Global Dividend Stocks And 2 Other Yield-Bearing Investments

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience despite a U.S. government shutdown and mixed economic signals, with equities gaining ground amid expectations of potential Federal Reserve rate cuts. As investors navigate this complex landscape, dividend stocks continue to attract attention for their ability to provide income in uncertain times. A good dividend stock typically offers a stable payout history and strong fundamentals, making it an appealing option for those seeking consistent returns amidst fluctuating market conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Torigoe (TSE:2009) | 4.13% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.88% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.91% | ★★★★★★ |

| NCD (TSE:4783) | 4.33% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.76% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.98% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.28% | ★★★★★★ |

Click here to see the full list of 1346 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

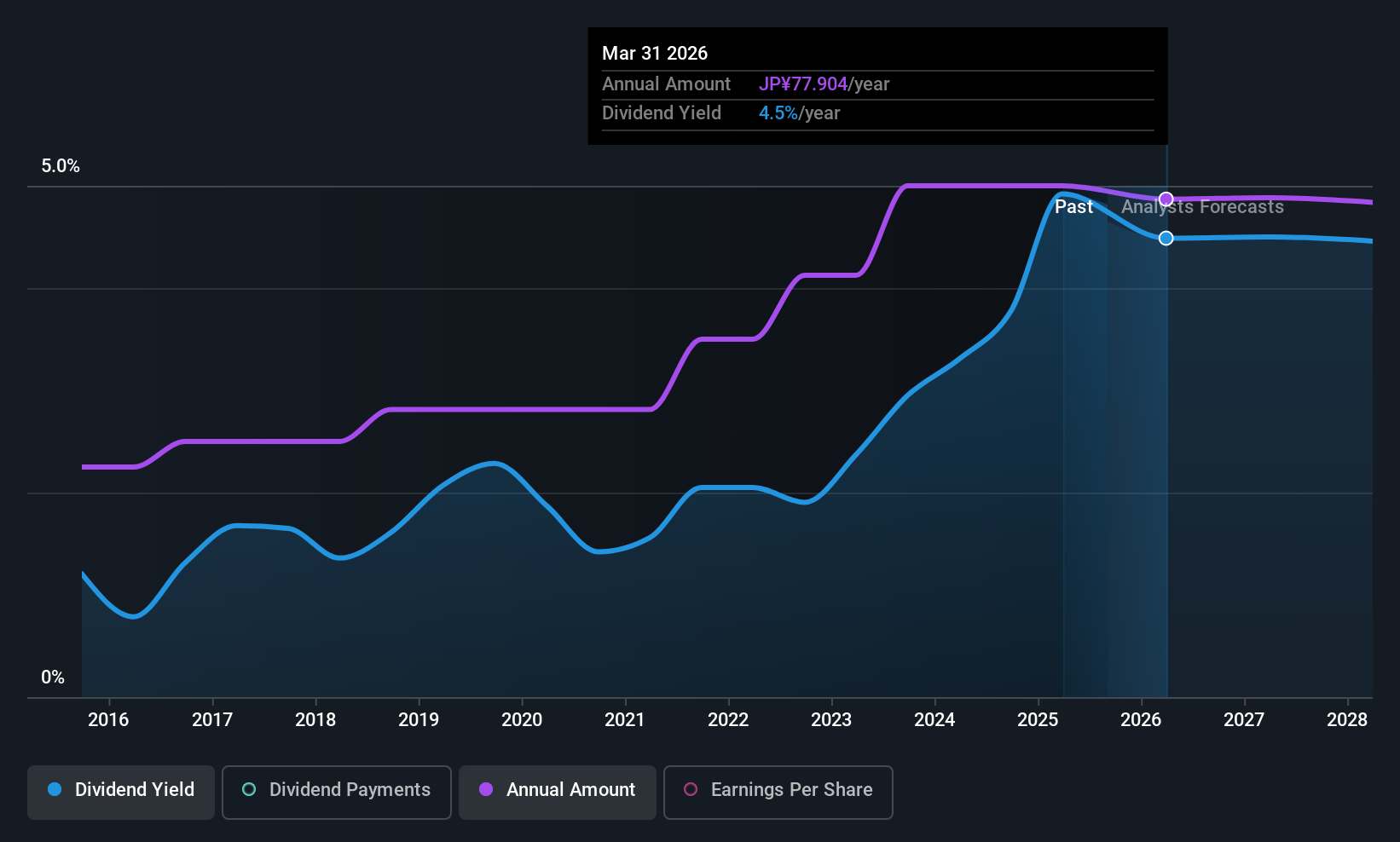

Ono Pharmaceutical (TSE:4528)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ono Pharmaceutical Co., Ltd. is engaged in the production, purchase, and sale of pharmaceuticals and diagnostic reagents globally, with a market cap of ¥811.06 billion.

Operations: Ono Pharmaceutical Co., Ltd. generates revenue primarily from its Pharmaceutical Business segment, which accounts for ¥496.73 billion.

Dividend Yield: 4.3%

Ono Pharmaceutical's dividend payments have been stable and growing over the past decade, positioning it in the top 25% of dividend payers in Japan with a yield of 4.33%. However, this dividend is not well covered by free cash flows, with a high cash payout ratio of 118.3%. Recent developments include European approval for ROMVIMZA™ and expansion into reinsurance to enhance risk management, potentially impacting future financial stability and dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Ono Pharmaceutical.

- Insights from our recent valuation report point to the potential undervaluation of Ono Pharmaceutical shares in the market.

