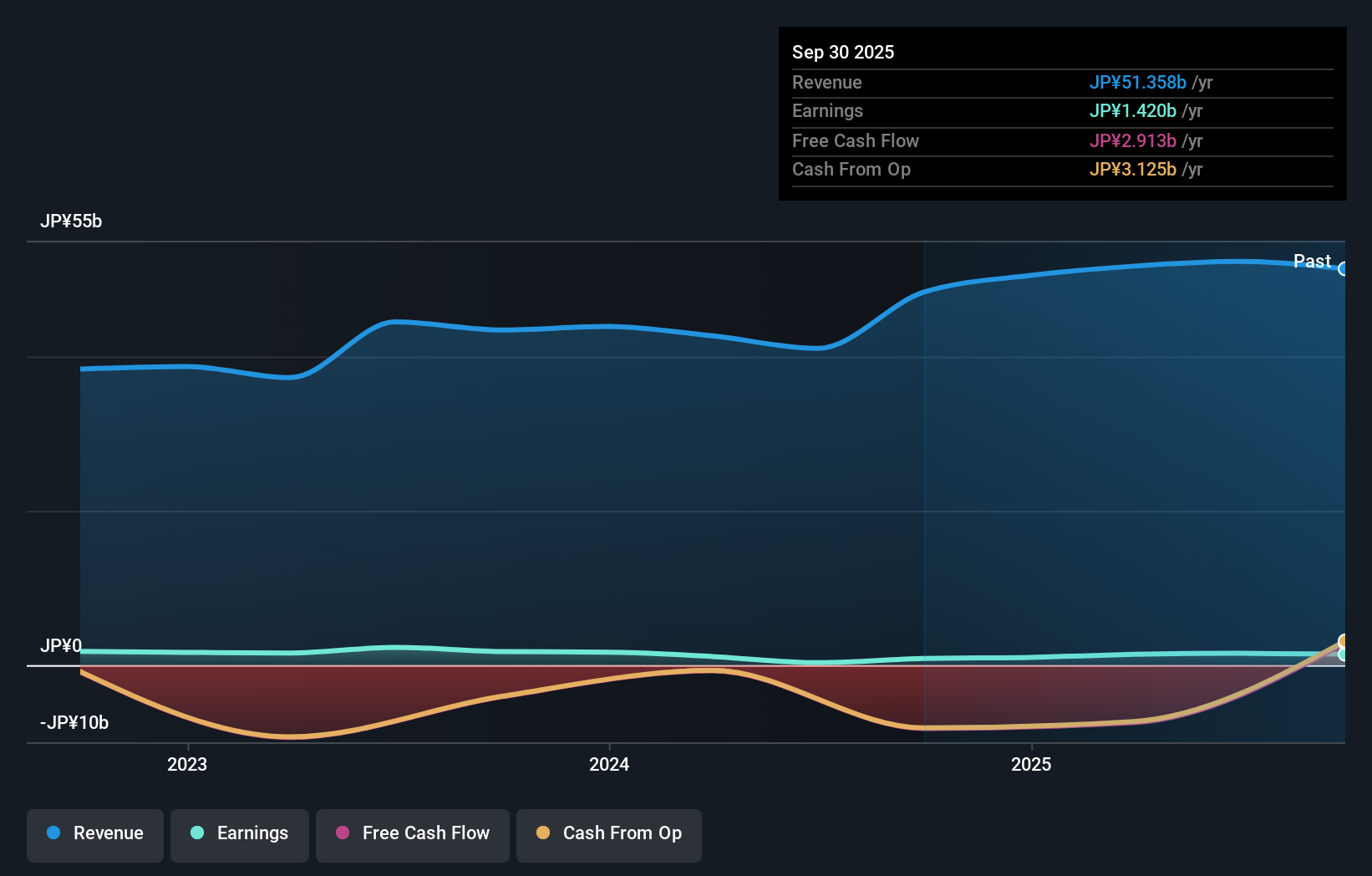

Since institutions own only a small portion of MIGALO HOLDINGS, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. So if the company itself can improve over time, we may well see more institutional buyers in the future. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

MIGALO HOLDINGS is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is the CEO Sei Nakanishi with 48% of shares outstanding. With 2.9% and 2.5% of the shares outstanding respectively, Shunichi Katono and Mimi Seo are the second and third largest shareholders.

To make our study more interesting, we found that the top 2 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of MIGALO HOLDINGS

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own the majority of MIGALO HOLDINGS Inc.. This means they can collectively make decisions for the company. So they have a JP¥12b stake in this JP¥22b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, who are usually individual investors, hold a 41% stake in MIGALO HOLDINGS. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with MIGALO HOLDINGS .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5535

Proven track record and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026