- Japan

- /

- Real Estate

- /

- TSE:3498

Kasumigaseki Capital (TSE:3498) Valuation in Focus After Follow-On Share Offering

Reviewed by Simply Wall St

Kasumigaseki CapitalLtd (TSE:3498) is making headlines after announcing a follow-on equity offering of 4,610,000 common shares. Decisions of this nature can reshape a company's balance sheet and influence future investor dynamics.

See our latest analysis for Kasumigaseki CapitalLtd.

Kasumigaseki CapitalLtd's share price has seen notable swings recently, with a sharp 14.96% slide over the past week. It remains up 21.01% year-to-date. Despite recent volatility, its long-term momentum stands out, delivering a 294.10% total shareholder return over three years and an impressive 923.95% over five years. This underscores how strong growth and corporate moves like the latest share offering are shaping investor expectations.

If this level of market action has you looking for more opportunities, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares pulling back after strong multi-year gains, is Kasumigaseki CapitalLtd now undervalued in light of its robust fundamentals, or has the market already factored in its future growth? Could this be a buying opportunity?

Price-to-Earnings of 16.2x: Is it justified?

Kasumigaseki CapitalLtd is currently trading at a price-to-earnings (P/E) ratio of 16.2x, which is higher than both its peer average (14.1x) and the broader JP Real Estate industry average (10.8x). Based on this metric, the share price appears expensive relative to sector norms, even after its recent pullback.

The price-to-earnings ratio expresses how much investors are willing to pay per yen of current earnings. For real estate development companies, this multiple can reflect the market's expectations of sustained earnings growth, especially if recent profit acceleration signals strong future outlook.

For Kasumigaseki CapitalLtd, the market seems to be pricing in exceptional future growth, given its rapidly increasing earnings and ambitions reflected in recent corporate moves. However, when compared to industry averages, this premium is pronounced. It is particularly striking when you note that a regression-based "fair" P/E for the stock sits at 26x, suggesting room for rerating if growth continues to impress.

Explore the SWS fair ratio for Kasumigaseki CapitalLtd

Result: Price-to-Earnings of 16.2x (OVERVALUED)

However, continued earnings growth is not guaranteed. This is particularly true if revenue momentum stalls or if market sentiment turns more cautious in Japan's real estate sector.

Find out about the key risks to this Kasumigaseki CapitalLtd narrative.

Another View: Discounted Cash Flow Valuation

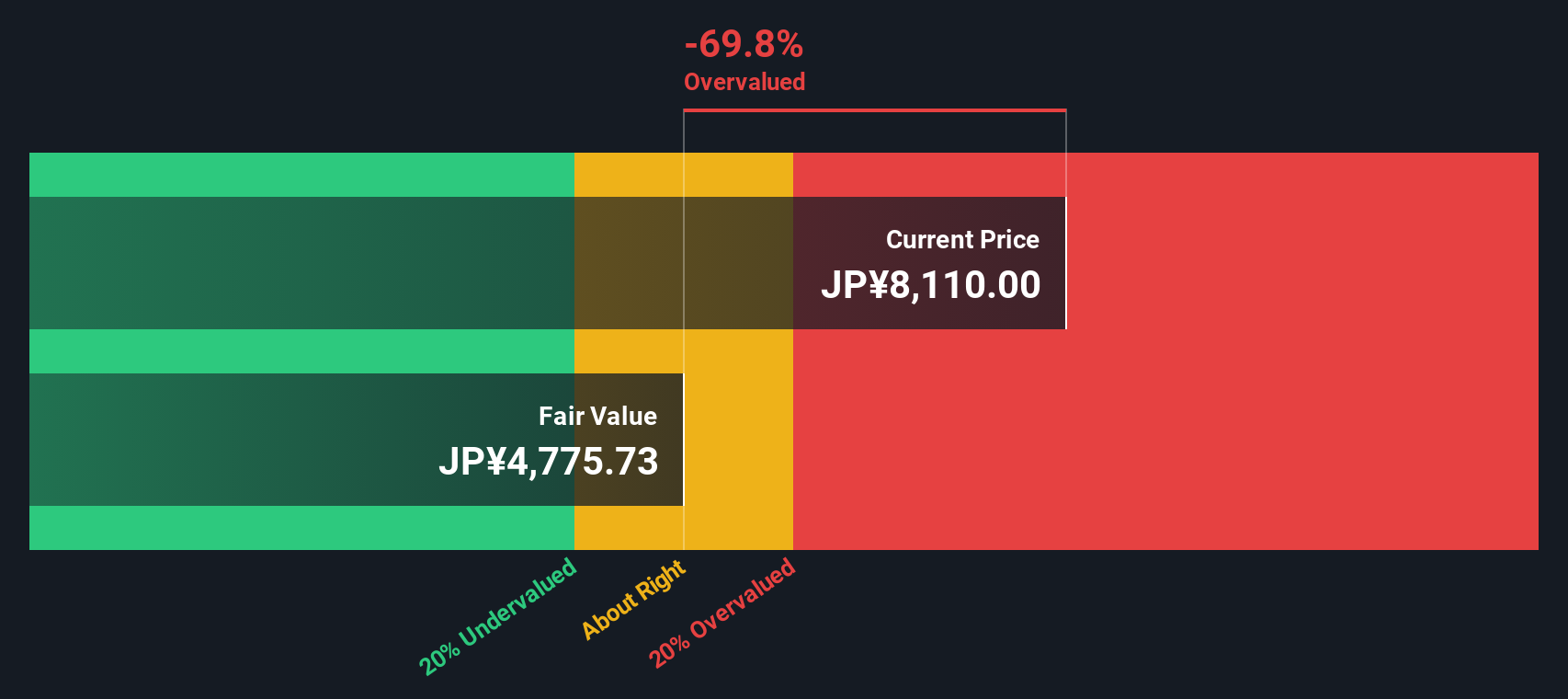

A different perspective is the SWS DCF model, which estimates Kasumigaseki CapitalLtd's fair value at ¥4,786.84, significantly below the current share price of ¥8,410. This may indicate that the stock is overvalued and challenges the optimism reflected by earnings-based multiples. Should investors reconsider their approach in light of this?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kasumigaseki CapitalLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kasumigaseki CapitalLtd Narrative

If you have a different perspective or want to dig deeper into the numbers, it's easy to run your own analysis and shape the narrative in minutes. Do it your way

A great starting point for your Kasumigaseki CapitalLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for Smart Investment Opportunities?

Don't miss the chance to expand your portfolio with fresh ideas you won’t find in the usual headlines. Get ahead and target high-growth potential or resilient sectors now.

- Uncover unique companies with strong fundamentals by tapping into these 834 undervalued stocks based on cash flows. This offers the potential for smart value gains often overlooked by the crowd.

- Seize the momentum of the artificial intelligence boom and gain exposure to innovation by accessing these 26 AI penny stocks, which power the next wave of technological growth.

- Capture reliable income streams by checking out these 22 dividend stocks with yields > 3%. These deliver market-beating yields above 3% for investors who want stability and cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kasumigaseki CapitalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3498

Kasumigaseki CapitalLtd

Engages in real estate consulting businesses in Japan.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026