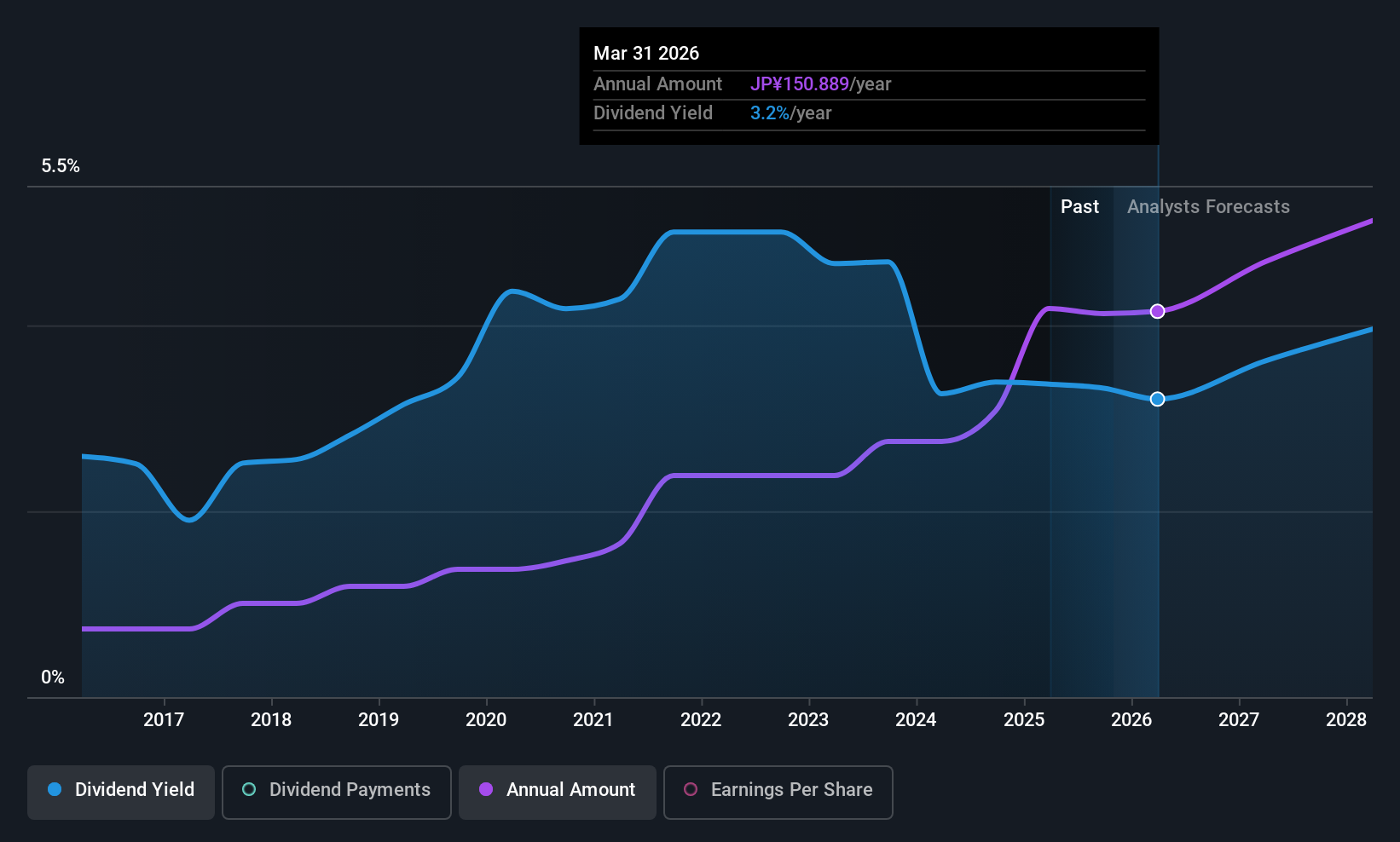

Takeuchi Mfg (TSE:6432)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takeuchi Mfg. Co., Ltd. is a company that manufactures and sells construction machinery both in Japan and internationally, with a market cap of ¥248.13 billion.

Operations: Takeuchi Mfg. Co., Ltd.'s revenue segments consist of ¥114.62 billion from the USA, ¥4.68 billion from China, ¥197.29 billion from Japan, ¥10.47 billion from France, and ¥15.05 billion from the United Kingdom.

Dividend Yield: 3.6%

Takeuchi Mfg. Co., Ltd.'s dividend of JPY 200 per share remains unchanged from the previous year, with a yield slightly below top-tier payers in Japan. Despite stable and growing dividends over the past decade, its high cash payout ratio of 187% indicates dividends are not well covered by free cash flows. However, a low earnings payout ratio of 37.4% suggests coverage by earnings is adequate, though sustainability concerns persist due to insufficient cash flow coverage.

- Unlock comprehensive insights into our analysis of Takeuchi Mfg stock in this dividend report.

- In light of our recent valuation report, it seems possible that Takeuchi Mfg is trading behind its estimated value.

Sompo Holdings (TSE:8630)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sompo Holdings, Inc. is a company that offers property and casualty insurance services both in Japan and internationally, with a market cap of ¥4.36 trillion.

Operations: Sompo Holdings, Inc. generates revenue through its Domestic Non-Life Insurance Business (¥2.32 billion), Overseas Insurance Business (¥1.71 billion), Domestic Life Insurance Business (¥318.15 million), and Nursing Care Business (¥183.83 million).

Dividend Yield: 3.1%

Sompo Holdings offers a reliable dividend yield of 3.08%, supported by a low payout ratio of 31.6% and cash payout ratio of 26.6%, indicating strong coverage by both earnings and cash flows. Dividends have been stable and growing over the past decade, though the yield is below Japan's top dividend payers' average. Recent completion of a share buyback worth ¥74.70 billion reflects confidence in financial stability, while strategic leadership changes aim to bolster international market growth.

- Click to explore a detailed breakdown of our findings in Sompo Holdings' dividend report.

- The analysis detailed in our Sompo Holdings valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Discover the full array of 1346 Top Global Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeuchi Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6432

Takeuchi Mfg

Manufactures and sells construction machinery in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives