Daiichi Sankyo (TSE:4568): Evaluating Valuation as Investor Sentiment Remains Subdued

Reviewed by Simply Wall St

Daiichi Sankyo Company (TSE:4568) shares saw modest movement this week, catching the attention of investors curious about the pharmaceutical group’s recent momentum and underlying performance. The stock’s swings invite a closer look at what might be shaping sentiment.

See our latest analysis for Daiichi Sankyo Company.

While Daiichi Sankyo's share price has seen mild fluctuations this week, it is worth noting that momentum has remained somewhat muted following a year-to-date slide of nearly 14%. The 1-year total shareholder return has lagged at -23%, signaling that near-term challenges continue to weigh on sentiment even as the company maintains steady revenue and profit growth. In addition, the longer-term 5-year total shareholder return is still positive, pointing to some resilience for patient investors.

If you want to see how competitors in the pharma sector are faring, take the next step and uncover opportunities with our See the full list for free.

With shares down in 2024 but analysts pricing in far higher upside, the question for investors is clear: is Daiichi Sankyo undervalued at current levels, or has the market already taken into account all the company’s future growth potential?

Most Popular Narrative: 33.3% Undervalued

Compared to its last close, Daiichi Sankyo’s fair value according to the most popular narrative stands far above the current market price. This creates a potential disconnect between consensus expectations and trading levels.

Pipeline depth in antibody-drug conjugates (ADCs), supported by ongoing R&D investment and multiple upcoming pivotal data readouts and regulatory submissions (such as for breast, gastric, lung, and gynecological cancers), positions the company to capture higher-margin opportunities as precision medicine gains traction. This could further boost future net margins and earnings. Expanding approvals and new indications (for example, ENHERTU in breast or gastric cancer, Datroway in lung cancer) are rapidly increasing the addressable patient population, while inclusion in national drug reimbursement lists (like in China) accelerates market penetration and recurring revenue streams.

Want to know why this high valuation stacks up? The answer is in a series of bold profit forecasts and a future multiple that is typically reserved for the most innovative companies. Just what assumptions drive such a leap in fair value? Dive in to discover the crucial drivers and unmask the surprising numbers behind these expectations.

Result: Fair Value of ¥5,546.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should remain aware that heavy reliance on a few oncology blockbusters and potential regulatory changes could still shift the outlook dramatically.

Find out about the key risks to this Daiichi Sankyo Company narrative.

Another View: What the Numbers Say About Valuation

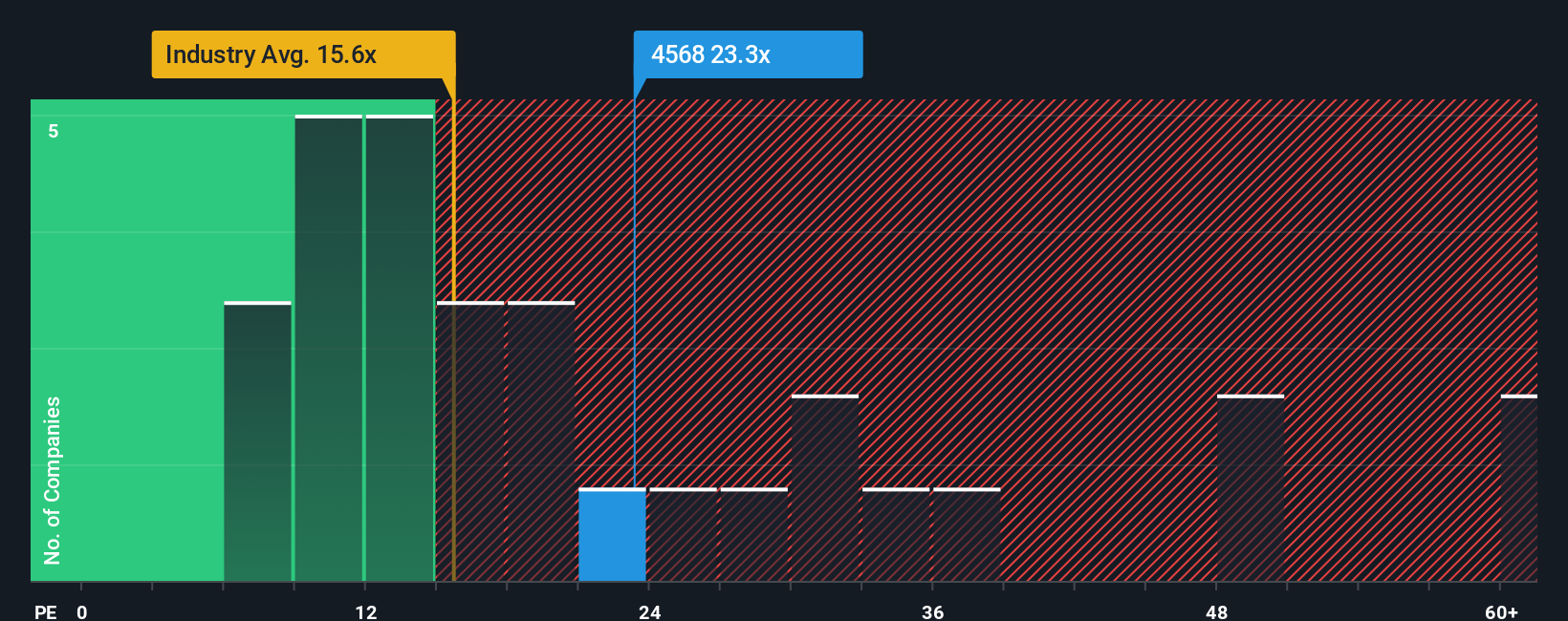

Looking from a different angle, Daiichi Sankyo is currently trading at a price-to-earnings ratio of 24.5x, making it pricier than peers in both the Japanese pharmaceuticals industry (15.8x) and its direct competitors (21.5x). While the market is willing to pay a premium, the fair ratio sits at 30x. This gap suggests both opportunity and risk. Could the market rerate higher, or are expectations already stretched?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daiichi Sankyo Company Narrative

If you see the story differently or want to explore the data and develop your own perspective, you can create a personal take in just a few minutes. Do it your way

A great starting point for your Daiichi Sankyo Company research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock your next opportunity with stock ideas uniquely tailored for forward-thinking investors. Let Simply Wall Street’s screeners guide you toward tomorrow’s winners.

- Spot undervalued gems primed for growth by checking out these 930 undervalued stocks based on cash flows. Get ahead before the crowd catches on.

- Capture attractive yields and consistent income streams by reviewing these 14 dividend stocks with yields > 3%. This tool features dividend payers with standout financial strength.

- Ride the momentum of artificial intelligence with these 25 AI penny stocks. This screener is designed to surface companies leading breakthroughs in machine learning and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, the United States, Europe, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026