- Japan

- /

- Real Estate

- /

- TSE:2337

Ichigo (TSE:2337): Reviewing Valuation After Strong November 2025 Power Generation Beats Forecasts

Reviewed by Simply Wall St

Ichigo (TSE:2337) just posted stronger than expected November 2025 power generation, with output rising year on year and topping internal forecasts, giving investors fresh data on its clean energy engine.

See our latest analysis for Ichigo.

The November beat slots into a mixed year for the stock, with an 8.53% year to date share price return and an 11.75% one year total shareholder return signalling steady, if not explosive, momentum as investors reassess Ichigo’s clean energy upside alongside its broader real estate exposure.

If this has you thinking about where else the market might be waking up to structural growth stories, it could be a good moment to explore fast growing stocks with high insider ownership

But with the shares already up this year and trading only slightly below analyst targets, is Ichigo still flying under the radar, or is the market already baking in its next leg of clean energy driven growth?

Most Popular Narrative Narrative: 3.1% Undervalued

With Ichigo last closing at ¥407 against a narrative fair value of ¥420, the story leans toward modest upside rather than a heroic rerating.

The analysts have a consensus price target of ¥470.0 for Ichigo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥570.0, and the most bearish reporting a price target of just ¥410.0.

Curious why steady revenue growth, slightly thinner margins, and shrinking share count still add up to upside potential? The narrative leans on a bolder future earnings multiple than the wider real estate sector. Would you like to see how those moving parts combine to justify today’s calculated fair value?

Result: Fair Value of ¥420 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher interest costs and ongoing clean energy underperformance could quickly erode margins and force a rethink of how much growth the market is pricing in.

Find out about the key risks to this Ichigo narrative.

Another View: Cash Flows Tell A Different Story

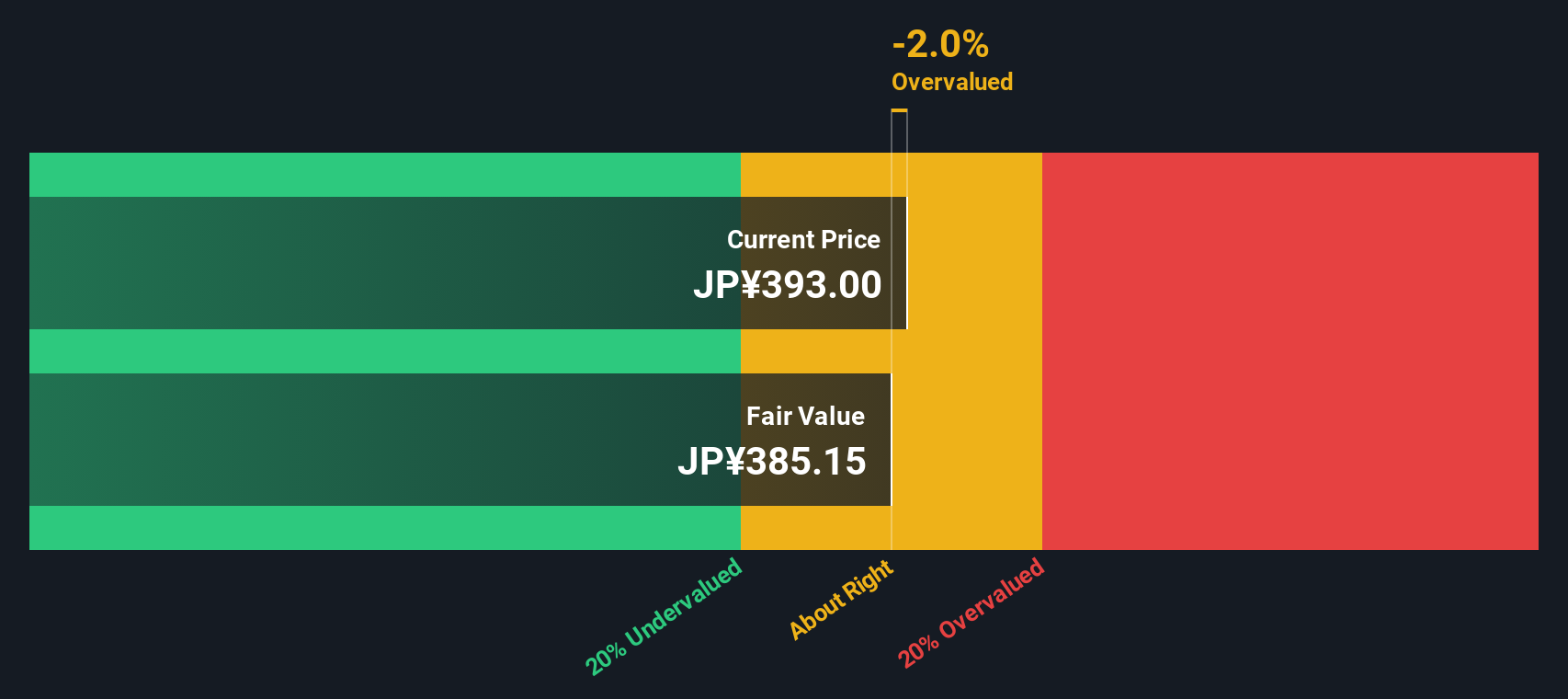

While the narrative fair value suggests modest upside, our DCF model is more cautious, putting Ichigo’s fair value nearer ¥385 versus today’s ¥407. That implies the shares may already be a bit ahead of their cash flow fundamentals, so which signal should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ichigo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ichigo Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a personalised view in minutes: Do it your way

A great starting point for your Ichigo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking For More Investment Ideas?

Before you move on, lock in your next potential edge by using the Simply Wall St Screener to pinpoint opportunities other investors may be overlooking.

- Capitalize on mispriced potential by reviewing these 905 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully recognised yet.

- Ride the next wave of technological change by targeting these 26 AI penny stocks positioned at the heart of automation, data intelligence and productivity breakthroughs.

- Secure your income stream by focusing on these 15 dividend stocks with yields > 3% that combine robust payouts with the potential for long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2337

Proven track record average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026