How New Long-term Leqembi Data And At-home Injections At Eisai (TSE:4523) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Eisai and Biogen recently presented new long-term data at the CTAD 2025 conference showing that Leqembi (lecanemab) treatment, including a subcutaneous autoinjector formulation, may substantially delay progression from mild cognitive impairment to more advanced Alzheimer’s disease while maintaining a safety profile consistent with earlier trials.

- The findings that earlier and continued Leqembi use could translate into several additional years before patients reach moderate Alzheimer’s stage, combined with at-home subcutaneous dosing that appears clinically equivalent to intravenous infusion, materially strengthen the real-world treatment case for Eisai’s Alzheimer’s franchise.

- We’ll now examine how the promising long-term “time savings” data and convenient at-home Leqembi injections may reshape Eisai’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Eisai Investment Narrative Recap

To own Eisai, you need to believe its Alzheimer’s portfolio can justify today’s premium valuation despite pricing pressure and intense competition. The new CTAD data, highlighting meaningful “time savings” and convenient at-home Leqembi injections, reinforces the near term catalyst around U.S. and Japan subcutaneous approvals, while the biggest risk remains overreliance on Leqembi amid regulatory and reimbursement uncertainty.

The most relevant recent update is Eisai’s completion of the rolling sBLA for Leqembi Iqlik, seeking U.S. approval for at-home subcutaneous initiation dosing. Combined with the CTAD time savings data, this filing shapes expectations for how quickly Eisai can convert clinical momentum into broader real world uptake, against the backdrop of drug pricing pressure and competing Alzheimer’s programs.

Yet while the long term data look encouraging for Leqembi’s role in early Alzheimer’s treatment, investors should also be aware that...

Read the full narrative on Eisai (it's free!)

Eisai's narrative projects ¥897.0 billion revenue and ¥66.6 billion earnings by 2028.

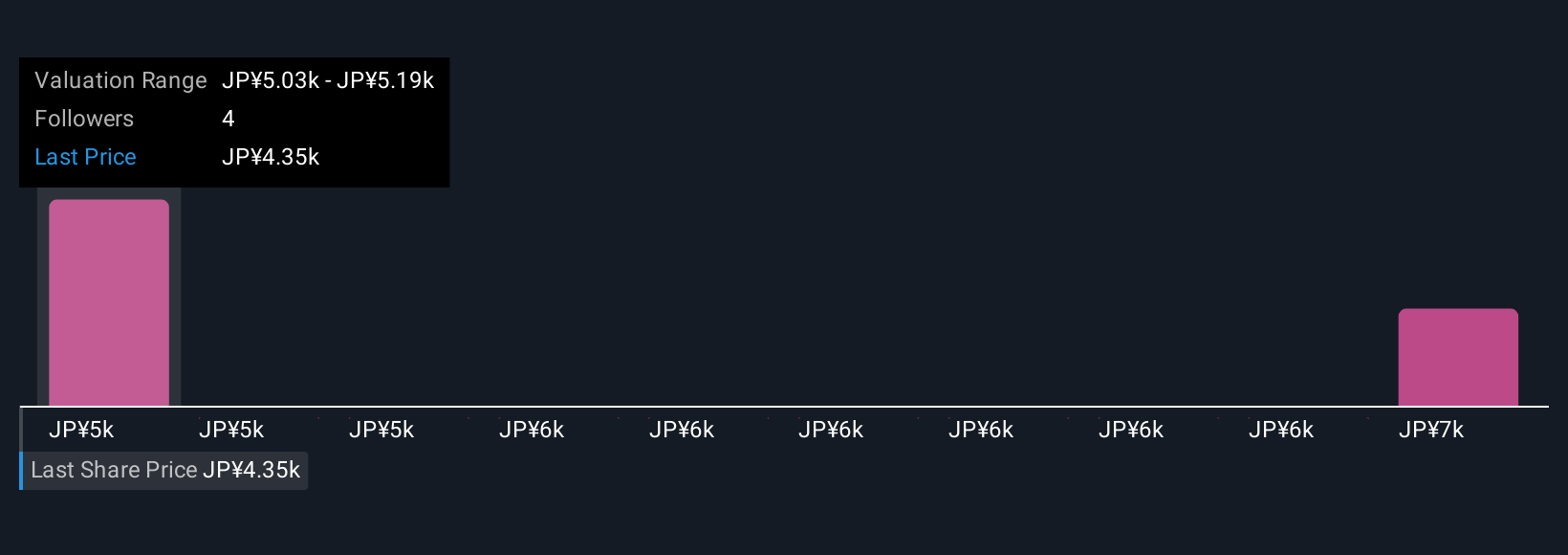

Uncover how Eisai's forecasts yield a ¥5012 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly ¥5,012 to ¥6,739 per share, underscoring how far apart individual views can be. Set against this, the key near term question is how much the stronger Leqembi “time savings” data and pending subcutaneous approvals can offset pricing pressure and Eisai’s heavy reliance on a single Alzheimer’s franchise.

Explore 2 other fair value estimates on Eisai - why the stock might be worth as much as 45% more than the current price!

Build Your Own Eisai Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eisai research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Eisai research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eisai's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eisai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4523

Eisai

Engages in the research and development, manufacture, sale, and import and export of pharmaceuticals.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026