Astellas Pharma (TSE:4503) Profit Margins Double, Challenging Bearish Narratives on Earnings Quality

Reviewed by Simply Wall St

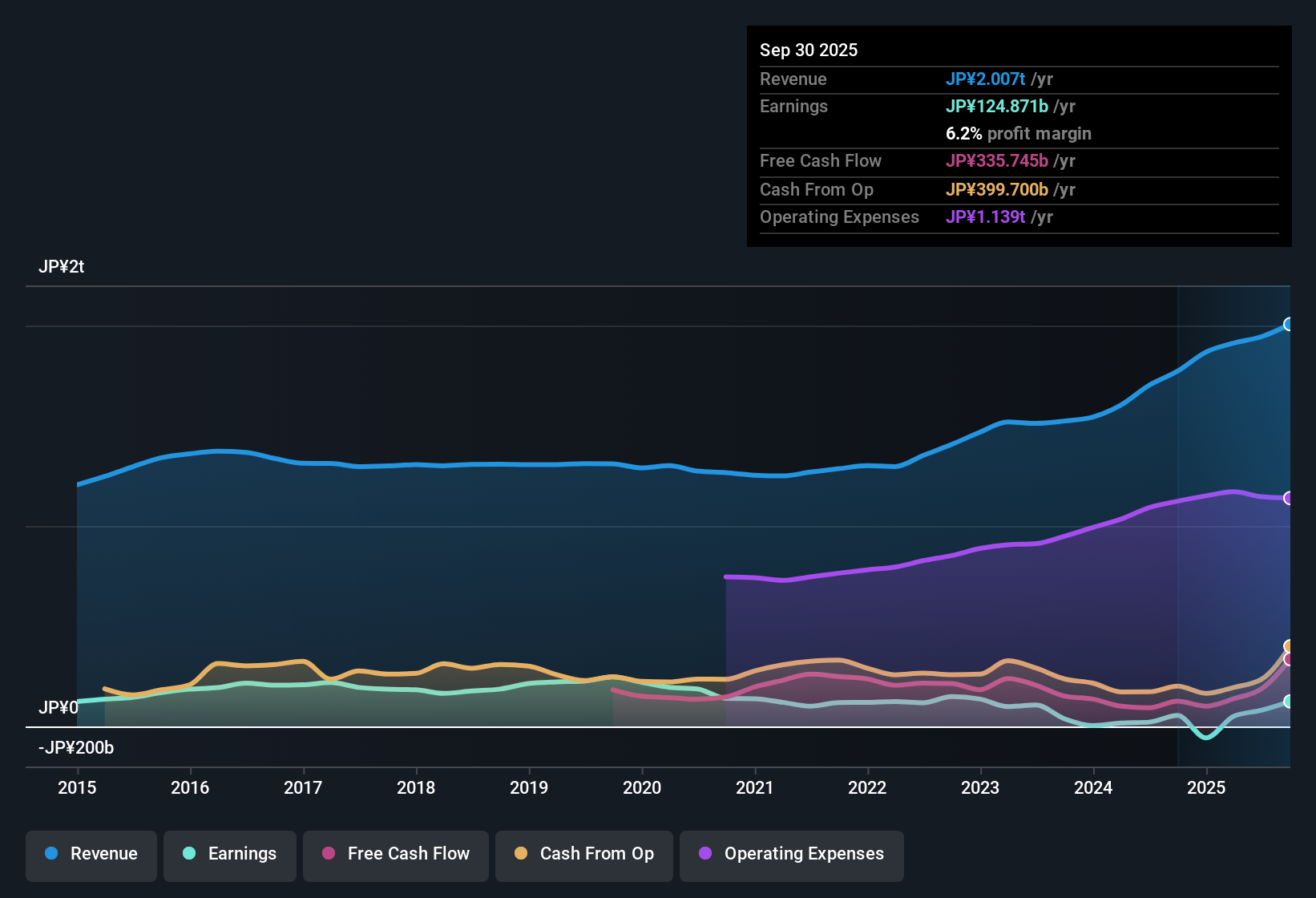

Astellas Pharma (TSE:4503) delivered net profit margins of 6.2%, doubling from 3.1% last year, while posting a 128.1% surge in profit growth over the past year compared to a five-year average decline of 24% per year. Despite this impressive profitability turnaround, revenue is forecast to decline 4.5% per year over the next three years, and the latest financial period included a one-off loss of ¥169.5 billion that has weighed on trailing results. The stock currently trades at ¥1,613.5, below the estimated fair value, with analysts expecting only modest earnings growth ahead and keeping a close eye on valuation and risk factors.

See our full analysis for Astellas Pharma.Now, let's see how these headline numbers match up against the current narratives in the market. Some long-held views may find confirmation, while others might be in for a surprise.

See what the community is saying about Astellas Pharma

Profit Margins on Track to Hit 9.8% by 2028

- Analysts project net profit margins will rise from 4.2% today to 9.8% in three years, even as annual revenue is forecast to contract by 1.3% through 2028.

- According to analysts' consensus view, the durability of margin gains rides on Astellas’s pipeline and expansion into new markets.

- A surge in strategic brands and progress in emerging regions is expected to offset headwinds from patent expiries and price pressure.

- Consensus notes that pipeline momentum, particularly for oncology and rare diseases, could underpin future profitability if clinical and market access milestones are met.

What really matters: Find out if the consensus expects Astellas’s profit surge to last in the Read the full Astellas Pharma Consensus Narrative. 📊 Read the full Astellas Pharma Consensus Narrative.

P/E Multiple Sits Below Peer Average, Above Industry

- The company trades at a price-to-earnings ratio of 23.1x, below the peer average of 63.5x but above the Japanese pharmaceuticals industry mean of 15.3x.

- Analysts' consensus view is that this P/E discount to global peers reflects tempered growth expectations but also investor confidence in Astellas’s margin improvement and lower risk relative to some highly valued counterparts.

- Bulls see the current P/E as fair given muted earnings forecasts, with only 2.6% annual EPS growth expected, while others argue relative undervaluation could support upside if revenue holds up better than feared.

- Consensus perspective is that any major surprises on the pipeline or cost savings front could close the P/E gap with global leaders, while downside risks linger from patent cliffs and pricing reforms.

¥1,613.5 Shares Trade Far Below DCF Fair Value

- Astellas Pharma's current share price of ¥1,613.5 is less than half its DCF fair value estimate of ¥3,854.42, suggesting the market prices in sizeable risk to the projected earnings path.

- Analysts' consensus view points out that even with a conservative discount rate of 4.72%, most modeled scenarios see the stock undervalued, though the narrow gap between the latest analyst price target of ¥1,752.86 and live price signals mixed conviction in a near-term rerating.

- Stretched analyst forecasts, ranging from ¥1,300.0 to ¥2,200.0 price targets, underline the high degree of uncertainty around long-term margin and topline delivery.

- Investors are encouraged to cross-check analyst DCF assumptions around earnings, margins, and risk before relying on fair value as a signal to buy or hold.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Astellas Pharma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on the numbers? Share your perspective and shape a custom narrative in just a few minutes. Do it your way

A great starting point for your Astellas Pharma research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite a turnaround in profitability, Astellas Pharma faces declining revenue forecasts and high earnings uncertainty because of patent cliffs and pricing pressures.

If market swings and inconsistent performance concern you, focus on companies with steadier trends and see which names deliver reliability with our stable growth stocks screener (2103 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4503

Astellas Pharma

Manufactures, markets, and imports and exports pharmaceuticals in Japan and internationally.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives