Santen Pharmaceutical (TSE:4536): Assessing Valuation After UK Approval of Ryjunea for Pediatric Myopia

Reviewed by Simply Wall St

Santen Pharmaceutical (TSE:4536) just received approval from the UK medicines regulator for its new pediatric myopia treatment, Ryjunea. This move strengthens the company’s footprint in Europe and signals a growing opportunity in children’s eye health.

See our latest analysis for Santen Pharmaceutical.

Santen Pharmaceutical’s shares have shown fresh momentum lately, helped by regulatory wins and a sizable buyback program that wrapped up just last week. While the stock’s year-to-date price return is still in negative territory, long-term holders are seeing the rewards. Total shareholder return stands at 50.6% over the past three years, reflecting both payout and growth potential as the company executes on its strategy.

If innovation in pediatric eye care sparked your interest, you might discover more forward-thinking companies with our dedicated See the full list for free.

With strong product approvals and brisk buybacks making headlines, does Santen’s current share price reflect untapped value, or is the market already factoring in the company’s next stage of growth?

Price-to-Earnings of 16x: Is it justified?

Santen Pharmaceutical's stock currently trades at a price-to-earnings (P/E) ratio of 16x, slightly above both its industry and peer averages. At the last close of ¥1,545.5, the stock is not trading at a discount compared to competitors.

The P/E ratio reflects how much investors are willing to pay for one yen of the company’s earnings. For pharmaceutical companies, this multiple often reveals expectations regarding future profitability and growth.

Santen's 16x P/E is higher than the industry average of 15.3x and is also above peer companies, which average 13.1x. This suggests that the market is assigning a premium for factors such as recent earnings growth or future potential. However, compared to the estimated fair P/E ratio of 19x, there may be room for price appreciation if the market adopts a more optimistic outlook for Santen’s prospects.

Explore the SWS fair ratio for Santen Pharmaceutical

Result: Price-to-Earnings of 16x (OVERVALUED)

However, slower revenue growth or weaker annual net income trends could quickly temper optimism and make the case for a higher valuation more difficult to support.

Find out about the key risks to this Santen Pharmaceutical narrative.

Another View: DCF Model Suggests Considerable Upside

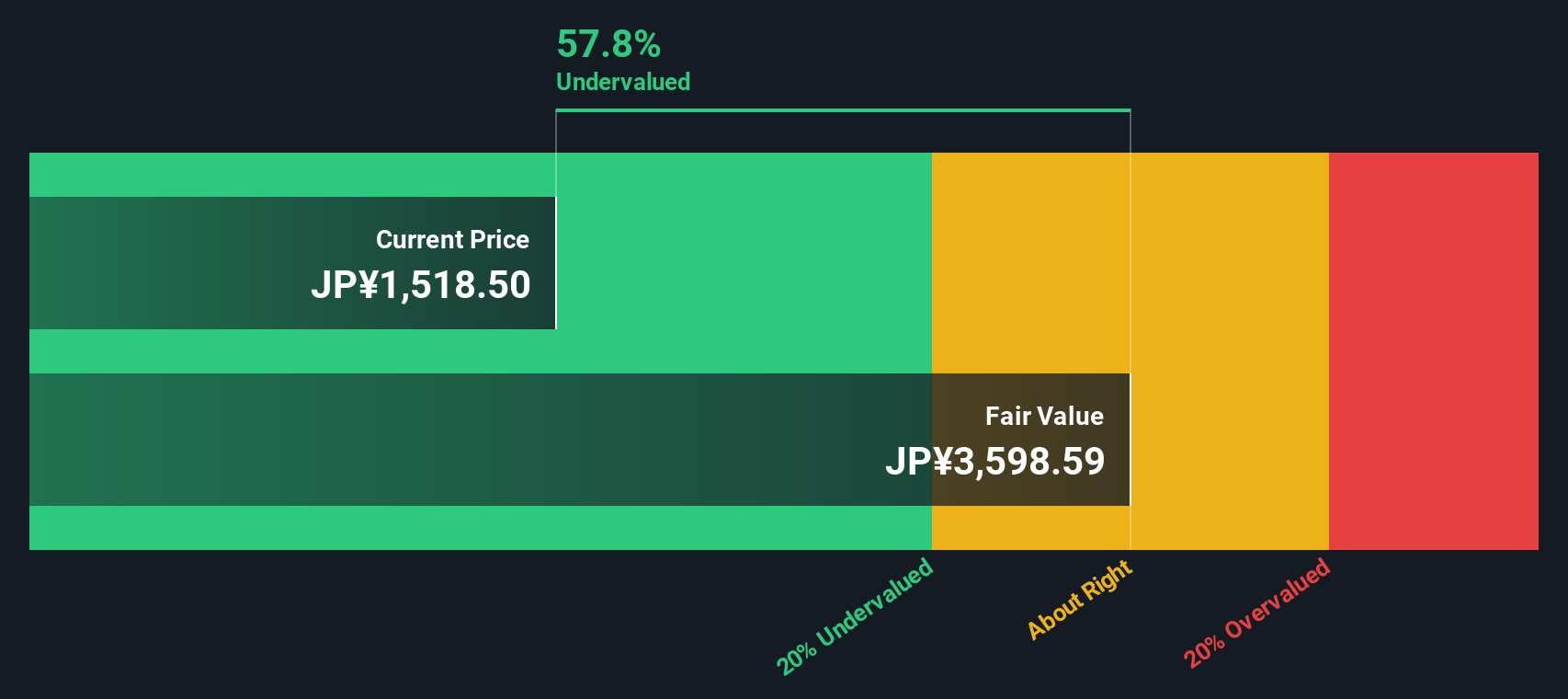

While Santen Pharmaceutical looks expensive compared to industry peers on an earnings basis, our DCF model tells a different story. According to this approach, Santen’s shares are trading at a steep 56.8% discount to fair value. Does this model highlight a genuine opportunity, or is the market wary for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Santen Pharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Santen Pharmaceutical Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, crafting your own insight takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Santen Pharmaceutical.

Looking for more investment ideas?

Smart investing is about seizing opportunities before they slip away. Make your next move by checking out these handpicked growth and value stock lists powered by the Simply Wall Street Screener.

- Tap into steady cash flow by seeking out high-yield options in these 15 dividend stocks with yields > 3%, which reward you with attractive, sustainable dividends.

- Spot genuine bargains by zeroing in on compelling growth stories among these 884 undervalued stocks based on cash flows, each evaluated for robust fundamentals and value potential.

- Ride the AI revolution by putting cutting-edge innovation to work in your portfolio with these 27 AI penny stocks, highlighting the forefront of intelligent technology breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4536

Santen Pharmaceutical

Engages in the research and development, manufacturing, and marketing of pharmaceuticals and medical devices in Japan, China, Asia, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives